Last week was stellar for stocks. Wall Street rose on Friday, with the major averages all ending within sight of their recent records amid ongoing optimism over the U.S. economic recovery.

The blue-chip Dow Jones Industrial Average and the benchmark S&P 500 climbed 0.9% and 1.2% respectively for the week, both breaking a two-week losing streak. The tech-heavy NASDAQ Composite, meanwhile, advanced 2.1% over the same timeframe to record its best weekly performance since Apr. 9.

This week, we've got more high-profile earnings reports upcoming from companies like Zoom Video (NASDAQ:ZM), DocuSign (NASDAQ:DOCU), Slack Technologies (NYSE:WORK), and Crowdstrike Holdings (NASDAQ:CRWD), to name a few.

And despite the holiday-shortened week, another round of important economic data will also be released, including the May U.S. employment report, making this week a busy one.

No matter which direction the market takes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Express

Express (NYSE:EXPR) will be in focus this week, as investors await the latest financial results from the mall-based fashion apparel retailer, which offers clothing and accessories for work, casual, and going-out.

Shares of the Columbus, Ohio-based company spiked last week, getting a boost as part of the "Meme Stock" phenomenon, which has seen names like GameStop (NYSE:GME), AMC Entertainment (NYSE:AMC), and Blackberry (NYSE:BB) score big gains this year.

Like GME, AMC, and BB, Express has emerged as a popular stock among retail traders on Reddit's WallStreetBets forum, despite seeing a sharp drop in the percentage of its outstanding shares held short.

EXPR stock, which started the year at around $0.90 and soared all the way to its 52-week high of $13.93 in late January, ended at $4.29 on Friday, earning the small-cap company a valuation of around $284 million.

Despite the intense volatility, shares of the clothing and accessories chain have gained 371% year-to-date, far outpacing the comparable returns of both the Dow and the S&P 500.

Consensus expectations call for a loss of $0.52 per share when Express delivers first-quarter results ahead of Thursday’s opening bell, improving substantially from a loss per share of $1.55 in the year-ago period. Revenue is forecast to jump 53% year-over-year to $322.1 million.

Beyond the top- and bottom-line numbers, investors will be watching to see if the clothing retailer’s comparable same-store sales improve, after tumbling 27% in the previous quarter due to the negative impact of COVID-19.

Market players will also be eager to hear further details on the company’s new e-commerce strategy that aims to grow its digital channel to $1 billion in sales by 2024.

Based on activity in the options market, traders are pricing in a big move for Express shares following the results, with a possible implied shift of about 9% in either direction.

Stock To Dump: The Clorox Company

Shares of Clorox (NYSE:CLX), the well-known household cleaning products maker, which was one of the biggest pandemic winners of 2020, are expected to suffer another volatile week amid receding fears over the spread of the coronavirus in the U.S.

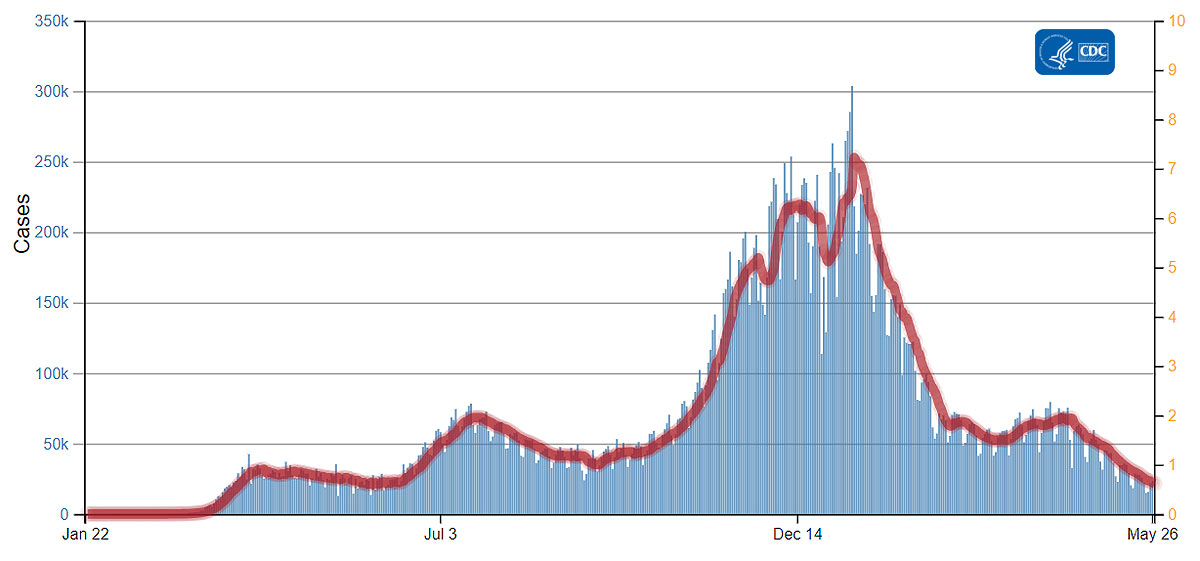

COVID-19 cases continue to fall across the country, dropping to their lowest levels in nearly a year, while the number of people vaccinated continues to grow.

The current U.S. 7-day moving average of daily new cases declined 22.3% from the previous week to 21,627, the lowest since June 2020, according to the latest numbers from the Centers for Disease Control and Prevention.

Even more encouraging, the current 7-day average is down 91% from a peak of roughly 253,000 reached in early January.

Chart courtesy CDC

Taking that into account, Clorox stock could fall further in the coming days as the improving health outlook will likely lead to more states dropping their pandemic-era social restrictions.

That should translate into reduced demand for COVID-era essentials, such as, hand sanitizer, cleaning wipes, and other disinfectant products.

The company’s bleach and disinfectant wipes account for approximately 25% of its sales. Perhaps even more important, Clorox’s Cleaning segment, which includes these products as well as other brands such as Pine-Sol and Green Works, generates 53% of Clorox’s overall earnings.

Clorox has seen its shares steadily drop to new lows even as the broader market shows signs of rebounding from its recent bout of volatility. Year-to-date, shares have lost 12.5%, compared to the S&P 500’s 12% gain over the same timeframe.

CLX stock, which is now roughly 26% below its all-time high of $239.85, closed Friday’s session at $176.73, the lowest since April 2020.

At current levels, the Oakland, California-based consumer products giant has a market cap of roughly $22 billion.