Kalkine Media -

Companies that produce or explore minerals such as silver, gold, iron ore, lithium, uranium, copper, coal, and many others are known as mining stocks.Highlights

- Teck Resources (TSX:TECKa)' steelmaking coal business grew its gross profit by 37 per cent in Q3'22 compared to Q3'21.

- Agnico Eagle provided cash from operating activities of US$ 575.5 million in Q3'22 compared to US$ 297.2 in Q3'21.

The Canadian mining sector generated roughly C$ 132 billion of the country's GDP in 2021. In addition, Canada positions itself as the world's fourth-largest aluminium producer and a leader in potash production.

The mining industry is often in the news for its cyclicality. When the economy slows down, the demand for mined resources usually decreases, and the recent recessionary headwinds have created a concerning situation for investors. On the other hand, the stability of mining companies as an inflation hedge and their consistent operating cash flows have benefited many investors.

Here, we will discuss three TSX-listed mining companies and their financial performances:

Teck Resources Limited (TSX: TECK) Teck Resources Limited is a diversified Canadian mining company in Canada, Chile, Peru, and the United States of oil sands, coal, copper, and zinc. The company is now focused on producing low-carbon metals, such as copper while being the world's second-largest exporter of seaborne metallurgical coal.

Teck Resources has a total market cap of over C$ 28 billion, with earnings per share (EPS) of C$ 8.47 and a 3-year dividend growth rate of 18.77 per cent. In addition, the company has paid its shareholders a quarterly dividend of C$ 0.125 per share.

Per the company's third quarter 2022 results, Tech Resources generated an adjusted profit of C$ 923 million or C$ 1.77 per share attributable to its shareholders. Adjusted EBITDA for Q3'22 was C$ 1.9 billion, generating C$ 10.8 billion in adjusted EBITDA over the last 12 months.

While Teck's zinc segment grew its gross profit by 9 per cent in the third quarter of 2022, the steelmaking coal business's gross profit improved by 37 per cent from Q3'21.

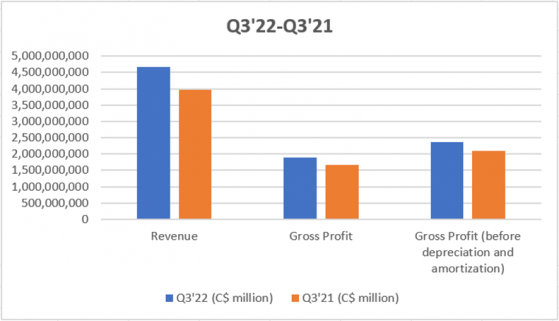

Teck Resources' financials are shown in the chart below:

© 2023 Krish Capital Pty. Ltd.

Agnico Eagle Mines (TSX: TSX:AEM) Founded in 1957, Agnico Eagle Mines is a Canadian mining company that explores precious metals in Canada, Mexico, Australia, and Finland. The company also has several exploration projects in the US and Colombia.

Agnico Eagle has delivered an EPS of C$ 1.80 alongside a 3-year dividend growth rate of 40.30 per cent.

Agnico Eagle generated a net income of US$ 79.6 million in the third quarter of 2022 alongside an adjusted net income of US$ 235.4 million.

The company reported achieving cash from operating activities of US$ 575.5 million in Q3'22, up from US$ 297.2 million in Q3'21. For the first nine months of 2022, cash provided by operating activities improved from US$ 1,083.2 million in Q3'21 to US$ 1,716.1 million.

Bottom Line Looking at the volatile nature of the stock market, investors should conduct extensive market research before investing their hard-earned money in mining stocks or other sectors.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.