Investing.com-- Investor sentiment in Chinese mainland stock markets has rebounded, as expectations rise for supportive economic policies ahead of next week’s Central Economic Work Conference (CEWC), according to Morgan Stanley (NYSE:MS).

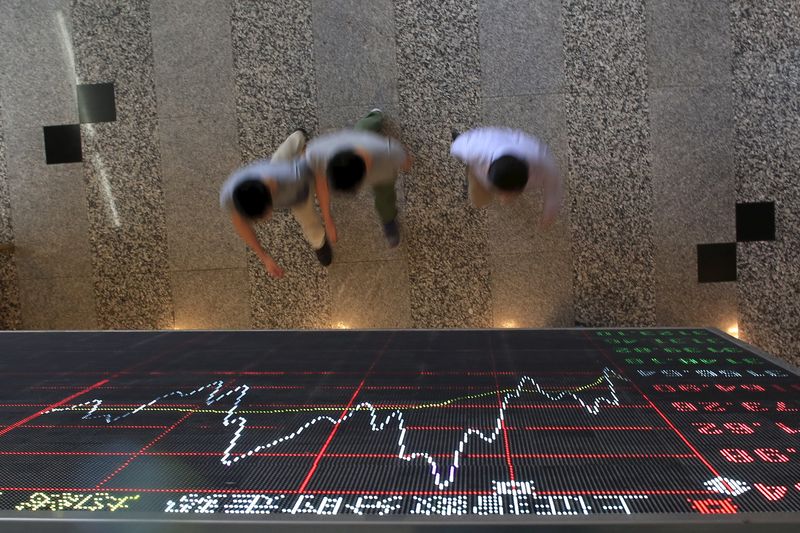

China's A-share market, which includes stocks traded in Shanghai and Shenzhen in local currency, saw increased trading activity and optimism among investors compared to last week, Morgan Stanley analysts said in a note.

The Morgan Stanley A-share Sentiment Indicator (MSASI) showed a notable improvement, with its weighted measure rising to 83% from 77% last week. Average daily trading volumes across key segments, including ChiNext and Northbound trades, also increased, reflecting growing investor interest, the brokerage said.

The optimism comes as China's manufacturing sector shows signs of stabilization. The Purchasing Managers’ Index (PMI) for manufacturing edged up to 50.3 in November, signaling expansion for the second straight month. Analysts attribute this to fiscal measures aimed at boosting infrastructure investment, though concerns about weak consumer demand persist.

However, geopolitical tensions and currency depreciation risks continue to weigh on the market. The U.S. dollar-Chinese yuan exchange rate has faced pressure, and could influence trade and investment dynamics, Morgan Stanley analysts said.

Despite the current optimism, the brokerage remains cautious about the broader market outlook for 2025. Key risks include sustained downward pressure on corporate earnings, potential reductions in consensus earnings estimates, and heightened U.S.-China tensions.

Looking ahead, analysts suggest the CEWC could introduce new fiscal and monetary measures, though they are expected to be moderate. Proposed policies may focus on supply-side reforms rather than direct consumer stimulation, as policymakers navigate a complex economic environment.

Morgan Stanley noted further challenges for China’s equity market, including persistent geopolitical risks and the potential for tighter global monetary policies.