- PCE inflation data, Fed rate hike expectations, recession fears in focus.

- Nike shares are a buy with upbeat earnings on deck.

- Micron stock is set to struggle amid shrinking profit and revenue growth.

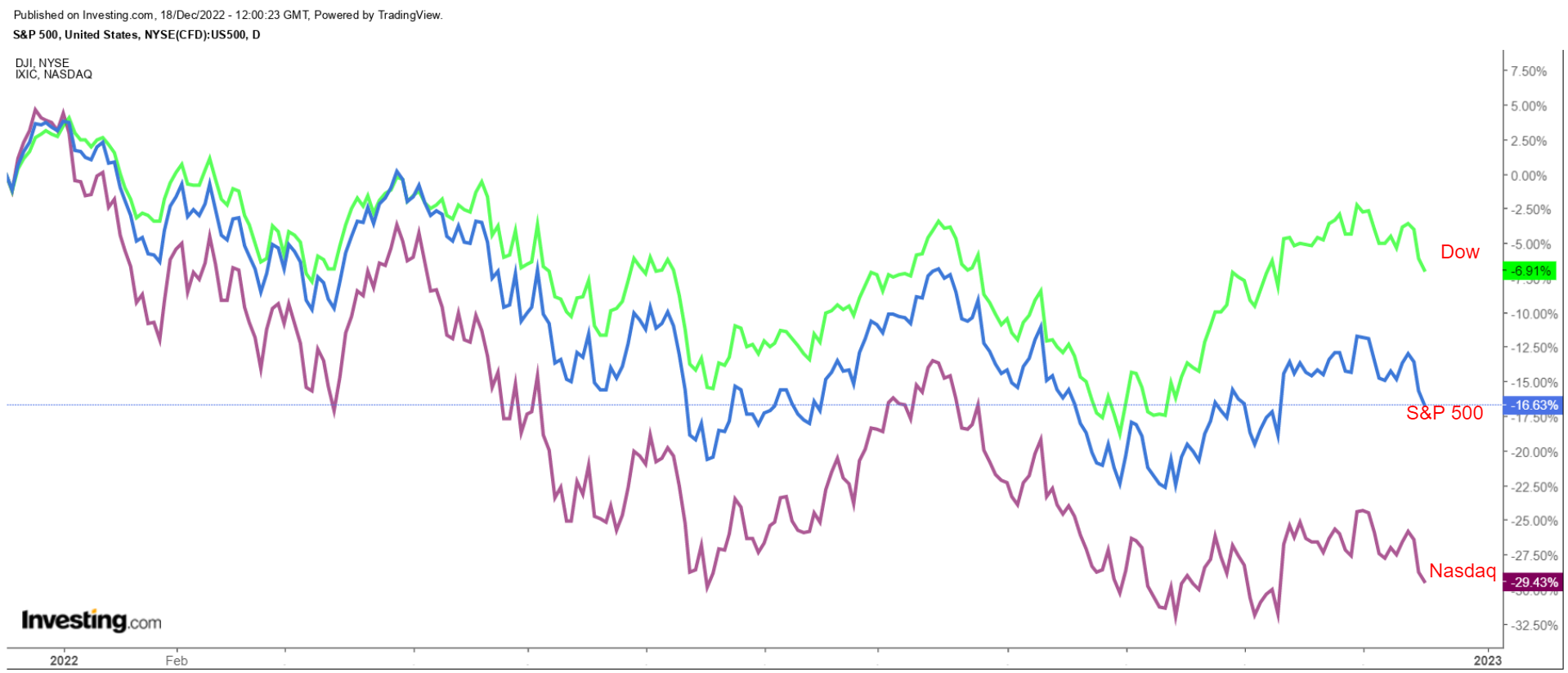

Stocks on Wall Street declined on Friday, with the major indices suffering their second straight week of losses as hopes for a year-end rally fizzled amid mounting concerns about further Federal Reserve rate hikes and a possible recession.

For the week, the blue-chip Dow Jones Industrial Average dropped 1.7%, while the benchmark S&P 500 and technology-heavy Nasdaq Composite fell 2.1% and 2.7% respectively.

Source: Investing.com

The coming week - which will be the last full trading week of 2022 - is expected to be another eventful one as markets continue to weigh the Fed’s rate hike plans for the months ahead.

Meanwhile, on the economic calendar, most important could be Friday’s personal consumption expenditures data, which includes the PCE price index, the Fed’s preferred inflation measure.

There will also be important third-quarter growth data, which will provide more clues as to whether the economy is heading for a recession.

Elsewhere, on the earnings docket, there are just a handful of corporate results due as Q3 earning season winds down, including Nike (NYSE:NKE), Micron (NASDAQ:MU), FedEx (NYSE:FDX), General Mills (NYSE:GIS), and Carnival (NYSE:CCL).

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another that could see further downside.

Remember though, our time frame is just for the upcoming week.

Stock To Buy: Nike

I expect Nike shares to rally in the week ahead as the sports apparel and footwear giant is forecast to report upbeat financial results and strong guidance when it delivers its latest earnings after the closing bell on Tuesday, Dec. 20.

As per moves in the options market, traders are pricing in a significant swing of 9.3% in either direction for NKE stock following the earnings update.

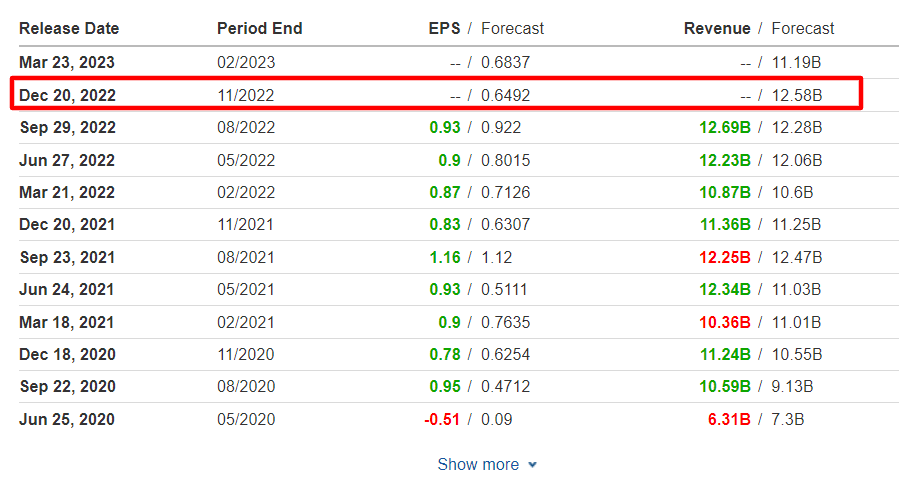

Consensus expectations call for the Beaverton, Ore.-based sneaker company - which has topped Wall Street’s profit estimates for nine consecutive quarters - to post earnings per share of $0.65 for its fiscal second quarter, according to analysts polled by InvestingPro+. That would be 21.7% lower than EPS of $0.83 in the year-ago period.

Source: Investing.com

Revenue growth is expected to accelerate for the second straight quarter, with an anticipated 10.7% year-over-year rise to $12.58 billion, as it benefits from favorable consumer trends for sports and recreation clothing and equipment.

In my opinion, Nike’s sales growth in North America will surprise to the upside, as demand remained strong heading into the holiday shopping season despite a difficult backdrop of rampant inflation and recession fears.

Perhaps of greater importance, sales figures from China are expected to reveal that revenue growth rebounded sharply in fiscal Q2 thanks to receding COVID-19 restrictions after falling 16% in the preceding quarter.

As a result, I anticipate Nike’s management will provide an upbeat outlook for the months ahead amid easing worries over the impact of excess inventory and gross margins in spite of a challenging environment for retailers.

NKE stock closed at $105.95 on Friday, earning the athletic apparel and footwear giant a valuation of roughly $165.8 billion.

Source: Investing.com

Shares, which have bounced off their recent lows along with the major stock indexes, are down 36.7% year to date and are approximately 38.1% below their all-time high of $179.10 reached in December 2021.

Stock To Dump: Micron Technology

I reckon Micron’s stock will suffer a challenging week ahead, with a potential breakdown to new multi-month lows on the horizon, as the struggling memory-and-storage chipmaker’s latest earnings results are likely to reveal a sharp slowdown in profit and sales growth due to the challenging operating environment.

Micron is scheduled to deliver fiscal Q1 numbers on Wednesday after the bell.

Market players expect a large swing in MU shares following the results, according to the options market, with a possible implied move of 9.8% in either direction.

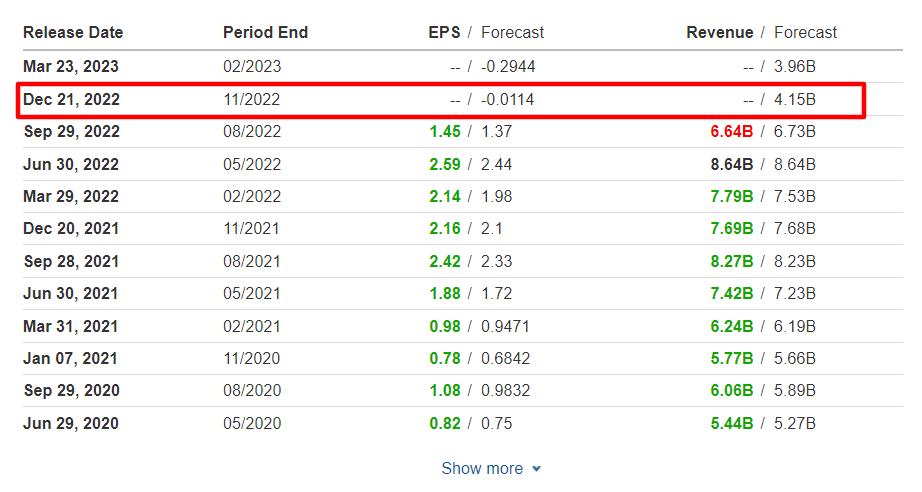

According to Investing.com, Micron is forecast to deliver a loss of $0.01 a share, plunging from a profit of $2.16 per share in the same quarter last year. If confirmed, that would mark Micron’s first quarterly loss on record due to the negative impact of rising operating expenses and weakening enterprise demand for its DRAM and NAND chips.

Source: Investing.com

Unsurprisingly, an InvestingPro+ survey of analyst earnings revisions points to mounting pessimism ahead of the report, with analysts cutting their EPS estimates 25 times in the past 90 days to reflect a drop of -100.4% from their initial expectations.

Meanwhile, revenue is forecast to tumble 46% year over year to $4.15 billion - which would be the lowest level since Q1 2016 - amid numerous headwinds, including ongoing inventory and supply-chain issues.

Taking that into account, I believe there is a growing downside risk that Micron’s management could once again cut its full-year profit and sales guidance as data centers cut back spending on memory and storage chips.

MU stock ended Friday’s session at $52.07, reapproaching its mid-September two-year low of $48.45. At current levels, the Boise, Idaho-based company has a market cap of $56.6 billion.

Source: Investing.com

Micron has seen its valuation collapse throughout 2022, with the stock falling 44.1% year to date. Even more worrying, shares are approximately 47% below their record peak of $98.45 reached on January 5.

Disclosure: At the time of writing, Jesse is short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (NYSE:SH) and ProShares Short QQQ ETF (NYSE:PSQ).

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

**

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »