Investing.com -- More than $129 billion flowed into cash funds for the week that ended Sept. 25, Bank of America (NYSE:BAC) said in a new report. This marks the largest inflow in 18 months.

Meanwhile, equities attracted $25.4 billion, with US stocks seeing an inflow of $10.9 billion, bringing year-to-date (YTD) inflows to an annualized $363 billion, the second-largest on record.

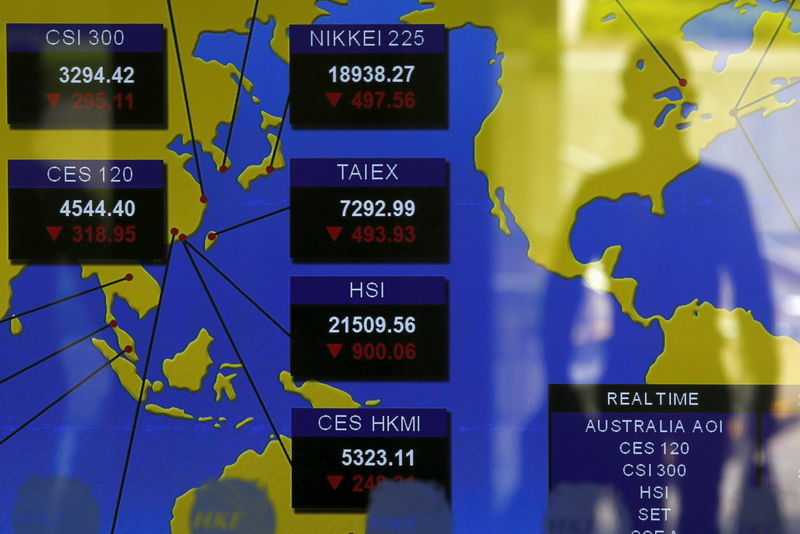

European stocks experienced their largest inflow in five months at $600 million, while emerging market (EM) equities recorded the fourth-largest inflow of 2024 with $9.7 billion. Despite minor outflows from tech funds at $200 million, YTD inflows in the sector are on track to set a record at $60 billion.

According to BofA’s strategists, Wall Street’s conviction trades include long positions in gold and tech, coupled with short positions in 30-year Treasuries and China.

They believe the ongoing bullish rotation will “continue until recession causes “retreat” from stocks into bonds or disorderly rise in bond yields reverses gold/tech leadership.”

BofA's team also suggests that investors could pivot toward international equities, especially to capitalize on China’s ongoing stimulus, which aims to bolster growth through measures like reserve requirement ratio (RRR) cuts and household savings from lower mortgage rates.

However, the bank cautions that “if this China stimulus doesn’t work then geopolitical risks [are] going to soar.”

Among other weekly flows, investment-grade (IG) funds saw an inflow of $10.2 billion, bringing YTD inflows to an annualized $415 billion, a record pace.

In contrast, US Treasuries faced a $1.6 billion outflow, marking the largest four-week redemption since December 2023.

Emerging market (EM) debt inflows were the largest since January 2023 at $1.2 billion.