- It’s becoming hard to find a quality stock that still offers an attractive yield

- The Calgary-based Enbridge (TSX:ENB) is a reliable dividend payer with an annual yield of over 6%

- BCE (TSX:BCE) has hiked its dividend every year since 1949; that’s 73 years of consistent income growth

- Yield: 6.15%

- Quarterly payout: $0.66

- Market Cap: $87 billion

- Yield: 5.6%

- Quarterly payout: $0.71

- Market Cap: $46 billion

After a year of relentless inflows into the safest areas of the market amid growing inflation and recession fears, the market seems to have turned sour for those looking to build an income-paying portfolio.

The average dividend yield paid by S&P 500 companies is currently hovering around 2%, well below the average inflation rate. Accordingly, some of the best dividend stocks in the market are offering yields in the low single digits.

But while U.S. companies are having a hard time raising their payouts due to the current market environment, we can find solid companies yielding around the 6% level north of the border.

Let’s look at two such companies:

1. Enbridge

The Calgary-based Enbridge (NYSE:ENB), North America’s largest gas and oil pipeline operator, is a reliable dividend payer with an annual yield above 6%.

Higher yields are usually a sign of danger, suggesting an elevated risk of a dividend cut down the road. But Enbridge is a relatively safe utility operator backed by solid cash flows and a diversified operational base.

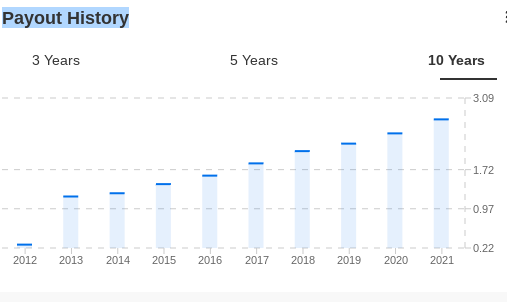

Moreover, Enbridge has paid steady dividends for more than six decades. Over the past 27 years, its yield has grown at an average compound annual growth rate of 10%.

Source: InvestingPro

Enbridge’s operations are well diversified across many businesses and geographies, helping the utility to weather the economic downturn better than other companies.

For instance, while the pandemic hurt oil consumption across the board, Enbridge’s gas transmission, distribution, and storage businesses, which account for about 30% of cash flows, shielded the company and saved its payout.

Over the past three years, Enbridge has been carrying out a restructuring plan, selling assets, focusing on its core strengths, and paying down its debt. These measures will likely benefit long-term investors who aim to earn steadily growing income.

Enbridge last month agreed to invest in the construction and operation of the Woodfibre LNG project in British Columbia, marking the pipeline giant’s first investment in a liquified natural gas terminal.

According to an agreement with Singapore-based Pacific Energy Corp., Enbridge will have a 30% ownership stake in the $5.1-billion LNG project. Enbridge’s investment comes amid high energy prices and growing global demand for natural gas, thanks to supply disruptions resulting from Russia’s war in Ukraine.

2. BCE

Just like power and gas utilities, Canadian telecom operators also offer a solid choice to investors to earn a steadily growing income stream. The nation’s largest telecom operator, BCE (NYSE:BCE), is one candidate to consider, especially when its yield is nearing 6%.

BCE has hiked its dividend every year since 1949. That’s 73 years of consistent income growth.

The company is investing $5 billion this year to expand its 5G network and connect another 900,000 client buildings with fiber optic lines. With its dominant position in the Canadian telecom market, there is a strong possibility that the Toronto-based BCE will continue to reward its long-term investors.

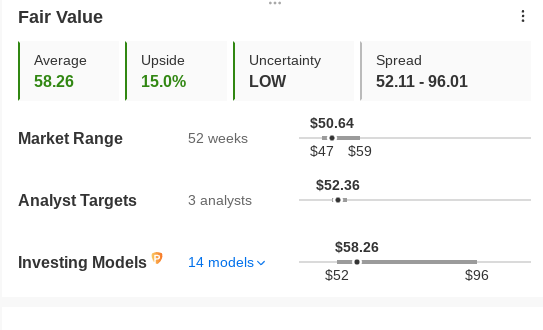

Source:InvestingPro

In a recent interview, BCE’s CEO Mirko Bibic said the telecom utility benefits from the consumer shift to 5G despite inflationary pressures. He said:

“5G customers use their phones and data, you know, basically twice as much, and they spend about 20 percent more, so we’re kind of seeing healthy growth on 5G. And on the internet side, actually, customers are subscribing to higher speed plans. So what we’re seeing so far is quite healthy, and we do not see any pressure on our receivables … so the payments are strong as well.”

BCE may not provide a hefty capital gain to its investors, but it remains a stable dividend-paying stock that suits long-term investors who aim to build a steady income stream.

A $10,000 investment in BCE shares 25 years ago would be worth about $200,000 today with the dividends reinvested.

Disclosure: The writer owns ENB and BCE shares.