By Jonathan Stempel

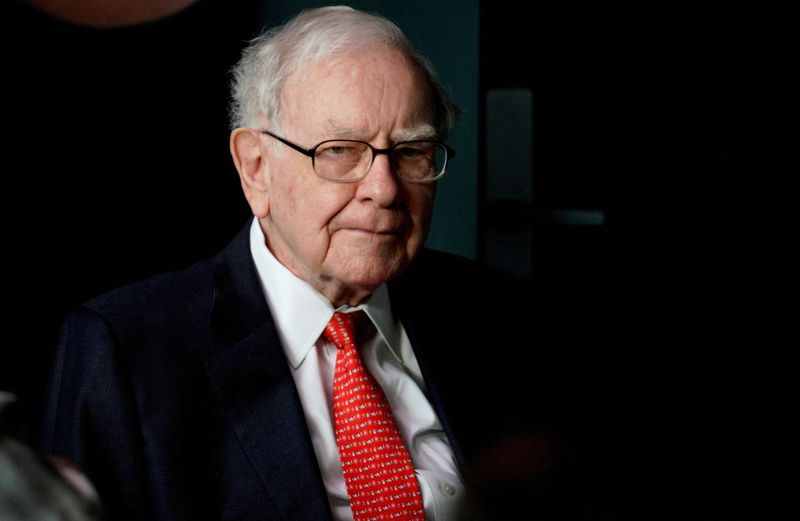

(Reuters) -Warren Buffett has donated another $4.64 billion of Berkshire Hathaway (NYSE:BRKa) stock to five charities, boosting his total giving since 2006 to more than $51 billion.

The annual donation made on Wednesday is the 92-year-old Buffett's largest, and consisted of about 13.7 million of Berkshire's Class B shares.

Buffett is donating 10.45 million shares to the Bill & Melinda Gates Foundation, which has received more than $39 billion of Berkshire stock overall.

He is also donating 1.05 million shares to the Susan Thompson Buffett Foundation, named for his late first wife, and 2.2 million shares split evenly among charities led by his children Howard, Susan and Peter: the Howard G. Buffett Foundation, the Sherwood Foundation and the NoVo Foundation.

Buffett is gradually giving away nearly all of the fortune he built at Omaha, Nebraska-based Berkshire, which he has run since 1965.

He and Bill Gates pioneered the Giving Pledge, in which more than 240 people like Michael Bloomberg, Larry Ellison, Carl Icahn, Elon Musk and Mark Zuckerberg committed at least half of their wealth to philanthropy.

Buffett has already donated more than half of his Berkshire stock. He still owned more than $112.5 billion, or 15.1%, of Berkshire shares following Wednesday's donations.

The number of shares Buffett donates falls by 5% each year, but this year's dollar amount set a record because Berkshire's stock price has been rising.

"Nothing extraordinary has occurred at Berkshire: a very long runway, simple and generally sound decisions, the American tailwind and compounding effects produced my current wealth," Buffett said in a statement.

"American tailwind" was coined by Buffett in 2019 to describe the United States' ability to build wealth over the long term, even through times of war and financial crisis.

Buffett built Berkshire into an approximately $740 billion company through businesses such as BNSF railroad and Geico car insurance, and stock holdings in companies such as Apple Inc (NASDAQ:AAPL).

The Susan Thompson Buffett Foundation works in reproductive health. The Howard G. Buffett Foundation focuses on alleviating hunger, mitigating conflicts and improving public safety. The Sherwood Foundation supports nonprofits in Nebraska, and the NoVo Foundation has initiatives focused on girls and women.