By Melanie Burton

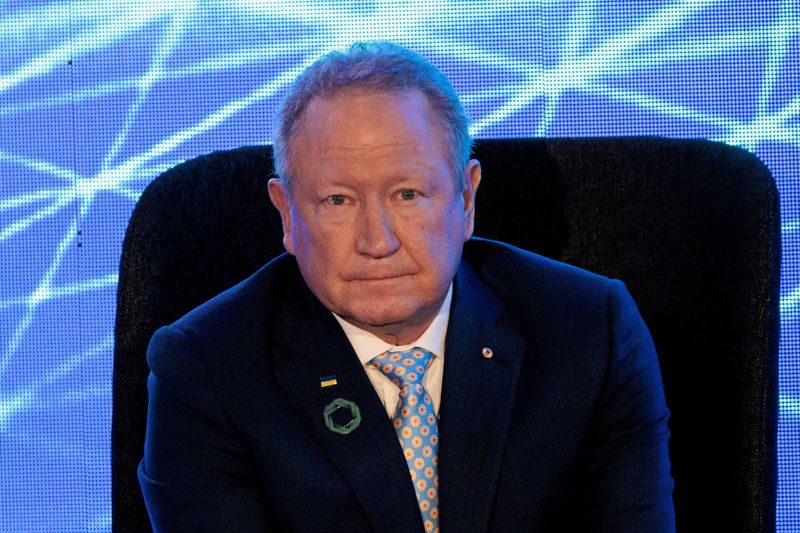

MELBOURNE (Reuters) - Wyloo Metals, the privately held battery resources unit of Australia iron ore baron Andrew Forrest, sees room to grow in nickel as it closes out its A$750.3 million ($501.4 million) buyout of miner Mincor Resources, its CEO said.

Wyloo has breached the 90% holding in Mincor for compulsory acquisition, it said on Wednesday, and the takeover is expected to be sealed in coming weeks.

A key attraction for the buyout is Mincor's Cassini nickel sulphide deposit in Western Australia's Kambalda region that raises Wyloo's Australian exposure to the battery material.

The Kambalda nickel mining district was pegged out decades ago by Western Mining Corp, an Australian mining behomoth that was acquired by BHP Group in 2005. The region is now home to several operators.

"We do like the idea of bringing it back together," Wyloo CEO Luca Giacovazzi said of the prospect of consolidating the district. "Do we have appetite to do more deals? I’m always going to answer the same way: Yes."

"Nickel is a big focus for us. I wouldn’t say it’s just nickel but I would say nickel is our main focus," he added.

Wyloo expects to build on Mincor's five-year mine life given the nature of Kambalda's geology that makes it the country's top nickel district, he said.

As well as BHP, Widgie Nickel and Lunnon Metals also have nickel projects in Kambalda.

Nickel makes batteries energy dense so cars can run further on a single charge. Sulphide deposits are seen as greener than laterite deposits found in top producer Indonesia because they require less power to process than laterite alternatives that are often processed using coal.

Mincor's nickel resources could help feed a A$600 million to A$1 billion precursor battery chemicals processing plant that Wyloo is planning to build with miner IGO in the country's west, and that it hopes to make a call on next year, Giacovazzi said.

Australia is looking to build a critical minerals processing industry to reap more value from the electric vehicle battery chain.

Wyloo elbowed out BHP to buy Canada's Noront Resources, which holds the high-grade nickel sulphide deposit Eagle's Nest, for C$617 million in late 2021. It also holds interests in copper and rare earths.

($1 = 1.4963 Australian dollars)