(Bloomberg) -- Sweden just jumped on the bandwagon of countries driving down their currencies with dovish policy pullbacks.

The krona plunged more than 1 percent against the euro Thursday as the Riksbank extended its bond-purchase program and signaled interest rates will stay below zero for longer than previously indicated. The Swedish central bank’s move echoes similar action by global peers -- the Bank of Canada abandoned its tightening bias this week after the European Central Bank, Bank of Korea and Reserve Bank of Australia flagged growth risks earlier this month.

Global central banks are pushing back policy-tightening plans amid heightened economic pessimism, which saw the International Monetary Fund cut its outlook for world growth to the lowest since the financial crisis. That is driving down currencies -- the Australian and Canadian dollars fell this week to the weakest levels since early January while the Korean won slid to a two-year low.

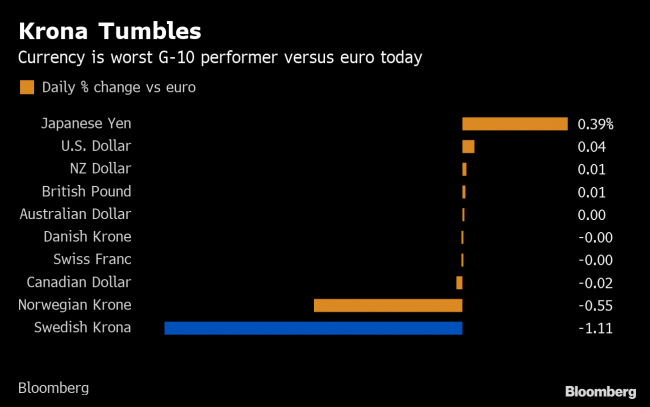

The krona was the worst performer among Group-of-10 currencies as Swedish policy makers said a hike was now expected “towards the end of the year or at the beginning of next year.” The Riksbank also announced it will purchase government bonds for a nominal value of 45 billion kronor ($4.7 billion) from July this year through to December 2020.

“Today’s announcement clearly shows the Riksbank is becoming more concerned about growth conditions outside of Sweden,” said Manuel Oliveri, a strategist at Credit Agricole (PA:CAGR) SA. “This is more dovish than we anticipated, slightly more dovish than what market expected and in the big scheme of things, a rebound towards 10.60 makes sense,” he said, referring to the euro-krona exchange rate.

The krona fell for a seventh straight day against the euro. It tumbled as much as 1.3 percent to 10.6651 per euro, the biggest intraday decline since Feb. 19. That was also the weakest krona level since Aug. 30 versus the shared currency.