Highlights

For any investor earning and saving money is the primary reason to be in the market. Currently, investors are trying to cut back on their spending habits and cope with the increasing interest rates and inflation. Managing debt is an effective way to endure inflation and move in an upward direction. Cash serves as a crucial weapon in the fight against inflation.

However, it should grow from time to time to make you stay on top of your finances. This makes investors consider adding certain dividend stocks to their TFSA accounts.

This account provides income and capital gains in a tax-free manner and helps in coping with inflation in a better way. Making a withdrawal is also tax-free irrespective of made at any time.

Your portfolio is the mirror image of your investing and wealth goals. Make it recession-ready to bring consistency and safety to your investments.

Let’s explore five dividend stocks and their recent financial performances:

- BCE Inc. (TSX: BCE)

BCE is a telecom provider that offers internet services for both, broadband and wireless. The Canada-based company also provides landline services, and operates a media segment as well that includes radio, television, and digital media assets.

In Q2 2022, the consolidated adjusted EBITDA rose by 4.6 per cent and was reported at C$ 2,590 million. The net earnings fell by 10.9 per cent and was noted at C$ 654 million from C$ 734 million in Q2 2021. The operating revenues increased by 2.9 per cent to C$ 5,861 million compared to C$ 5,698 million for the same comparative period.

The company pays a quarterly dividend of C$ 0.92. Further, the dividend yield reported by the company is 5.96 per cent with an EPS (earnings per share) of C$ 3.14.

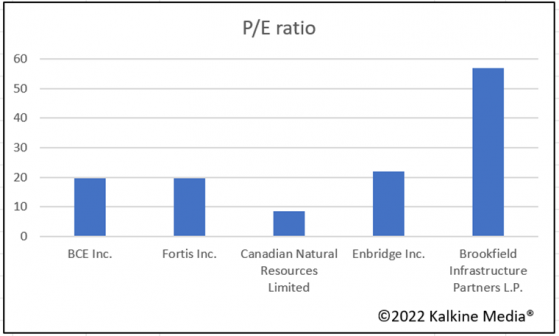

The graph below depicts the P/E (price-to-earnings) ratio of BCE, FTS, CNQ, ENB and BIP.UN.

- Fortis Inc . (TSX: TSX:FTS)

Fortis operates in the US and Canada and is the owner of utility distribution and transmission assets. The company caters to a customer base of more than 3.4 million. Further, it also is engaged in electricity generation with smaller stakes.

In Q3 2022, the net earnings for Fortis were reported at C$ 326 million versus C$ 295 million in Q3 2021. The adjusted EPS also grew to C$ 0.71 from C$ 0.64.

There was a decline in the operating cash flow to C$ 633 million from C$ 711 million. The company reported a quarterly dividend of C$ 0.565 per share with a dividend yield of 4.257 per cent. The dividend growth for five-year was noted at 5.66 per cent.

- Canadian Natural Resources Limited (TSX: CNQ)

Canadian Natural Resources produces oil and natural gas. It primarily operates in western Canada, along with Africa and North Sea. The company’s portfolio includes synthetic oil, heavy oil, bitumen, natural gas, and natural gas liquids.

In the second quarter ending on June 30, 2022, the cash flow from operating activities was reported at C$ 5.8 billion from C$ 2.8 billion on March 31, 2022. The net earning was reported at C$3,502 million versus C$ 3,101 million for the same comparative period. The company pays a dividend of C$ 0.75 per share on a quarterly basis. The five-year dividend growth for Canadian Natural Resources was posted at 15.2 per cent and the dividend yield was 3.655 per cent. The EPS of the company is C$ 9.73.

On November 2, 2022, the stock price of the company was reported at C$ 82.09 and witnessed an increase of 54.68 per cent within 12 months.

- Enbridge Inc. (TSX: TSX:ENB)

Enbridge is the owner of midstream assets. These asserts are used by the company for transportation of hydrocarbons across Canada and the U.S.

In Q2 2022, the adjusted EBITDA for Enbridge was reported at C$ 3.7 billion compared to C$ 3.3 billion in Q2 2021. The adjusted earnings witnessed a decrease to C$ 1,350 million from C$ 1,357 million for the same comparative period. The company pays a dividend of C$ 0.86 per share. The three-year dividend growth of the company was 6.16 per cent.

- Brookfield Infrastructure Partners L.P. (TSX: BIP.UN)

Brookfield Infrastructure Partners LP is the owner of long-life assets for generating stable cash flows. The company is engaged in the acquisition of low maintenance infrastructure assets that have high barriers to entry.

For Q3 2022, the net income of Brookfield Infrastructure decreased to US$ 113 million as against US$ 413 million in the year-ago quarter. The revenue grew to US$ 3,627 million from US$ 2,939 million.

As of September 30, 2022, the cash and cash equivalents were noted at US$ 1,053 million versus US$ 1,406 million on December 31, 2021. There was a fall in the total assets which were reported at US$ 71,960 million versus US$ 73,961 million for the same comparative period. With the quarterly dividend of US$ 0.36 per share, the dividend yield was at 3.756 per cent.

On November 2, 2022, the stock price of the company was US$ 49.41 that saw an increase of 2.04 per cent within a span of 12 months.

Bottom Line: Market volatility is an indispensable part of every investor’s journey. Follow a detailed and risk-proof approach to invite substantial value to your stocks in future. Selecting the right dividend stocks can pave a smooth way for the investor and help them pass through rough times. Also, different stocks should be explored keeping in mind the aspect of diversification.

So, as an investor, widen your horizon for the stock selection criteria and make your portfolio a diversified one. This will give you the strategy to minimize the risk and tap on to more opportunities.

The market is dynamic in nature and requires the investors to be updated at all the times. It is easy to move with the uncertainties, but it requires proper planning to deal with the fluctuations and be risk ready. Hence, while adding up your stocks look at them from a 360-degree point of view and stay relevant in the ever-changing markets.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.