(Adds Icahn comments on Valeant, AIG, cash repatriation law)

By Michael Flaherty

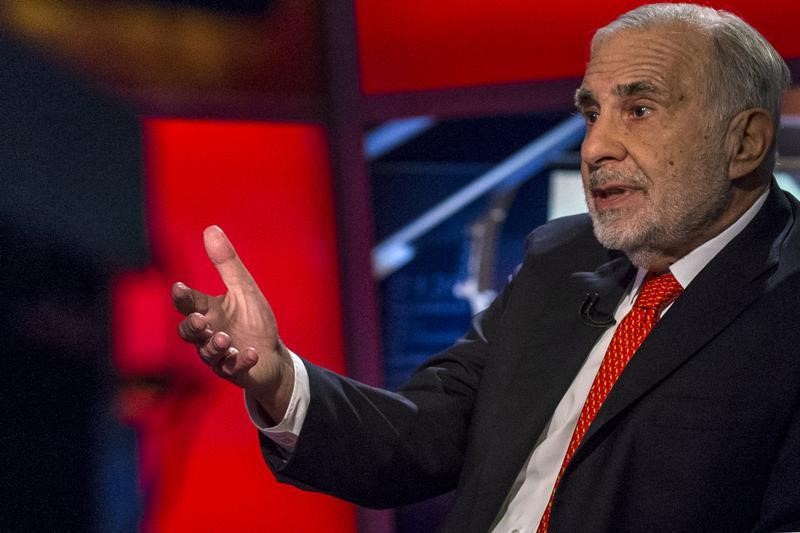

NEW YORK, Nov 3 (Reuters) - Billionaire investor Carl Icahn

made a cryptic reference suggesting he has an interest in

embattled drug maker Valeant on Tuesday, and said he was

speaking to U.S. politicians about a corporate cash repatriation

law that would deter so-called tax inversion deals.

"I'm not in Valeant, well, I don't want to say I'm not

completely in it but I'm not going to tell you where I am with

it," Icahn said, when asked about the company at the New York

Times DealBook conference. He did not explain further.

Valeant Pharmaceuticals International Inc (N:VRX) VRX.TO shares

have plunged almost 40 percent since a scathing report last

month by a short-seller alleged accounting improprieties in a

network of specialty pharmacies.

Icahn said he was speaking to Wisconsin Republican

Congressman Paul Ryan and New York Democratic Senator Chuck

Schumer about a law that would encourage U.S. companies to

repatriate cash from overseas, and would discourage the

controversial practice of inversion, where a company strikes a

merger deal to re-incorporate overseas and lower its tax rate.

Icahn said he supports Republican presidential candidate

Donald Trump, but said he would not be Treasury Secretary under

him, as Trump has suggested. The activist investor said he never

goes to Washington, but added that some of the politicians he

speaks to are brighter than some of the chief executives he

deals with.

Speaking on his latest corporate campaign, Icahn said he had

been in touch with American International Group Inc (N:AIG) AIG.N

Chief Executive Peter Hancock and confirmed that the two would

soon meet.

In a letter sent to AIG last week, Icahn said he wanted

Hancock to spin off AIG's life and mortgage units into public

companies, cut costs more aggressively and give back more cash

to shareholders.

Hancock said on Tuesday that a split would drive up certain

expenses and distract the company from cost-cutting, adding the

amount AIG spent on U.S. regulatory compliance was a fraction of

its total regulatory compliance costs around the world.

AIG is also taxed as a life and non-life insurer, which

allows it foreign tax credits. Hancock had said in a letter to

shareholders in 2014 that changes to this structure would mean

forfeiting "significant economic benefit."

Icahn said on Tuesday he has agreed to hear what Hancock has

to say, in a meeting that Hancock said will happen on Thursday.

- English (USA)

- English (UK)

- English (India)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

UPDATE 1-Icahn nods at Valeant interest, pushes for cash repatriation law

Published 2015-11-03, 06:33 p/m

UPDATE 1-Icahn nods at Valeant interest, pushes for cash repatriation law

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.