HighlightsThe renewable energy sector is vast, from geothermal to hydroelectricity and natural gas to ocean energy. Reportedly, Canada is the second largest producer of hydroelectricity globally.

- In Q2 2022, the EBITDA (adjusted) for TransAlta Renewables Inc. increased by 30 per cent and was C$ 126 million.

- The stock price for Brookfield Renewable Partners LP fell by four per cent and was C$ 43.25 as on October 5, 2022.

- In Q2 2022, the Sales for Northland Power Inc . (TSX:NPI) increased to C$ 557 million from $408 million in Q2 2021.

To invest in the renewable energy sector, one should study the demand for clean energy as it decides the fundamentals of the stock. Also, consider the other relevant factors that define the market and these stocks.

Along with these factors, analyze your portfolio and be clear about its demand.

Here, we look at five renewable energy stocks and their performances in recent quarters:

TransAlta Renewables Inc. (TSX: RNW) TransAlta Renewables Inc. is an electric utility company. It owns and operates transmission facilities and energy generation.

In Q2 2022, the EBITDA (adjusted) for TransAlta was C$ 126 million, with an increase of 30 per cent as against the same quarter the previous year. Free cash flow (FCF) for the reported quarter was C$ 87 million, an increase of 23 per cent in the same period in 2021.

On the other hand, cash flow from operating activities was C$ 28 million, which decreased 65 per cent compared to the same quarter in 2021.

Brookfield Renewable Partners LP (TSX: BEP.UN) Brookfield Renewable is a global firm that is a multi-technology owner and operates clean energy assets.

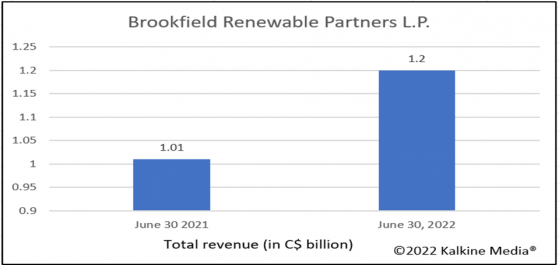

For the quarter ending June 30, 2022, the cash & cash equivalents were C$ 823 million against C$ 764 million in the year-ago quarter. The total assets and liabilities increase was reported at C$ 57,030 million compared to C$ 55,867 million as of December 31, 2021.

The net income for Q2 2022 saw a surge and was reported at C$ 122 million. On the contrary, the stock price for Brookfield Renewable Partners LP fell by four per cent and was C$ 43.25 as on October 5, 2022.

The below graph displays the changes the in the total revenue YoY.

Northland Power Inc. (TSX: NPI) Northland Power Inc. operates, constructs, and develops maintainable infrastructure assets. Their range includes onshore and offshore wind, solar, and energy supply through a regulated utility.

In Q2 2022, the Sales for Northland Power Inc. grew to C$ 557 million from $408 million in Q2 2021, and Gross profit jumped to C$ 485 million from C$ 368 million for the same comparative year.

In Q2 2022, the company's EBITDA (adjusted) also increased to C$ 335 million from C$ 203 million in the year-ago quarter. Further, the net income increased to C$ 268 million from a net loss of C$ 6 million in Q2 2021.

As of October 5, 2022, the stock price was C$ 41.31 and increased by 6.24 per cent within 12 months.

Boralex Inc. (TSX: TSX:BLX) Boralex Inc. is a power producer. The company has renewable energy power stations, which they develop and operate.

In Q2 2022, the consolidated operating income was C$ 45 million, up from C$ 24 million in Q2 2021. Meanwhile, EBITDA witnessed a growth of 15 per cent and amounted to C$ 121 million.

For Q2 2022, cash flow from operations also increased by C$ 20 million and was reported at C$ 86 million.

Innergex Renewable Energy Inc. (TSX: INE) Innergex Renewable Energy Inc. is a renewable power producer (independent). The company deals in hydroelectric, solar and wind facilities. They operate, acquire, own, and develop these facilities.

For the June quarter, the total revenue for Innergex Renewable Energy Inc. increased to C$ 219.74 million from C$ 170.6 million in the previous quarter. The EBITDA (adjusted) also increased and was reported at C$ 152.87 million.

The cash flow from operating activities also increased and was reported at C$ 308.38 million against C$ 252.21 million in the same quarter the previous year.

As of October 5, 2022, the stock price for Innergex Renewable Energy Inc. was C$ 17.13 and decreased by 12 per cent within 12 months.

Bottom Line Investing during market volatility is an uphill task and very challenging for investors. It requires an in-depth analysis of the stock and the companies before zeroing in. However, long-term strategies always protect traders during bearish market trends or otherwise.

Consider every aspect and ensure to make your portfolio is error-proof in every sense. Look at the long-term growth opportunity and follow a pragmatic approach.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.