Stocks on Wall Street ended a volatile week on a mixed note on Friday, as investors continued to weigh fears over rising inflation, which could prompt the Federal Reserve to roll back its stimulus sooner than expected.

The blue-chip Dow Jones Industrial Average and the benchmark S&P 500 both suffered their first back-to-back weekly losses since February, falling 0.5% and 0.4% respectively. The tech-heavy NASDAQ Composite, however, managed to eke out a gain of 0.5% over the same timeframe.

This week we'll see another batch of high-profile earnings reports from companies like Nvidia (NASDAQ:NVDA), Salesforce (NYSE:CRM), Costco (NASDAQ:COST), and Best Buy (NYSE:BBY). Add to that the release of additional, important economic data all of which should make the week ahead a busy one.

No matter the direction the market takes, we've highlighted one stock likely to be in demand and another which could see a further slump.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Dick’s Sporting Goods

Dick’s Sporting Goods (NYSE:DKS) will be in focus this week, as investors await the latest financial results from the nation’s largest athletic-gear retailer; it has either beaten or matched Wall Street estimates for three consecutive quarters.

The retail chain has thrived this year, making it one of the notable big retail-industry winners of 2021. Year-to-date, Dick’s Sporting Goods has seen its stock jump by around 48%.

Even more impressive, shares have gained roughly 160% over the past 12 months, far outpacing the comparable returns of both the Dow and the S&P 500, as coronavirus-related lockdowns created soaring demand for at-home fitness gear and equipment for outdoor activities.

DKS stock ended at $83.29 on Friday, within sight of its all-time high of $91.80 reached on May 10, earning the Coraopolis, Pennsylvania-based company a valuation of around $7.4 billion.

Consensus expectations call for earnings per share (EPS) of $1.16 when Dick’s delivers first-quarter results ahead of Wednesday’s opening bell, improving from a loss of $1.71 per share in the year-ago period.

Revenue is forecast to jump 66% year-over-year to $2.21 billion, reflecting strong growth in its athletic apparel and footwear business as well as robust demand for outdoor activities equipment, such as golf clubs and bicycles.

Beyond the top- and bottom-line numbers, the company’s same-store sales and e-commerce sales will also be eyed, after growing by a record 19.3% and 57% respectively in the previous quarter.

In addition, market players will pay close attention to the sporting goods retailer’s guidance for the rest of the year. After striking a cautious tone in the last quarter, investors are hoping Dick’s management will sound more upbeat regarding its outlook for full-year fiscal 2021 sales growth as it continues to benefit from favorable consumer trends and customer demand.

Stock To Dump: MicroStrategy

Shares of MicroStrategy Incorporated (NASDAQ:MSTR)—the software company which has increasingly become a popular coattail play for Bitcoin—are expected to suffer another volatile week amid the ongoing selloff in the cryptocurrency market.

The steep plunge began earlier this month following controversial tweets from Tesla (NASDAQ:TSLA) CEO Elon Musk. The selling then gathered momentum last week after China announced new crypto regulations and trading restrictions, while the U.S. called for stricter compliance with the IRS to crack down on crypto tax evasion risk.

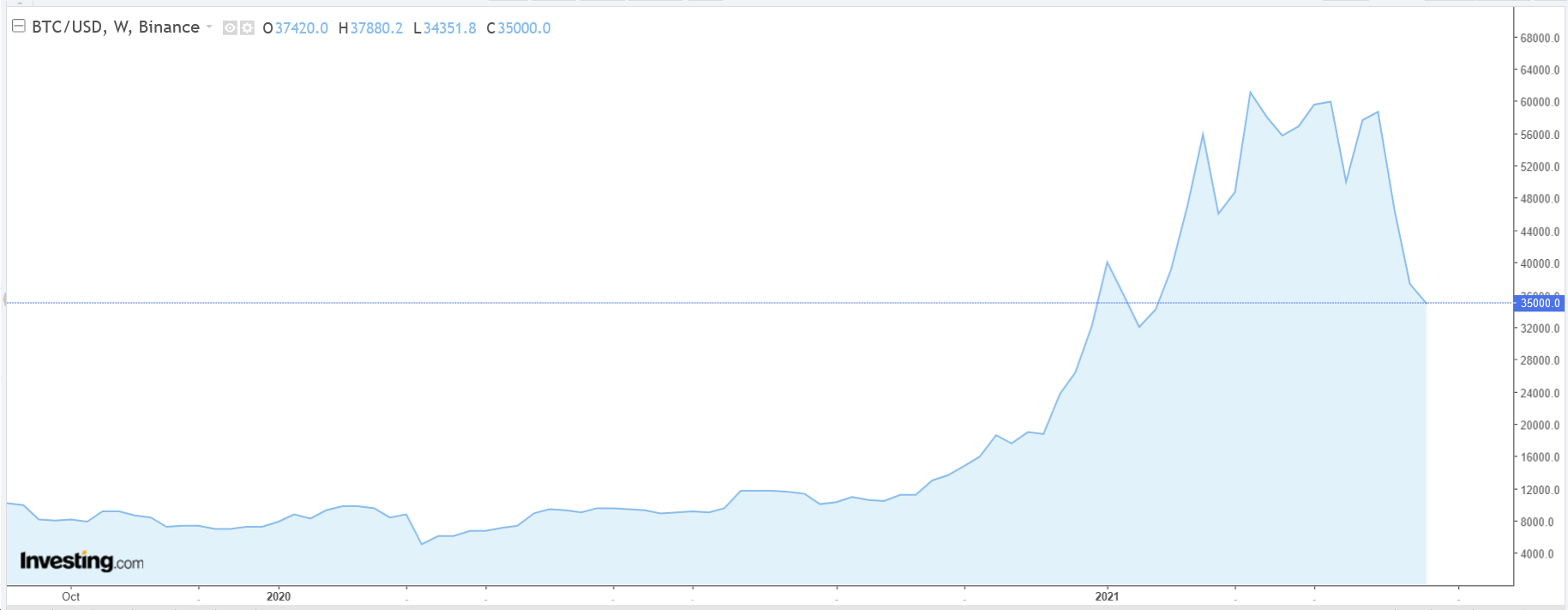

That led Bitcoin to drop by as much as 30% on Wednesday to a low of about $30,000. Though it recovered to end the week above $40,000 on Friday, prices have since slid again in weekend trade.

The cryptocurrency, which peaked at $64,829.14 on Apr.16, was last down around 8% in Sunday action, hovering at about the $35,000-level.

The enterprise software company disclosed last week that it purchased 229 Bitcoin tokens amid the latest selloff at an average price of $43,663, totaling $10.9 million. The company now holds 92,079 Bitcoins, acquired for $2.25 billion at an average purchase price of $24,450 per BTC.

Taking that into account, MicroStrategy stock could fall further in the coming days, as investors react to the violent swings in Bitcoin prices.

After enjoying year-to-date gains of almost 250% through mid-February, shares of MicroStrategy have since lost momentum, tumbling 48.5% in the last three months.

MSTR stock—which closed Friday’s session at $450.52—is now roughly 66% below its all-time high of $1,312.00 touched on Feb. 9. At current levels, the Tysons Corner, Virginia-based business analytics software provider has a market cap of $4.3 billion.

MicroStrategy CEO Michael Saylor will speak at this week’s four-day Coindesk Consensus conference, along with other high-profile names, such as, ARK Invest's Cathie Wood, Bridgewater's Ray Dalio, as well as Federal Reserve Governor Lael Brainard.