GuruFocus - On June 18, 2024, James Young, Director at Novavax Inc (NASDAQ:NVAX), executed a sale of 7,500 shares of the company. The transaction was filed on the same day through an SEC Filing. Following this transaction, the insider now owns 69,260 shares of Novavax Inc.

Novavax Inc is a biotechnology company focused on the discovery, development, and commercialization of innovative vaccines to prevent serious infectious diseases. The company's proprietary recombinant technology platform combines the power and speed of genetic engineering to efficiently produce highly immunogenic nanoparticles designed to address urgent global health needs.

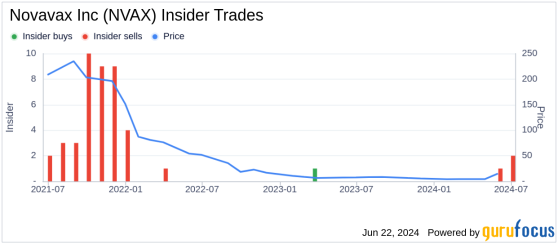

Over the past year, James Young has sold a total of 7,500 shares and has not made any purchases of the company's stock. This recent sale is part of a broader trend observed at Novavax Inc, where there have been no insider buys but three insider sells over the same timeframe.

Shares of Novavax Inc were trading at $13.72 on the day of the transaction. The company has a market cap of approximately $2.065 billion.

The stock's valuation metrics, such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, are calculated based on historical data, adjustments for past performance, and future business estimates. According to the GF Value, the intrinsic value of Novavax Inc is estimated at $29.87 per share, suggesting that the stock might be undervalued.

The price-to-GF-Value ratio stands at 0.46, indicating that the stock could be a possible value trap, and potential investors should think twice before making an investment decision.

This insider selling activity and the current valuation metrics provide critical data points for investors monitoring Novavax Inc's stock performance and insider behaviors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com