Investing.com -- Paul Marino, Chief Revenue Officer at Themes ETFs, advises investors to focus on innovation and infrastructure rather than obsessing over Federal Reserve decisions.

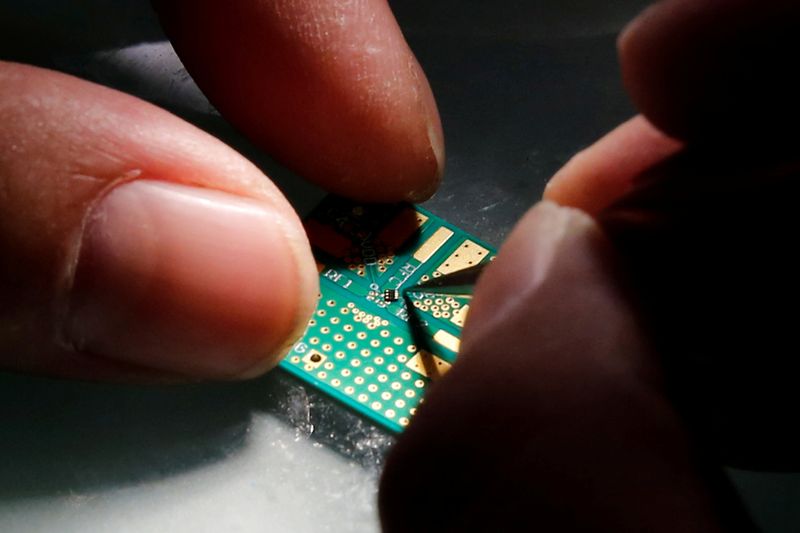

As the market debates the Federal Reserve's next move, Marino told Investing.com that broader economic trends, especially in semiconductors and infrastructure, present more significant opportunities for long-term growth.

"Regardless of what the Fed does with one rate decision, semiconductors and infrastructure remain attractive," Marino said.

According to the industry veteran, the real conversation should revolve around tech giants like Elon Musk and Larry Ellison, who "begged Nvidia (NASDAQ:NVDA) CEO Jensen Huang to let them spend more money on GPU chips." Marino believes companies such as Nvidia, AMD (NASDAQ:AMD), and Broadcom (NASDAQ:AVGO) are top investment choices in the semiconductor space.

"Whether or not the Federal Reserve raises rates or lowers them, demand will continue to be beyond strong in AI, hyper data centers, gaming and autonomous driving," he explained, adding that leading tech companies are making capital expenditure decisions based on staying ahead of the competition, not on Federal Reserve policies.

"Innovative tech giants can't afford to make capex decisions based on 'Uncle Sam,' or in this case 'Uncle Jerome,'" stated Marino.

Marino also emphasized the importance of infrastructure investment, bolstered by the US Infrastructure Bill.

"There are nearly 36 trillion reasons why we like infrastructure," he said, citing companies like Caterpillar (NYSE:CAT) and United Rentals (NYSE:URI), which have hit record highs thanks to ongoing infrastructure projects. "We love companies that supply equipment and those that move it around," he added.

Freight companies like Union Pacific (NYSE:UNP) and Norfolk Southern (NYSE:NSC) are also poised to benefit as they transport the equipment and materials required for these projects.

Looking ahead, Marino highlighted key trends and potential risks in both sectors. He pointed to rising demand for semiconductor chips, driven by AI and tech innovations, but warned of potential supply shortages, geopolitical tensions in Taiwan, and regulatory scrutiny.

Nevertheless, "this is a once-in-a-lifetime investment theme," Marino concluded, urging investors to seize the opportunity.