Investing.com -- BHP Group (ASX:BHP), the world’s largest miner, clocked a sharp decline in its fiscal 2023 profit on Tuesday as weakening metal demand in China, particularly for iron ore, weighed heavily on sales through the year.

Underlying profit attributable for the year to June 30 slid 37% to $13.4 billion - its weakest annual profit in three years. This was driven by a 17% drop in annual revenue to $53.8B.

The Anglo-Australian miner declared a final dividend of $0.80 a share, down from $1.75 per share last year. BHP shares fell as much as 2% after the results, dragging the ASX 200 index down 0.3%.

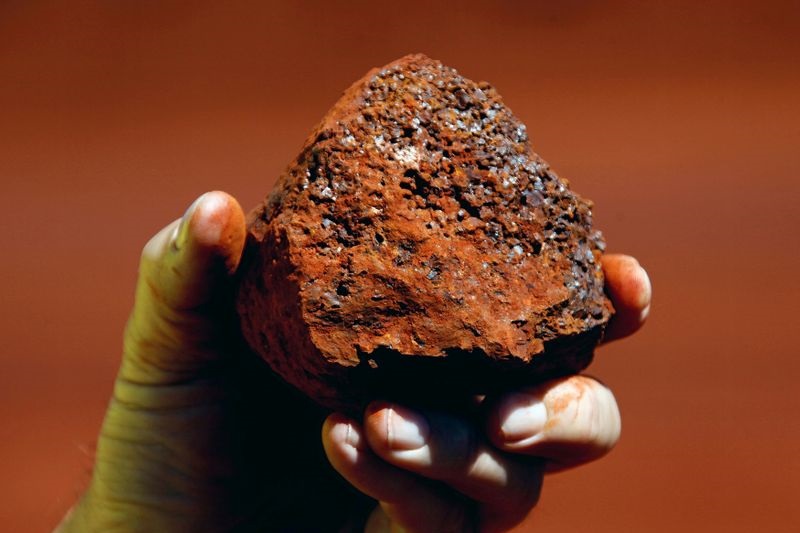

BHP saw an 18% decline in average realized prices on its iron ore sales through fiscal 2023, as weakening demand in China pulled down spot prices sharply over the past year.

China is grappling with a slowing post-COVID economic recovery, with manufacturing and real estate, the country’s biggest economic drivers, having failed to pick up despite the lifting of anti-COVID restrictions at the beginning of 2023.

A brewing debt crisis in China’s property market has been a key source of concern, given that the sector is a major driver of metal demand. Some of the country's biggest property firms are facing a potential default, which could cause contagion in the economy.

Still, BHP said that despite recent weakness, China and India are expected to remain a steady source of commodity demand, and that demand in the developed world has slowed substantially.

BHP is also facing increased costs in Australia due to a rising cost of living and a tight labor market - a trend that is expected to continue through 2024.

BHP peer Rio Tinto Ltd (ASX:RIO) had in July also logged a drop in its half-year earnings, stemming from weakness in China and iron ore prices. Shares of the firm edged lower on Tuesday.