Citi released a statement addressing the potential outcomes of the Liberal Democratic Party (LDP) presidential election in Japan and their impact on the USD/JPY currency pair.

The financial services company noted the difficulty in predicting the election's influence on the exchange rate due to the congested nature of the race.

According to Citi, the main risks to the USDJPY pair hinge on the election's victor. If Sanae Takaichi wins, it could be seen as a negative for the normalization of the Bank of Japan's monetary policy, possibly leading to a weaker Japanese yen.

Conversely, a victory for Shigeru Ishiba might signal a departure from Abenomics-style policies, potentially strengthening the yen.

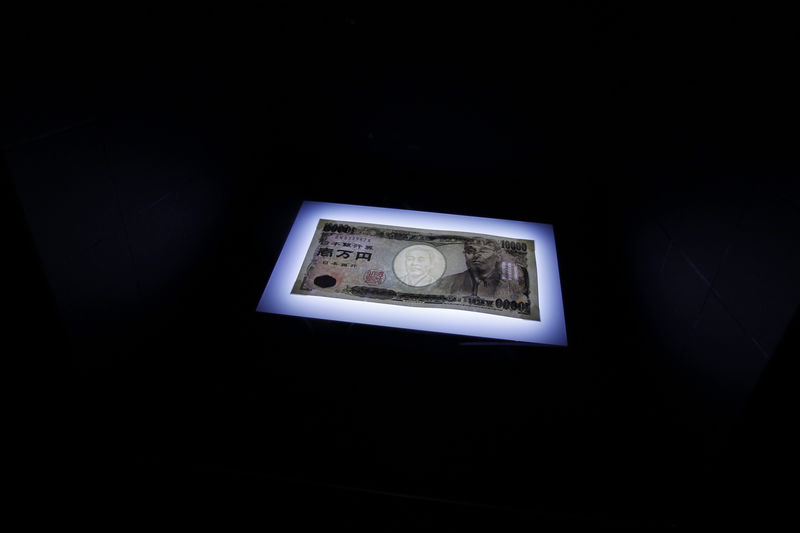

Despite the uncertainties, Citi's outlook for the USD/JPY remains unchanged. The firm anticipates that the currency pair will not fall below ¥140/$ until the following year. However, there is also the possibility of a rebound to a range between ¥151/$ and ¥155/$ before that time.

Citi emphasized that while the risks are tilted towards a downside for the USD/JPY, they do not expect significant deviation from their current scenario.

This outlook suggests a level of stability in the currency pair, despite the political variables at play. Citi's analysis indicates a watchful eye on the election's outcome, given its potential implications for currency market dynamics.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.