- Fed’s Jackson Hole gathering, Powell speech, retailer earnings in focus.

- Palo Alto Networks is a buy with upbeat earnings, guidance on deck.

- Lowe’s is a sell with weak profit growth, outlook expected.

- Looking for more actionable trade ideas? Try InvestingPro for under $8/Month.

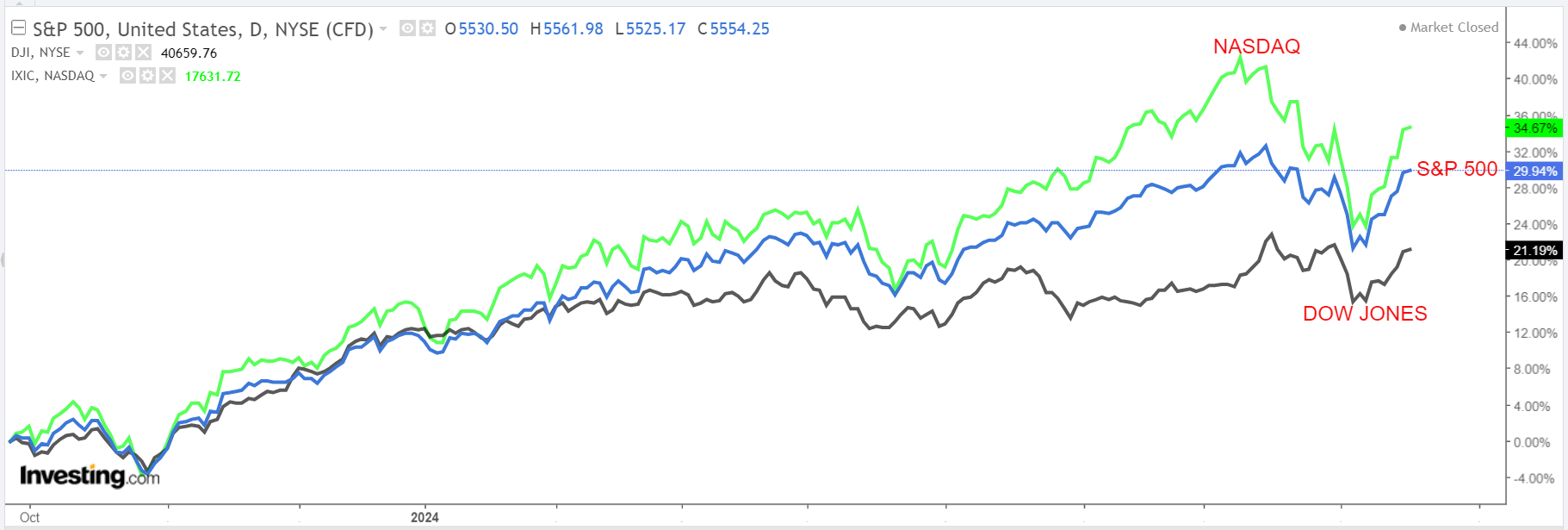

Stocks on Wall Street ended higher on Friday to cap off the best week of 2024 after encouraging U.S. economic data helped soothe fears of a recession.

Source: Investing.com

The benchmark S&P 500 jumped 3.9%, its best week since November 2023. The tech-heavy Nasdaq Composite gained 5.2%, while the blue-chip Dow Jones Industrial Average added 2.9%.

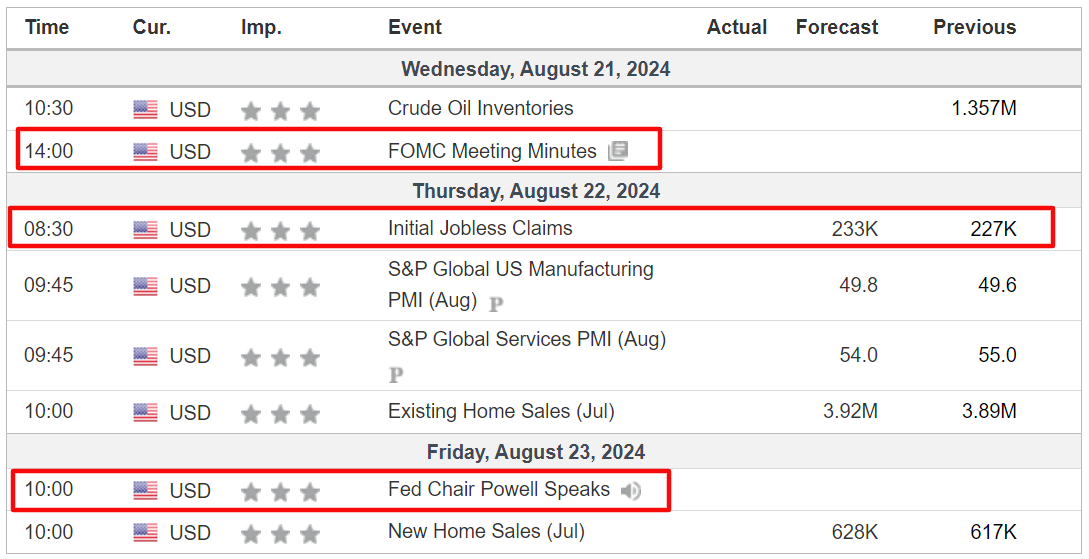

Next week is expected to be another eventful one as attention turns to the Fed’s annual Economic Policy Symposium, which will take place in Jackson Hole, Wyoming, starting on Thursday.

Investors will scrutinize a speech from Fed Chair Jerome Powell on Friday for clues on the outlook for interest rates. As of Sunday morning, investors see a 75% chance of the Fed cutting rates by 25 basis points at its September meeting, and a 25% chance of an outsized 50-basis-point cut.

Source: Investing.com

Elsewhere, on the earnings docket, there are just a handful of corporate results due as Q2 earning season winds down, including a slew of retailers such as Target (NYSE:TGT), TJX Companies (NYSE:TJX), Lowe’s (NYSE:LOW), and Macy’s (NYSE:M). The tech sector has Palo Alto Networks (NASDAQ:PANW), Snowflake (NYSE:SNOW), Workday (NASDAQ:WDAY), and Baidu (NASDAQ:BIDU) stepping into the earnings confessional.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, August 19 - Friday, August 23.

Stock to Buy: Palo Alto Networks

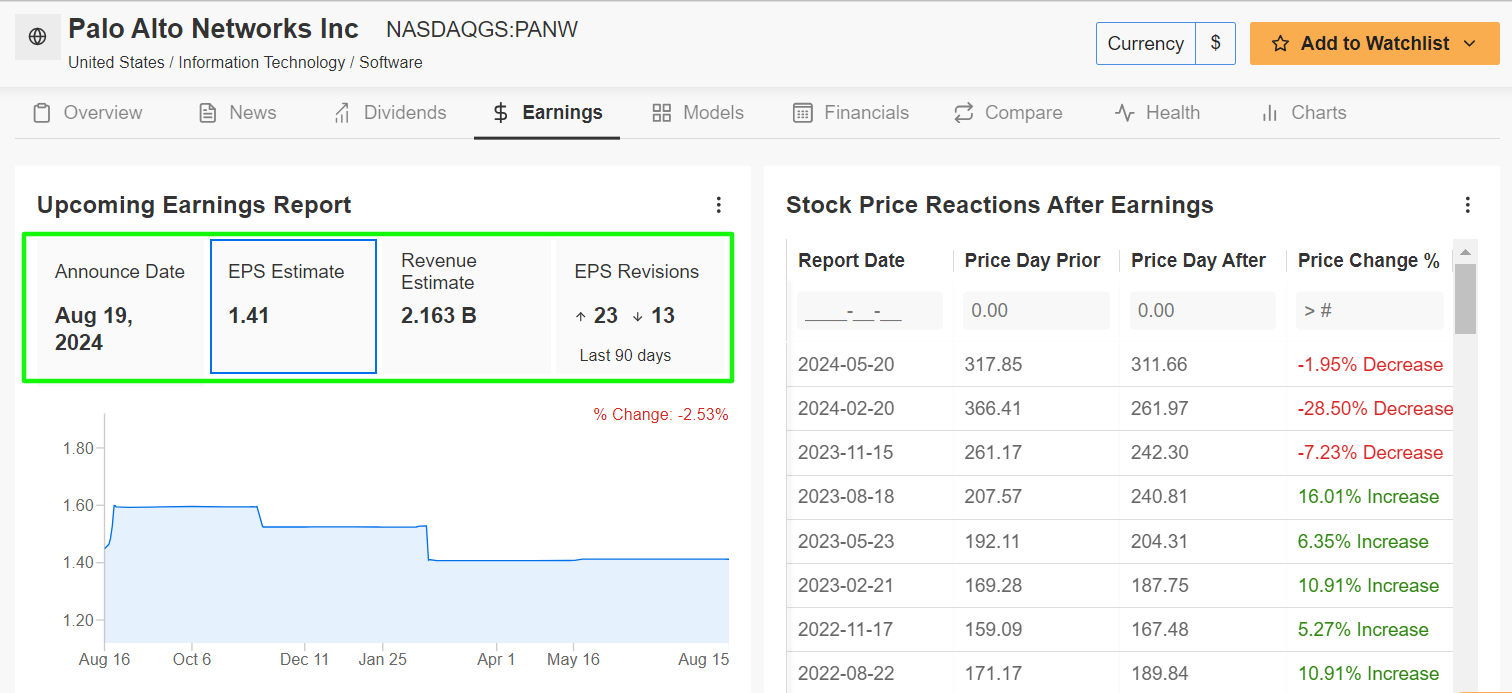

I believe that Palo Alto Networks is poised for significant gains this week, as cybersecurity leader will likely report another quarter of upbeat top-and bottom-line growth and provide a solid outlook thanks to robust demand for its various cloud-delivered security services.

The Santa Clara, California-based company is scheduled to deliver its fiscal fourth quarter earnings update after the U.S. market closes on Monday at 4:05PM ET.

Market participants expect a sizable swing in PANW shares following the print, as per the options market, with a possible implied move of approximately 9.6% in either direction.

Source: InvestingPro

Analysts expect the cybersecurity specialist to report a profit of $1.41 per share, marking a 2% year-over-year decline. Meanwhile, revenue is projected to rise by 8% to $2.16 billion as cybersecurity threats continue to evolve and businesses prioritize digital security.

Palo Alto Networks has consistently benefited from the increasing demand for its cloud-based security offerings amid a surge in cyberattacks worldwide. This trend has led to growing confidence among analysts and investors alike.

Over the past 90 days, Palo Alto Networks has seen 23 upward revisions to its earnings per share (EPS) estimates, according to InvestingPro, signaling strong optimism about the company's prospects.

But as is usually the case, it is more about guidance than results. Taking that into account, I reckon Palo Alto Networks CEO Nikesh Arora will provide an upbeat outlook for fiscal 2025 as the company continues to benefit from robust growth prospects in the cybersecurity space.

PANW stock ended Friday’s session at $334.11, roughly 12% below its record high of $380.84 reached on February 9. At current levels, Palo Alto Networks has a market valuation of $108.2 billion. Shares are up 13.3% year-to-date.

Source: Investing.com

It is worth noting that InvestingPro's AI-powered models rate Palo Alto Networks with a near-perfect Financial Health Score of 4.0 out of 5.0, highlighting its solid profitability and promising growth trajectory.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now to InvestingPro for 50% OFF and position your portfolio one step ahead of everyone else!

Stock to Sell: Lowe’s

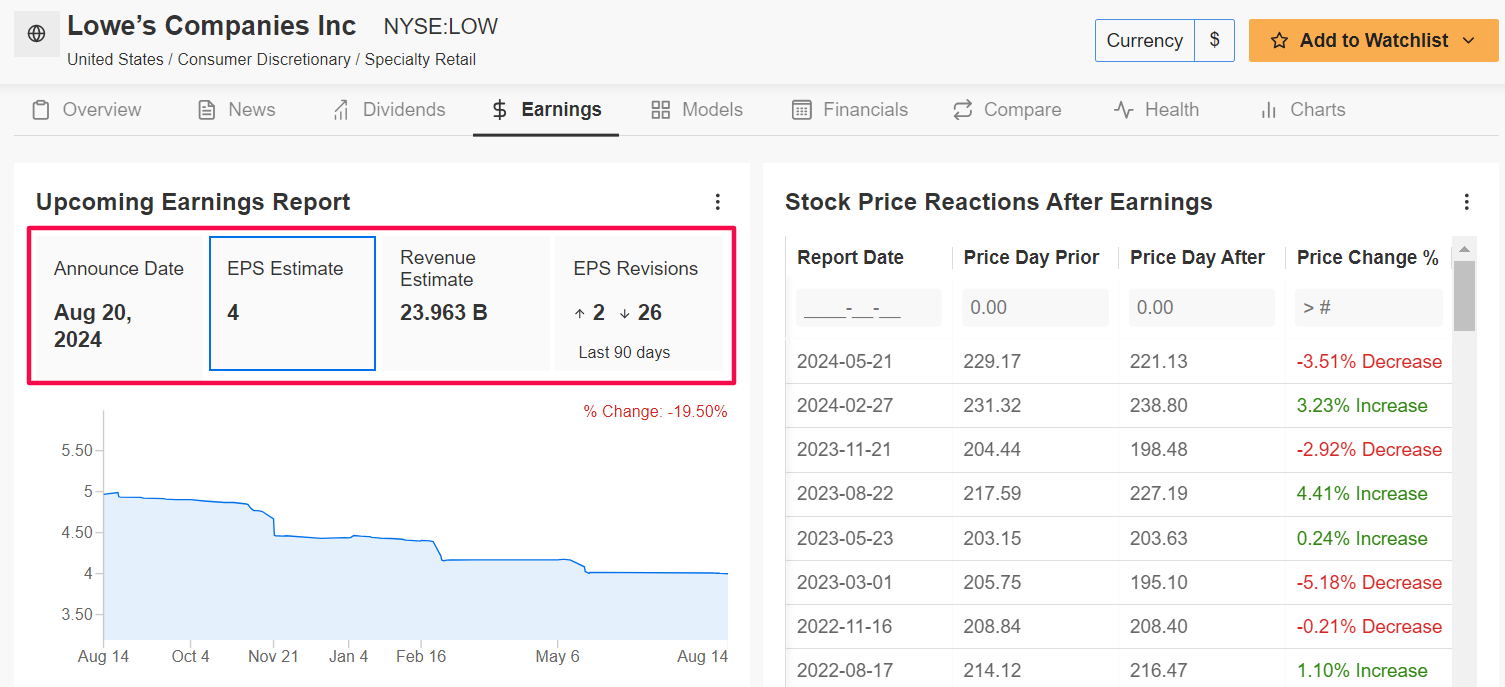

On the other hand, Lowe's, the home improvement retailer, presents a less favorable outlook. The company is set to release its Q2 update before the U.S. market opens on Tuesday at 6:00AM ET and the expectations are not promising.

Lowe’s has struggled with weakening consumer demand trends and an uncertain fundamental outlook. The retailer's earnings have fallen in each of the past four quarters, while sales have declined in the last five quarters. Consumers are spending less on do-it-yourself (DIY) projects and are increasingly hesitant to invest in larger home improvement projects.

According to the options market, traders are pricing in a swing of about 5% in either direction for LOW stock following the print.

Source: InvestingPro

Wall Street sees the Mooresville, North Carolina-based company earning $4.00 a share in the July quarter, declining 12.3% from EPS of $4.56 in the year-ago period, due to higher cost pressures and declining operating margins. Meanwhile, revenue is forecast to inch down 4.2% annually to $23.96 billion.

InvestingPro reports that 26 out of 28 analysts have slashed their EPS and sales estimates for Lowe's ahead of its earnings release, further highlighting the bearish sentiment surrounding the stock.

Looking ahead, it is my belief that Lowe’s executives will provide a disappointing outlook for the current quarter and strike a cautious tone due to several near-term headwinds, including a decline in discretionary spending on items like outdoor grills and patio sets.

Unlike its competitor Home Depot (NYSE:HD), which derives a significant portion of its revenue from professional contractors and builders, Lowe's is more reliant on DIY customers. This reliance has made the company more vulnerable to shifts in consumer behavior, especially in the current economic climate.

LOW stock ended at $241.15 on Friday, earning it a market cap of $137.4 billion. Shares are down nearly 8% since climbing to a 2024 peak of $262.49 on March 22.

Source: Investing.com

It should be noted that InvestingPro paints a negative picture of Lowe’s stock, citing concerns over declining profit and sales growth prospects.

This summer, get exclusive discounts on InvestingPro subscriptions, including annual plans for less than $8 a month!

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Don't miss this limited time offer.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.