Highlights

- The capital expenditures for Fortis (TSX:FTS) Inc. saw an increase and were reported at C$ 930 million as against C$ 840 million same quarter previous year

- As of September 27, 2022, Royal Bank of Canada (TSX:RY) completed the acquisition of Brewin Dolphin Holdings PLC

- The revenue for Canadian Natural Resources (TSX:CNQ) Limited saw an increase and was reported at C$ 11.4 billion

As a result of continuous economic pressure, this year is marked by market volatility. Other factors like rising inflation and high-interest rates are also playing their part, especially among new investors. As an investor, make healthy investment choices to surpass market uncertainties.

When choosing your stocks, back it up with thorough research and analysis. Understand the market working and fluctuations before adding a stock to your portfolio.

Here, we look at a few stocks and their performances in recent quarters:

Fortis Inc . (TSX: FTS) Fortis Inc. operates and owns utility transmission assets. It also involves distribution assets and serves gas and electricity customers.

Currently, the total market capitalization for Fortis Inc. is C$ 25.122 billion. The company announced a dividend of C$ 0.565 with a dividend yield of 4.306 per cent. The five-year dividend growth has been 5.66 per cent.

For the second quarter of fiscal 2022, Fortis' net earnings increased to C$ 284 million compared to C$ 253 million in the same quarter of the previous year. On the other hand, capital expenditures saw an increase and were reported at C$ 930 million as against C$ 840 million in Q2 2021.

The company's earnings per share (EPS) was C$ 2.65, with a price-to-earnings (P/E) ratio of 19.80.

Royal Bank of Canada (TSX: RY) Royal Bank of Canada offers its clients personal, corporate, and commercial banking. Along with this, it is into wealth management and insurance services as well. It operates with an employee size of 88,541.

In Q3 2022, the net income of Royal Bank of Canada witnessed a decline of 16 per cent and was reported at C$ 3.6 billion compared to the previous quarter. The EPS was also down by 15 per cent year-over-year (YoY) and was announced at C$ 2.51.

Reportedly, Royal Bank of Canada had C$ 340 million of provisions taken on loans in the current quarter due to unfavourable changes in their macroeconomic outlook.

As of September 27, 2022, Royal Bank of Canada completed the acquisition of Brewin Dolphin Holdings PLC.

Imperial Oil Limited (TSX: TSX:IMO) Imperial Oil Limited is an oil company that focuses on the marketing of petroleum products and operations for petroleum refining.

For Q2 2022, the net income increased by C$ 366 million and was reported at C$ 2,409 million. Further, cash flow from operating activities increased by C$ 852 million and was calculated at C$ 2,682 million.

Imperial Oil Limited declared the Q3 dividend of C$ 0.34 per share. It has a five-year dividend growth of 11.8 per cent.

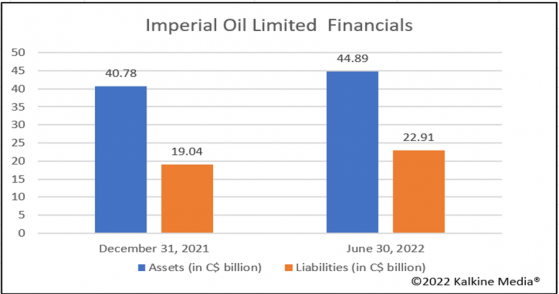

The below graph depicts the changes in assets and liabilities from December 31, 2021, to June 30, 2022.

Canadian Natural Resources Limited (TSX: CNQ) Canadian Natural Resources Limited is an oil and natural gas producer, and its portfolio includes natural gas liquids, heavy oil, light and medium oil, synthetic oil and natural gas.

The total market capitalization for Canadian Natural Resources Limited is C$ 74.3 billion. The company announced a quarterly dividend of C$ 0.75 per cent per share. It had a dividend yield of 4.666 per cent.

For the ended June 30, the net earnings of Canadian Natural Resources were C$ 3.5 billion. Cash flow from operating activities in the reported quarter were approximately C$ 5.9 billion.

BCE Inc. (TSX: TSX:BCE) BCE Inc. is an internet service provider. It offers landline and wireless phone services, broadband and television services and operates with an employee size of 49,781.

Further, the EBITDA for BCE Inc. increased by 4.6 per cent. On the contrary, net earnings for Q2 2022 declined by 10.9 per cent and was reported at C$ 654 million.

The digital revenue for the company witnessed a growth of 55 per cent and media revenue increased by 8.7 per cent.

Free cash flow for the company also increased and was reported at C$ 1,333 million.

Bottom Line As new investors, you may follow an approach that suits your portfolio. Try to capture the daily fluctuations. Analyze and understand the market trends to survive the market hiccups. Additionally, study about the types of stocks that operate in the market.

Explore the stocks before you choose them to add to your portfolio. Have a look at the company's latest financials and go for stark comparisons to choose as per your suitability.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.