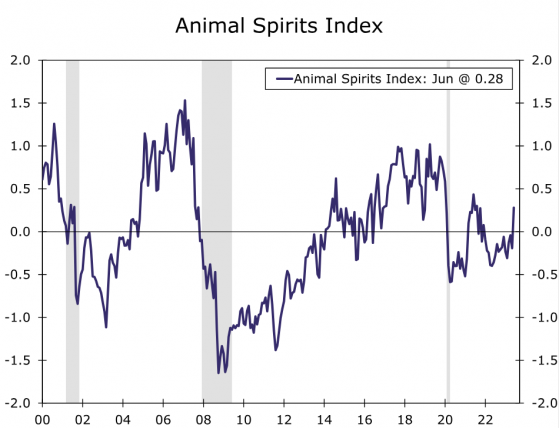

Proactive Investors - An index measuring underlying investor sentiment turned positive last month for the first time since 2021 but analysts expect this to evaporate again before long.

The Animal Spirits Index, compiled by Wells Fargo (NYSE:WFC) and named after a term coined by legendary economist John Maynard Keynes to describe the emotional enthusiasm of investors driving decisions such as buying and selling shares, climbed to 0.28 in June, up from -0.19 in May, the first positive reading after 17 months in the red.

In simple terms, an ASI index value above zero indicates investor optimism, while a value below zero suggests pessimism.

All five of the index components – the S&P 500, the US consumer confidence index, the yield curve on US Treasuries, the VIX volatility index and the Economic Policy Uncertainty Index – increased in June.

The ASI's break into positive territory aligns with better-than-expected economic data over the past few months, Wells Fargo economics Azhar Iqbal and Nicole Cervi noted.

However, while recent data have been stronger than expected data, “the latest readings on employment and consumer spending suggest momentum is fading,” the pair said.

They expect hiring to continue to slow in the coming months alongside softer wage growth.

“The weaker labor market will pressure consumer spending, and we expect real personal consumption expenditures to contract over the first half of 2024.

“The pullback is set to weigh on confidence later this year and early next, creating scope for the ASI to return to the red.”

Looking at the underlying index components, the S&P 500 gained roughly 270 points during the month as it completed a four-month positive streak, though many market observers have pointed out that a bunch of six or seven tech 'mega caps' have generated almost all the gains and masked weaker performance from many others.

The VIX index improved (fell) four points as stock market volatility eased in June, while in the bond market, the yield spread on the 10-year and 3-month Treasuries unwound some of its deep inversion, rising to -141 bps in June from -156 bps the prior month.

Mirroring the broad improvement in financial markets, the US consumer confidence index jumped seven points in June to its highest level in 17 months, while the Economic Policy Uncertainty Index subsided 18.5 points in June.

Read more on Proactive Investors CA