- Core PCE inflation, Q4 GDP, and more earnings will be in focus this week.

- Salesforce (NYSE:CRM) is a buy with a strong beat-and-raise quarter expected.

- Beyond Meat (NASDAQ:BYND) is a sell with weak results, dismal outlook on deck.

- Looking for more actionable trade ideas? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

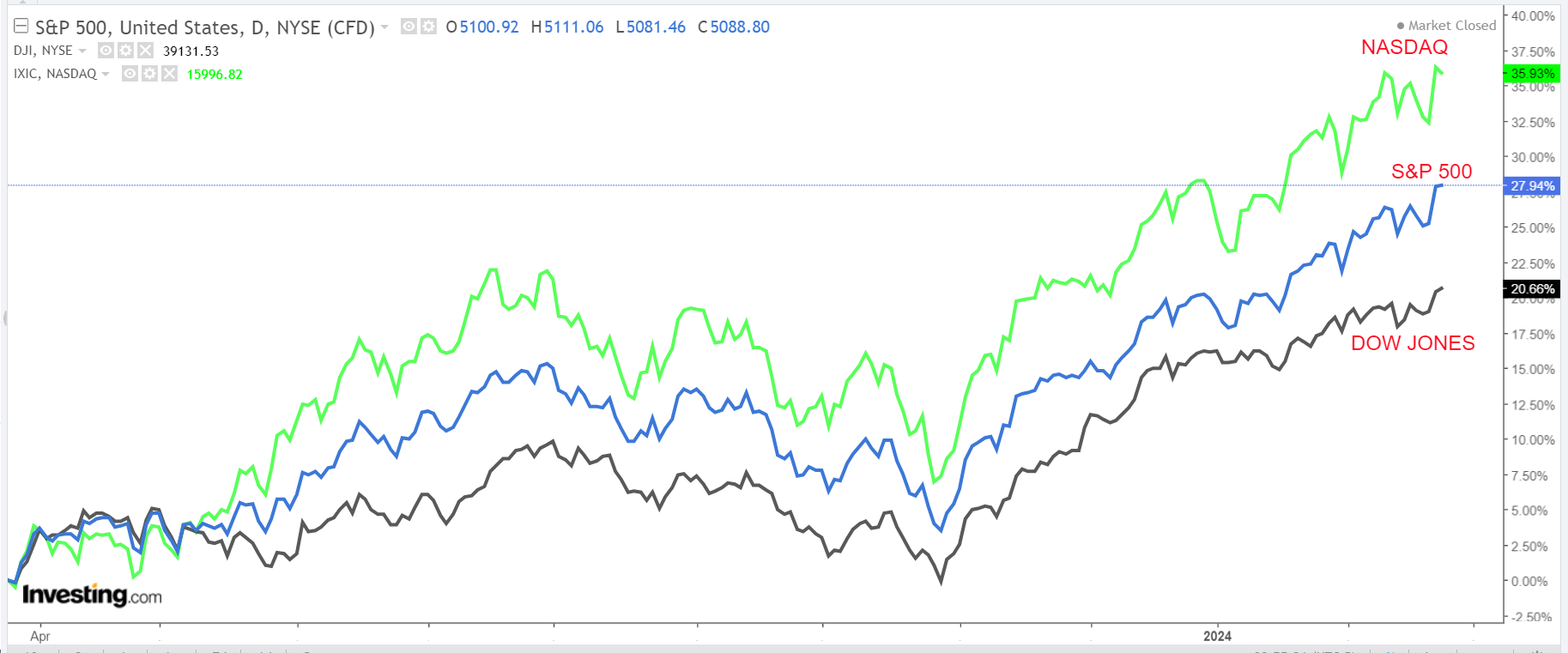

Stocks on Wall Street closed higher on Friday to notch another winning week as the S&P 500 climbed above the 5,100-point level for the first time in history amid an ongoing rally in mega-cap tech shares.

For the week, the benchmark S&P 500 rose 1.7%, the tech-heavy Nasdaq Composite advanced 1.4%, and the blue-chip Dow Jones Industrial Average added 1.3%.

Source: Investing.com

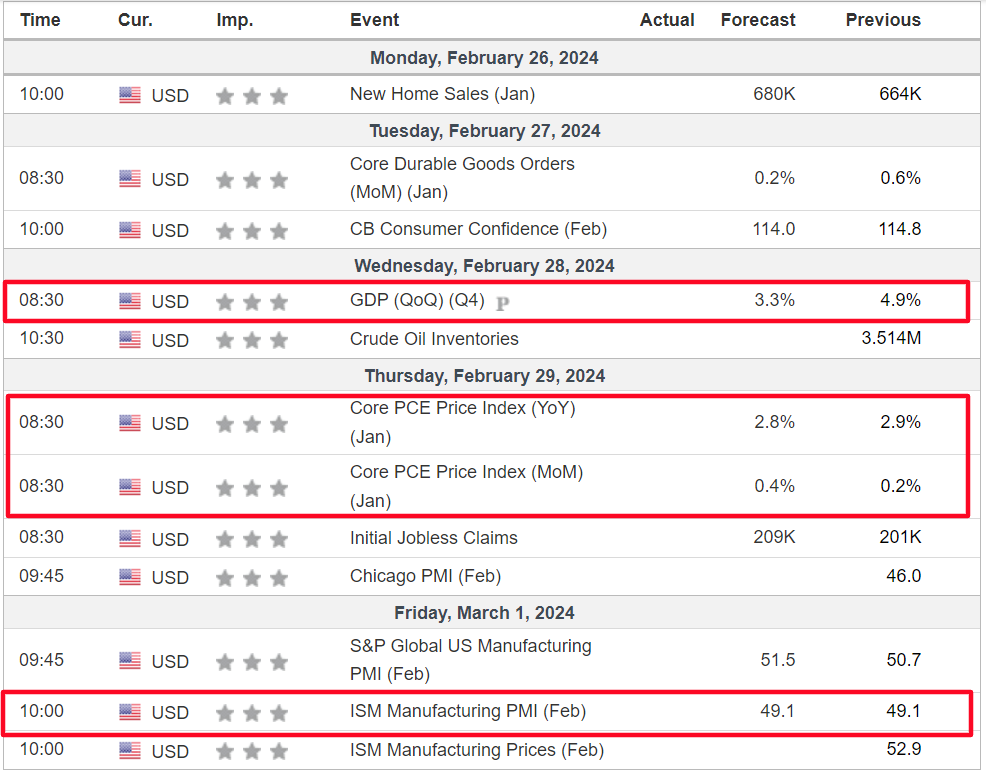

The week ahead is expected to be another eventful one as investors continue to assess how much juice is left in the AI-inspired rally on Wall Street and when the Fed may decide to cut interest rates.

Most important on the economic calendar will be the core personal consumption expenditures (PCE) price index, due on Thursday. In addition, there is also important fourth quarter GDP data due on Wednesday, which will provide more clues as to whether the economy is heading for a soft-landing or a recession.

Source: Investing.com

Elsewhere, some of the key earnings reports to watch include updates from Salesforce, Snowflake (NYSE:SNOW), Zoom (NASDAQ:ZM), Zscaler (NASDAQ:ZS), Lowe’s (NYSE:LOW), Best Buy (NYSE:BBY), TJX Companies (NYSE:TJX), and Macy’s (NYSE:M) as Wall Street’s Q4 reporting season draws to a close.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, February 26 - Friday, March 1.

Stock to Buy: Salesforce

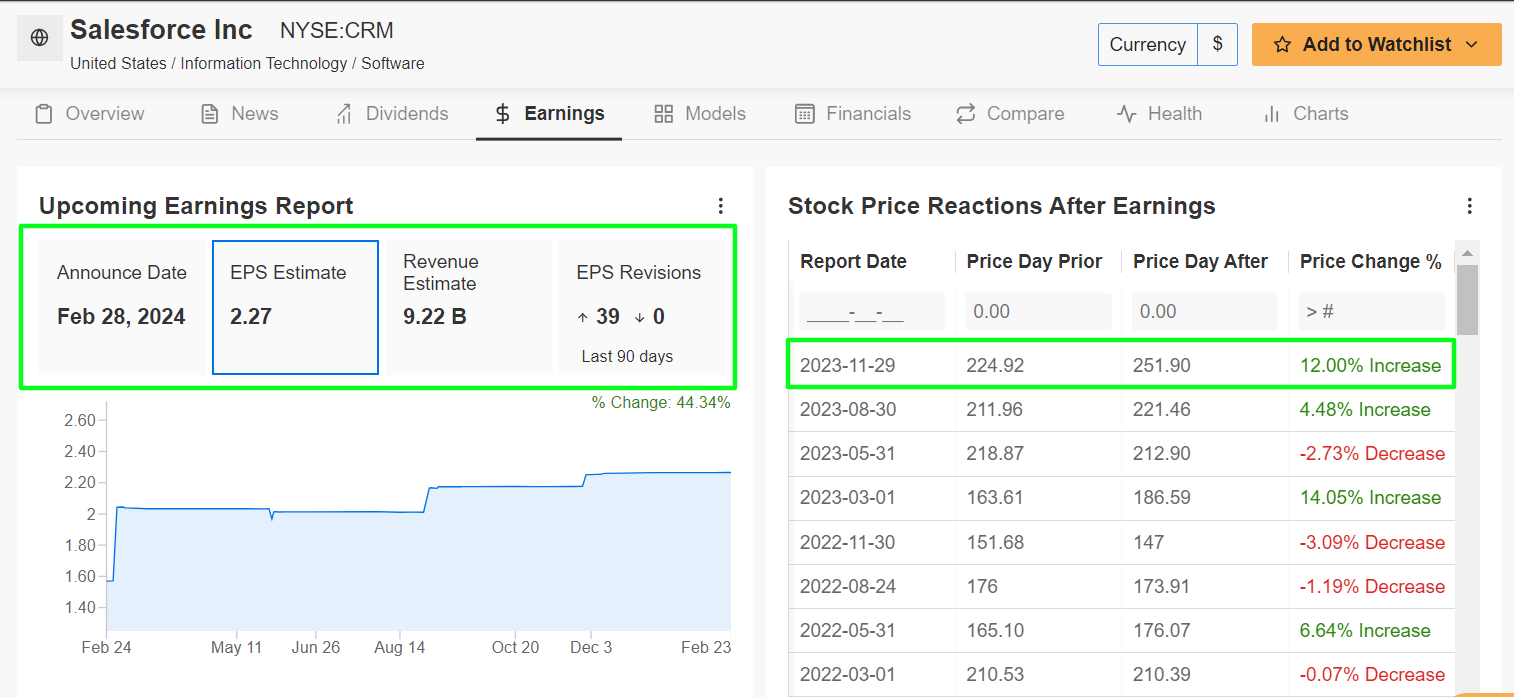

I expect Salesforce stock to outperform this week, with a potential breakout to a new record high on the horizon, as the enterprise software giant’s latest earnings and guidance will easily top estimates in my view thanks to broad strength in its cloud business and recent AI initiatives.

The San Francisco, California-based company is scheduled to deliver its fourth quarter update after the U.S. market closes on Wednesday, February 28 at 4:05PM ET.

Market participants expect a sizable swing in CRM shares, as per the options market, with a possible implied move of roughly 7% in either direction. Notably, the stock soared 12% after its last earnings report in late November.

As could be expected, an InvestingPro survey of analyst earnings revisions points to mounting optimism ahead of the print. As can be seen below, all 39 analysts covering the company upwardly revised their profit estimates in the past 90 days as the Street grows increasingly bullish on the cloud software provider.

Source: InvestingPro

Salesforce is seen earning $2.27 a share in the December quarter, rising 35.1% from the year-ago period due to the positive impact of ongoing cost-cutting measures. Meanwhile, revenue is forecast to increase 10% year-over-year to $9.22 billion thanks to solid demand from businesses and organizations for its customer relationship management tools and solutions.

It should be noted that the Marc Benioff-led company has a long history of beating Wall Street’s quarterly estimates for profit and sales growth, doing so in every quarter dating back to at least Q2 2014.

Looking ahead, I believe the tech giant will provide upbeat profit and sales guidance for the rest of the year as it remains well positioned to thrive amid the current environment. As businesses increasingly prioritize digital engagement and data-driven decision-making, Salesforce's AI-powered CRM platform, ‘Einstein GPT’, positions the company for continued success in a rapidly evolving market.

Source: Investing.com

CRM stock ended Friday’s session at $292.77, a level not seen since November 2021. At current levels, Salesforce has a market cap of $283.4 billion, earning it the status as the most valuable cloud-based software company in the world, ahead of SAP (NYSE:SAP), Intuit (NASDAQ:INTU), and ServiceNow (NYSE:NOW).

Shares - which are one of the 30 components of the Dow Jones Industrial Average - are up about 11% since the start of the year, after ending 2023 with a whopping gain of nearly 98%.

It should be noted that CRM remains extremely undervalued according to the quantitative models in InvestingPro and could see an increase of 12% from Friday’s closing price to its ‘Fair Value’ target of about $328.

Stock to Sell: Beyond Meat

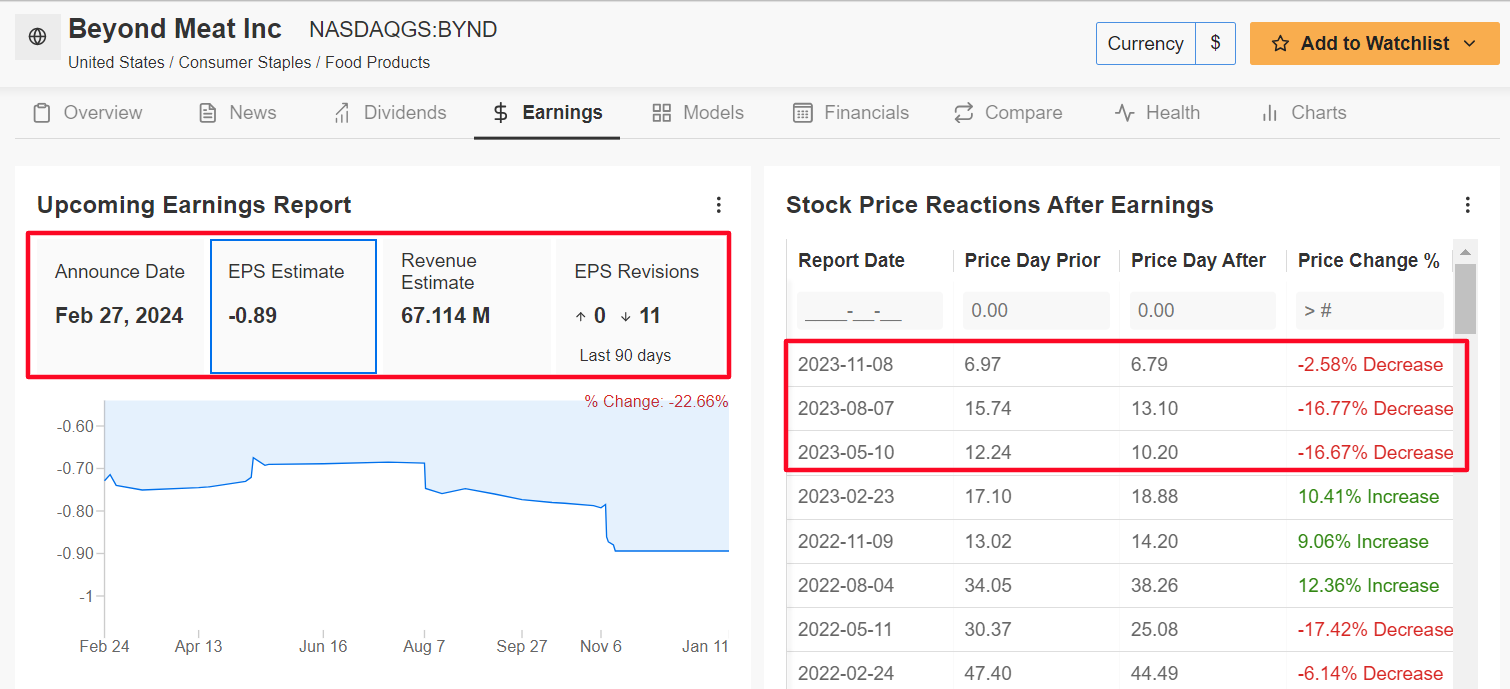

I foresee a weak performance for Beyond Meat this week, as the out-of-favor plant-based meat company’s latest earnings report will likely underwhelm investors due to the negative impact of various headwinds on its business.

Beyond Meat’s fourth quarter print is slated to come out after the closing bell on Tuesday at 4:05PM ET and results are likely to suffer from a brutal combination of weakening demand for plant-based meat substitutes and increasing competition from companies such as Tyson Foods (NYSE:TSN) and privately owned Impossible Food.

According to the options market, traders are pricing in a swing of roughly 12% in either direction for BYND stock following the report. Shares suffered their third straight negative earnings-day reaction after the company’s Q3 report in November.

Underscoring several near-term headwinds Beyond Meat faces amid the current backdrop, all 11 of the analysts surveyed by InvestingPro cut their EPS estimates in the 90 days leading up to the earnings release to reflect a drop of nearly 22% from their initial forecasts.

Source: InvestingPro

Consensus expectations call for Beyond Meat to post a loss of -$0.89 per share for the fourth quarter, as the beleaguered plant-based meat products manufacturer continues to face several challenges on its path to achieving profitability.

To make matters worse, sales are seen falling 16% year-over-year to $67.1 million, amid shrinking demand for the company’s meatless burger, sausage, and chicken products.

If that is confirmed, it would mark the third straight quarter of declining sales, with more pain seen ahead in 2024 and 2025.

As such, it is my belief that Beyond Meat’s management will disappoint investors in their forward guidance and strike a cautious tone given weakening sales trends, which will likely prolong its path to profitability and heighten its execution risk.

Source: Investing.com

BYND stock closed at $7.81 on Friday, earning the El Segundo, California-based company a valuation of $504 million. At its peak, Beyond Meat was valued at roughly $15 billion back in July 2019 when shares touched an all-time high of $279.

Beyond Meat is off to a weak start in 2024, with shares falling around 12%. The plant-based meat maker saw its stock fall to a record low of $5.58 on October 26.

It should be noted that ProTips paint a mostly bearish picture of Beyond Meat, due to fears over its significant debt burden, and downbeat profit and sales growth prospects. Furthermore, Beyond Meat's balance sheet is a cause of great concern, as the company burns capital at a worryingly high rate due to elevated costs.

*****************

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.