Investing.com — For the first time in years, staying long on the Mag 7 hasn't quite paid off as expected. Since the start of H2, the Roundhill Magnificent Seven ETF (NASDAQ:MAGS) has shed -1.05%, while the S&P 500 gained a solid 3.44% during the same period.

The main reason behind the trend was an extraordinary earnings season, in which corporate profitability grew at the fastest pace since 2021, while big tech consistently failed to meet the lofty expectations.

Against this backdrop, investors who managed to anticipate the market by broadening their investments across different higher-value blue-chip stocks scored fat profits - and are now well positioned to continue to do so as the market shoots for a new all-time high.

Such is the case of our premium users who, for less than $9 a month, followed our list of AI-picked winning stocks for both July and August.

With best-in-breed insights such as the following earnings season winners:

- Charter Communications (NASDAQ:CHTR): +19.72%

- Eli Lilly and Company (NYSE:LLY): +15.48%

- Expedia (NASDAQ:EXPE): +14.80%

- F5 Networks (NASDAQ:FFIV): +14%

- Pool Corporation (NASDAQ:POOL): +13.64%

- Molina Healthcare (NYSE:MOH): +12.99%

- PayPal Holdings (NASDAQ:PYPL): +11.60%

- Enphase Energy (NASDAQ:ENPH): +11.60%

- Frontdoor (NASDAQ:FTDR): +11.50%

- YETI Holdings (NYSE:YETI): +10.60%

Along with the following top picks for August:

- Fortinet (NASDAQ:FTNT): +32% in August.

- Floor & Decor Holdings (NYSE:FND): +14.75% in August.

- We also bought the CrowdStrike (NASDAQ:CRWD) dip for a 19.54% gain

- And the Nike (NYSE:NKE) post-earnings dip for another 11.5%.

...Just to name a few... ProPicks users once again managed to beat the market by a lofty margin, with our flagship Top Value strategy leading the pack with a massive +4.8% gain in the month - more than twice the S&P 500's 2% during the same period.

It was then closely followed by Best of Buffett (+3.5%), Beat the S&P 500 (+3.3%), and Dominate the Dow (+3%) in August.

Now, as the Fed prepares for the first rate cut of its cycle later this month, our AI has just released one of its largest updates on record today.

Stop guessing and check out our AI's top high-value picks for just under $9 a month here.

Already a Pro user? Then, jump straight to the updates via this link.

But how does our AI do it so consistently?

Unlike other models, our AI identifies undervalued names before they become too expensive.

Instead of relying solely on momentum models, our approach integrates decades of comprehensive stock market fundamental and technical analysis of a multitude of data sets.

The results speak for themselves.

Check out some of our performance numbers since our official launch in November last year (as of today's premarket figures):

- Tech Titans: +77.81%

- Top Value: +41.10%

- S&P 500: +33.28%

This is no backtest; it's real-world performance, unfolded in real time to our users' benefit.

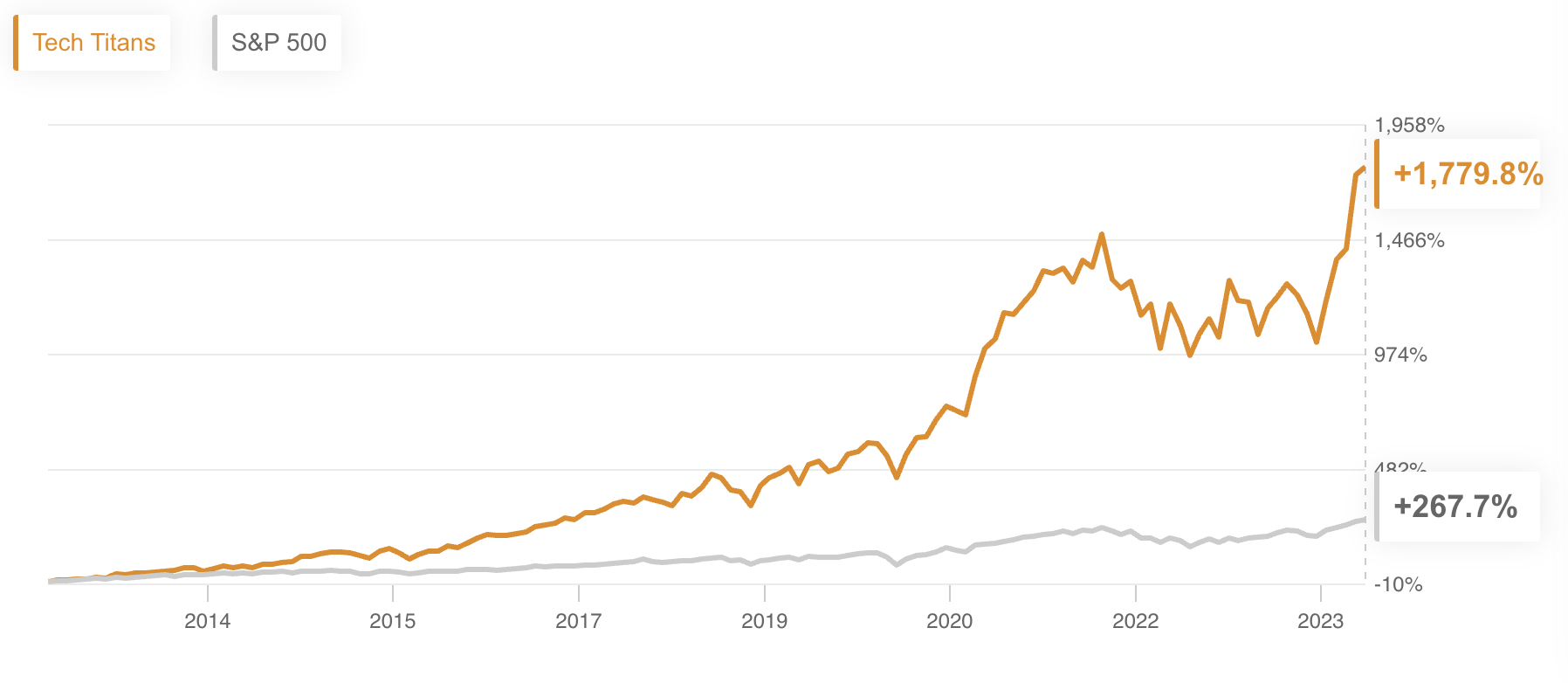

In fact, our backtest suggests that going for the long run will give you even heftier gains. See chart below for reference:

Source: ProPicks

This means a $100K principal in our strategy would have turned into an eye-popping $1,879,800K by now.

Will you risk going another month without the super-human power of AI data processing?

For less than $9 a month, that decision has never been easier.