Tuesday marked the second day that the NASDAQ pulled back while the Dow Jones climbed higher led by cyclical stocks.

Following Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX)'s press release announcing that their "Vaccine candidate was found to be more than 90% effective in preventing COVID-19 in participants without evidence of prior SARS-CoV-2 infection," stay-at-home stocks lost some luster, while many value stocks received a boost from the optimism.

Whether it's the U.S. election, vaccine developments or other macro-factors pulling the markets, the lack of stability seen in equities has many wondering if profit-taking could hit more stocks.

Yesterday's post addressed ETFs for diversification during periods of volatility.

Today we will look at 2 fixed-income bond ETFs that can do the same and may also be appropriate for market participants looking for alternatives to equities in this low-interest-rate environment:

1. iShares Morningstar Multi-Asset Income ETF

- Current price: $23.09

- 52-week range: $17.59 - $26.08

- Yield: 5.43%

- Expense ratio: 0.60%

The iShares Morningstar Multi-Asset Income ETF (NYSE:IYLD) provides exposure to different asset classes, including bonds (60%), equities (20%) and alternative income sources (20%). The fund offers a diversified portfolio of other BlackRock (NYSE:BLK) ETFs, with a focus on fixed-income funds.

IYLD began trading in 2012 and tracks the Morningstar Multi-Asset High Income Index. With ten holdings, its net assets are close to $264 million. The top five funds in IYLD, which constitute close to 70% of the ETF, are:

- iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG)

- iShares 10-20 Year Treasury Bond ETF (NYSE:TLH)

- iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT)

- iShares Mortgage Real Estate Capped ETF (NYSE:REM)

- iShares Emerging Markets Dividend ETF (NYSE:DVYE)

IYLD primarily has exposure to non-US equities funds as dividend income in non-US equities tends to be higher than those offered by US stocks.

Year-to-date, IYLD is down about 10%. The fund's composition makes it more appropriate for IYLD to target passive income seekers, such as retirees. Its current yield stands at 5.43%.

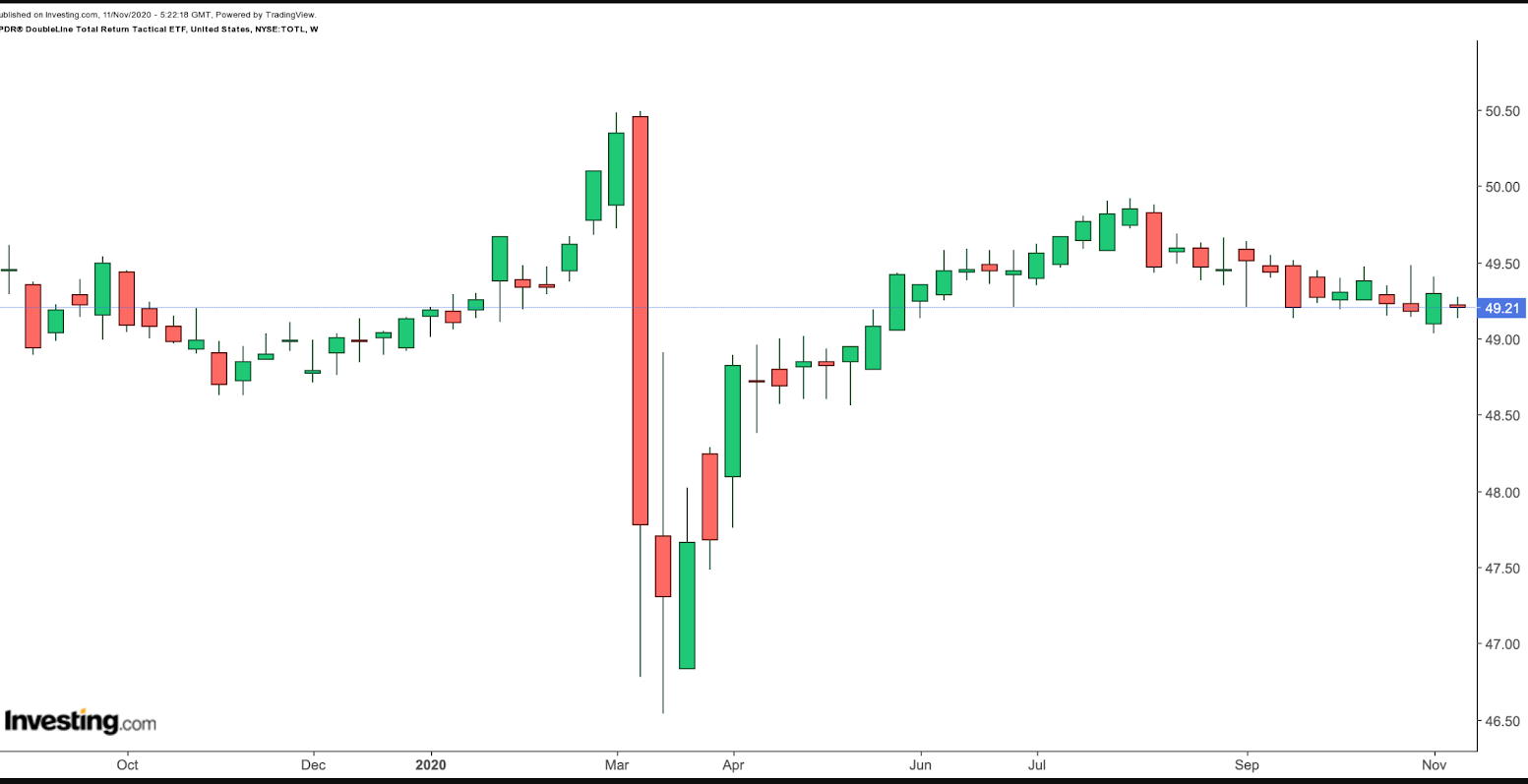

2. SPDR DoubleLine Total Return Tactical ETF

- Current price: $49.21

- 52-week range: $46.54 - $50.49

- Yield: 3.16%

- Expense ratio: 0.55%

The SPDR DoubleLine Total Return Tactical ETF (NYSE:TOTL), which has 1097 holdings, provides exposure to a range of bonds. TOTL started trading in 2015 and has over $3.2 billion in assets. Since the start of the year, the fund is up about 1%.

As an actively-managed ETF, it aims to outperform its bond aggregate benchmark, Blooomberg Barclays US Aggregate Bond Index, by exploiting the bond market's mispriced areas.

The benchmark index measures the performance of the US dollar-denominated investment-grade bond market. Assets include government bonds, corporate bonds, mortgage-backed securities (MBSs) and other asset-backed securities.

MBSs represent almost 45% of the ETF's overall mix, followed by US Treasuries (26.85%). TOTL also invests in high yield bonds (4.61%) and emerging markets debt (5.06%), which are not part of the benchmark.

Put another way, in TOTL, the emphasis is on total return and providing "alpha," a fund manager’s ability to produce excess returns for a particular risk level.

When investors consider actively-managed funds, they need to pay attention to how risk is being managed. If higher excess returns are achieved by taking on excessive amounts of risk, an investor could instead buy an aggregate passive fund. For example, investors should see how much the maximum drawdown, or the peak-to-trough decline, of an investment during a specific period has been. Then they can better decide whether the fund fits their risk/return profile.

For those who would like to park some of their capital in bond markets, TOTL could offer an acceptable level of income while not experiencing much price volatility risk. Investors are also entitled to dividends.

Since its inception, its returns have not necessarily beaten the benchmark or a comparable passive bond ETF, such as the iShares Core U.S. Aggregate Bond ETF (NYSE:AGG). However, it has come with less volatility risk. In addition, the fund's CEO, Jeffrey Gundlach, is a highly-regarded bond investor. Capital preservation, coupled with steady performance, is among the most important considerations in investing.