- Cognizant and Trimble are two under-the-radar AI stocks with robust growth prospects.

- Both companies show strong upside potential, with double-digit gains forecasted by InvestingPro’s AI-powered models.

- As such, CTSH and TRMB stand out as compelling long-term investment opportunities amid the current market backdrop.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro for less than $8 a month!

As artificial intelligence continues to reshape industries, investors are searching for the next wave of AI-driven companies poised for massive growth.

While tech giants like Nvidia (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), and Broadcom (NASDAQ:AVGO) dominate headlines, several lesser-known players are making significant strides in AI.

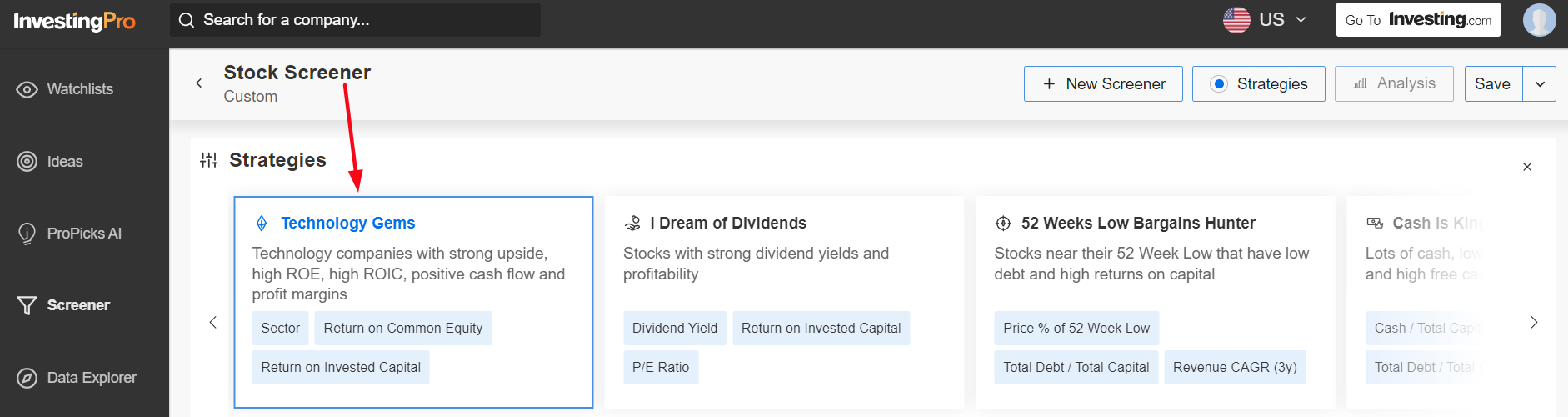

Using the InvestingPro ‘Technology Gems’ stock screener, I identified Cognizant Technology Solutions (NASDAQ:CTSH) and Trimble (NASDAQ:TRMB) as two underappreciated AI stocks that deserve your attention. Both have significant upside potential and are well-positioned to benefit from ongoing advancements in the AI space.

Source: InvestingPro

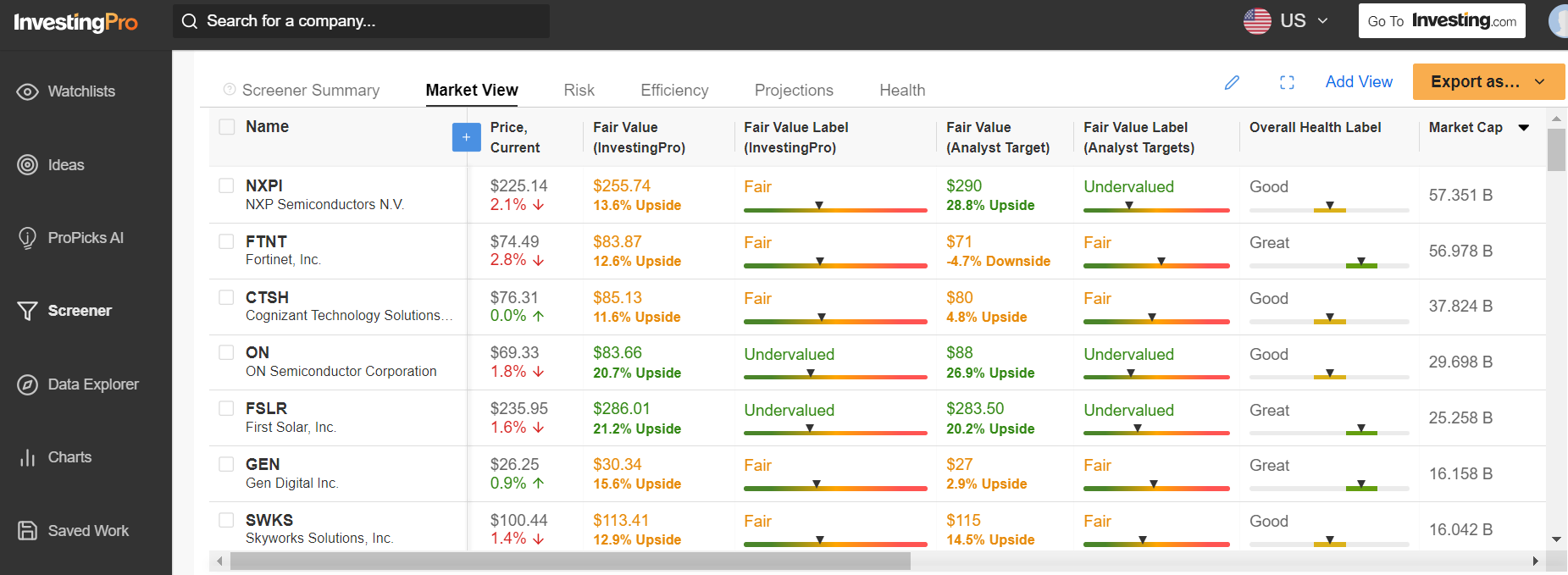

Source: InvestingPro

Let's explore why these overlooked AI gems should be on your radar.

1. Cognizant

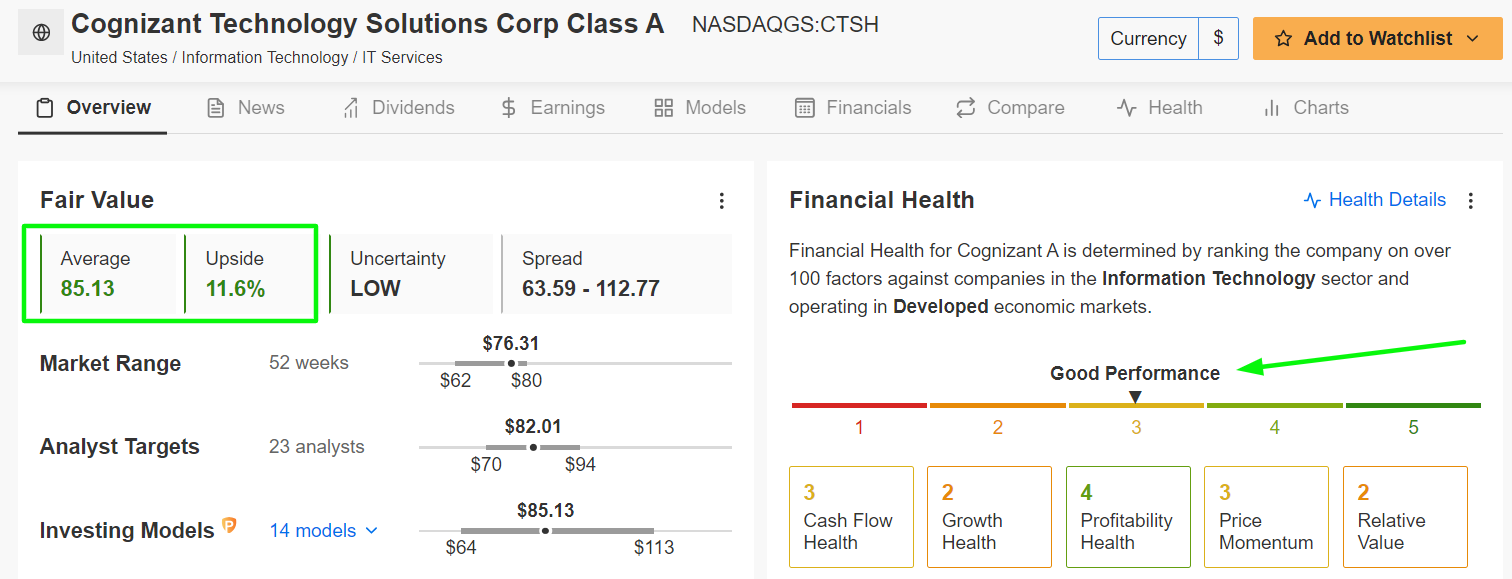

- Current Price: $76.31

- Fair Value Price Target (NYSE:TGT): $85.13 (+11.6% Upside)

Cognizant Technology Solutions is a global leader in IT services, offering consulting, technology, and outsourcing services to help businesses adapt to digital transformation. The Teaneck, New Jersey-based company serves a wide range of industries, including healthcare, banking, and retail.

CTSH stock closed at $76.31 last night, not far from a recent 52-week peak of $80.27 touched on August 1. Cognizant has a market cap of $37.8 billion at its current valuation. Shares are up 1% year-to-date.

Source: Investing.com

With over two decades of experience, Cognizant has built a strong reputation for delivering innovative solutions, and AI has become a central pillar of its strategy.

By integrating generative AI and machine learning into its suite of services, Cognizant is helping businesses improve automation, data analytics, and decision-making processes. Furthermore, the company's focus on AI has also allowed it to drive efficiencies across its own operations, positioning itself as a competitive player in the global AI market.

Looking ahead, Cognizant’s investments in AI, automation, and cloud technologies are expected to fuel revenue growth and profitability. AI-driven initiatives, such as enhancing digital experiences for clients and optimizing IT infrastructure, are anticipated to generate significant long-term tailwinds for the company.

From a valuation standpoint, Cognizant has substantial upside potential, according to AI-powered Fair Value models from InvestingPro. The stock has an estimated +11.6% upside potential, which would bring it closer to its Fair Value price of $85.13.

Source: InvestingPro

Given the company’s robust financial health, as evidenced by its above-average InvestingPro Financial Health Score, Cognizant's stock could deliver solid returns as AI adoption accelerates across industries.

2. Trimble

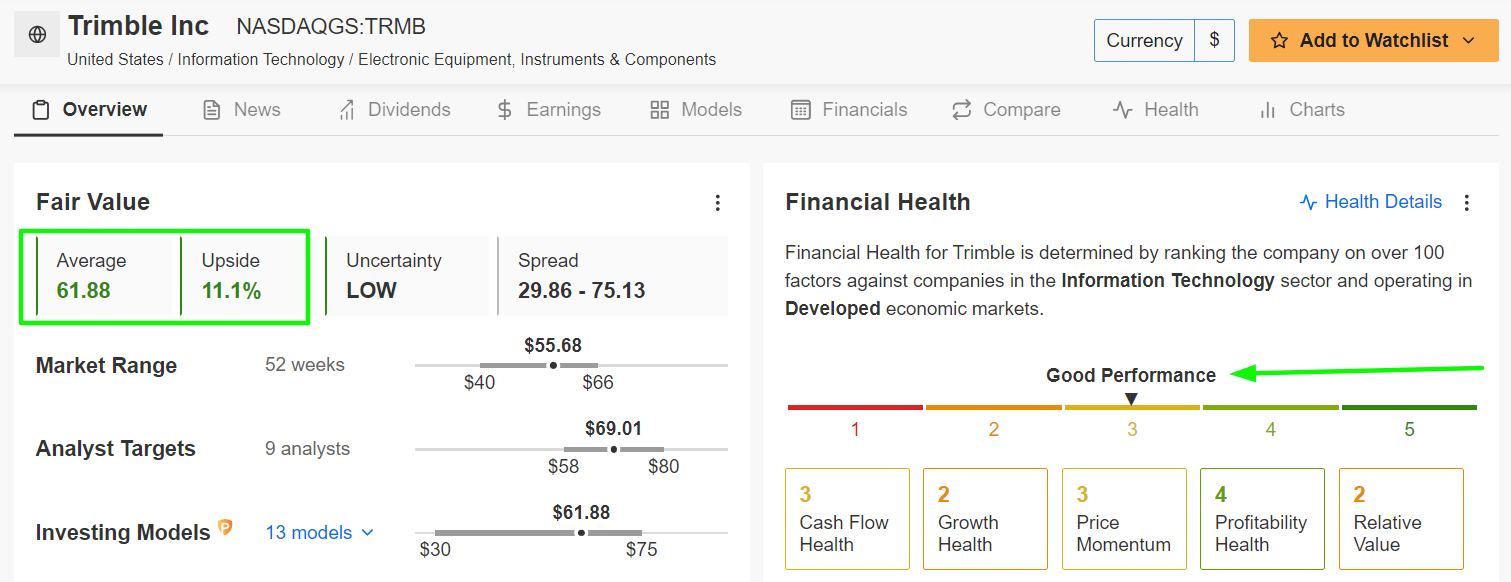

- Current Price: $55.68

- Fair Value Price Target: $61.88 (+11.1% Upside)

Trimble is a lesser-known but highly innovative company that specializes in providing advanced positioning and location-based technologies for various industries, including agriculture, construction, and transportation.

TRMB stock ended Thursday’s session at $55.68, giving the Westminster, Colorado-based software, hardware, and services technology company a market cap of $13.6 billion. Shares have gained 4.7% in 2024.

Source: Investing.com

While it may not be as well-known as some of its peers, Trimble has been making waves in the AI space by leveraging machine learning and AI to enhance its offerings. The company’s AI-powered solutions are designed to improve precision and efficiency across a wide range of industries.

For example, in agriculture, Trimble uses AI to help farmers optimize crop yields through data-driven insights. In construction, the company’s AI-driven technologies assist in automating workflows and improving project outcomes. As industries increasingly adopt AI to streamline operations, Trimble is well-positioned to benefit from these trends.

One of the most exciting areas of Trimble’s AI innovation is its focus on autonomous technology. Trimble has been a pioneer in integrating AI into autonomous systems, helping businesses in logistics and transportation achieve greater efficiency.

These AI-driven advancements, combined with Trimble's broad portfolio of solutions, create a compelling growth story for the company.

Like Cognizant, Trimble also holds significant upside potential according to InvestingPro’s Fair Value models. Trimble’s stock is expected to gain +11.1%, reaching a Fair Value price of $61.88.

Source: InvestingPro

With its ongoing technological innovation and strong financial position, as reflected by its InvestingPro Financial Health Score, Trimble is poised to capitalize on AI-driven growth in the months and years ahead.

Conclusion:

Both Cognizant Technology Solutions and Trimble represent under-the-radar opportunities in the AI space, with their strong technological innovation and clear AI strategies positioning them for long-term growth.

Moreover, both companies boast resilient business models and profitable operations, as evidenced by their above-average InvestingPro Financial Health Scores, making them attractive picks for investors looking to gain exposure to the rapidly evolving AI sector.

In a world increasingly driven by AI, these two companies are well worth keeping on your radar.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now with an exclusive discount and unlock access to several market-beating features, including:

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- AI ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.