- Stocks on Wall Street are rallying, with the S&P 500 hitting a series of new record highs recently.

- Identifying strong-buy momentum stocks with solid growth prospects becomes paramount in the current environment.

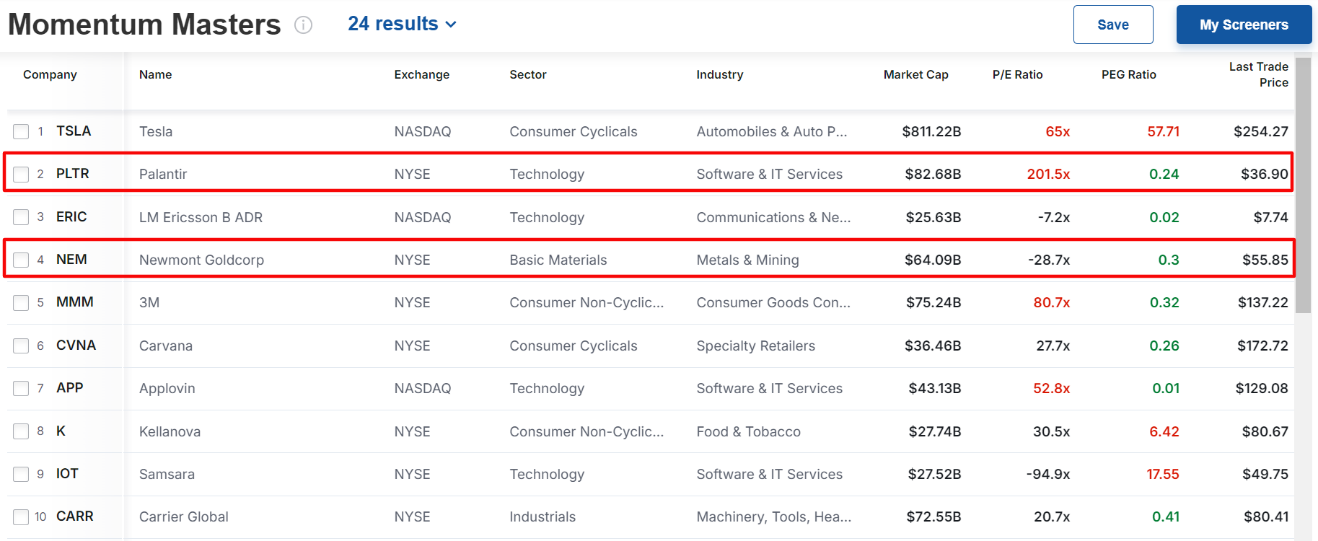

- As such, I used the Investing.com ‘Momentum Masters’ stock screener to find winning stocks with strong upside ahead.

- You can utilize the screener to pick out high-potential stocks too. Get started for free by accessing the new Investing.com screener here!

As the S&P 500 extends its rally to new record highs above the 5,700-level, identifying momentum stocks with solid growth prospects is crucial for investors looking to capitalize on upward trends.

Source: Investing.com

Using the 'Momentum Masters' pre-set stock screener on Investing.com, which tracks stocks with impressive recent price performance and high trading volumes, two strong candidates stand out: Palantir Technologies (NYSE:PLTR), and Newmont Goldcorp (NYSE:NEM).

Source: Investing.com

Both companies have seen their stock prices surge to or near all-time highs, significantly outperforming the broader market in recent weeks. Here’s why Palantir and Newmont Goldcorp are worth considering for your portfolio.

1. Palantir

- 2024 Year-To-Date: +114.9%

- Market Cap: $82.7 Billion

Palantir Technologies, a leading data analytics company that was just added to the benchmark S&P 500 index, has emerged as one of the hottest stocks in the market, fueled by its expanding AI-driven software solutions.

PLTR stock was trading at $36.90 as of Wednesday morning, a tad below a recent 52-week high of $38.19 reached on September 23.

Shares have gained 115% year-to-date. At current levels, the Denver, Colorado-based big-data firm has a market cap of $82.7 billion.

Source: Investing.com

The recent surge in Palantir’s stock can be attributed to several factors:

- AI Leadership: Palantir’s suite of AI-powered software solutions has positioned it as a leader in the ongoing AI boom. The company’s Foundry and Gotham platforms provide mission-critical analytics to both commercial and government clients, and its ongoing innovations in AI have driven investor enthusiasm.

- Strong Earnings Momentum: Palantir recently delivered strong earnings results, exceeding both revenue and profit expectations, which further stoked investor confidence.

- Increased Adoption: The company’s expansion into the commercial sector has significantly broadened its customer base, fueling higher demand for its AI products.

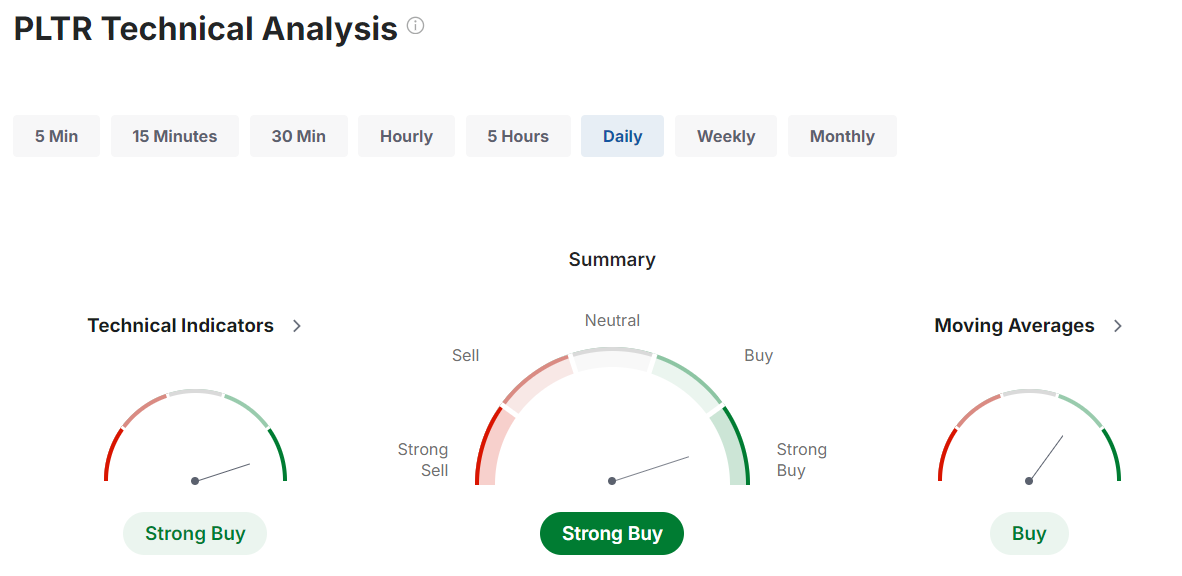

From a technical standpoint, Palantir’s stock shows exceptional momentum. As can be seen below, the stock’s price action is well above key moving averages and various technical models are signaling continued strength.

Source: Investing.com

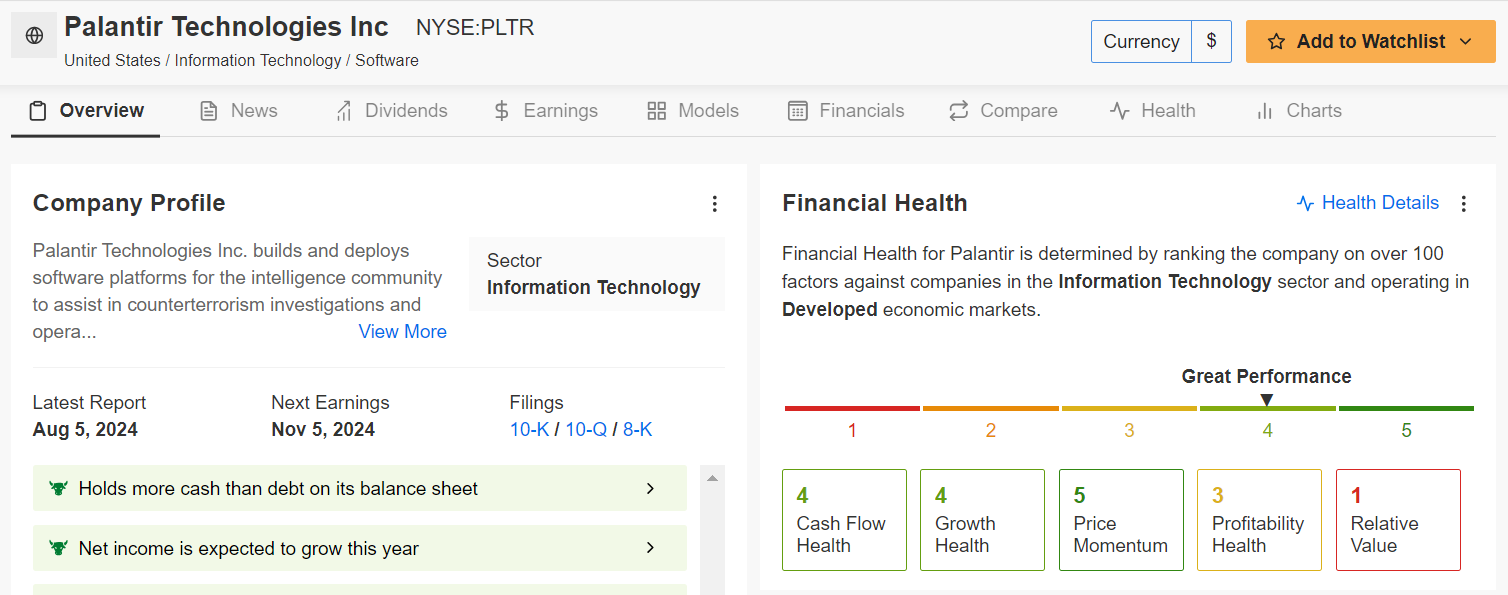

Moreover, Palantir has an above-average Financial Health score according to InvestingPro’s AI-powered models, indicating the company is in solid financial standing with strong cash flow and a resilient business model.

Source: InvestingPro

With the growing demand for AI-driven data analytics, Palantir is well-positioned to capitalize on the trend, making it a compelling buy.

2. Newmont Goldcorp

- 2024 Year-To-Date: +35%

- Market Cap: $64.1 Billion

Newmont Goldcorp, one of the world’s largest gold mining companies, has also experienced a remarkable price surge. As commodity prices rise and geopolitical uncertainties push investors toward safe-haven assets, Newmont has been a top beneficiary.

NEM stock was trading at $55.85 heading into Wednesday’s session, the highest level since July 14, 2022.

Shares have gained 35% year-to-date. The Greenwood Village, Colorado-based gold producer has a market valuation of $64.1 billion.

Source: Investing.com

Several factors have contributed to Newmont Goldcorp’s recent price momentum:

- Soaring Gold Prices: With gold prices rallying to new record highs, Newmont’s stock has naturally followed suit. As a leading player in the gold industry, Newmont’s earnings and profit margins benefit directly from higher gold prices.

- Strategic Acquisitions: Newmont’s recent strategic acquisitions and its focus on sustainable mining operations have bolstered its growth prospects, making it more attractive to institutional investors.

- Inflation Hedge: As inflation concerns persist, gold remains one of the most reliable inflation hedges, driving demand for Newmont’s stock.

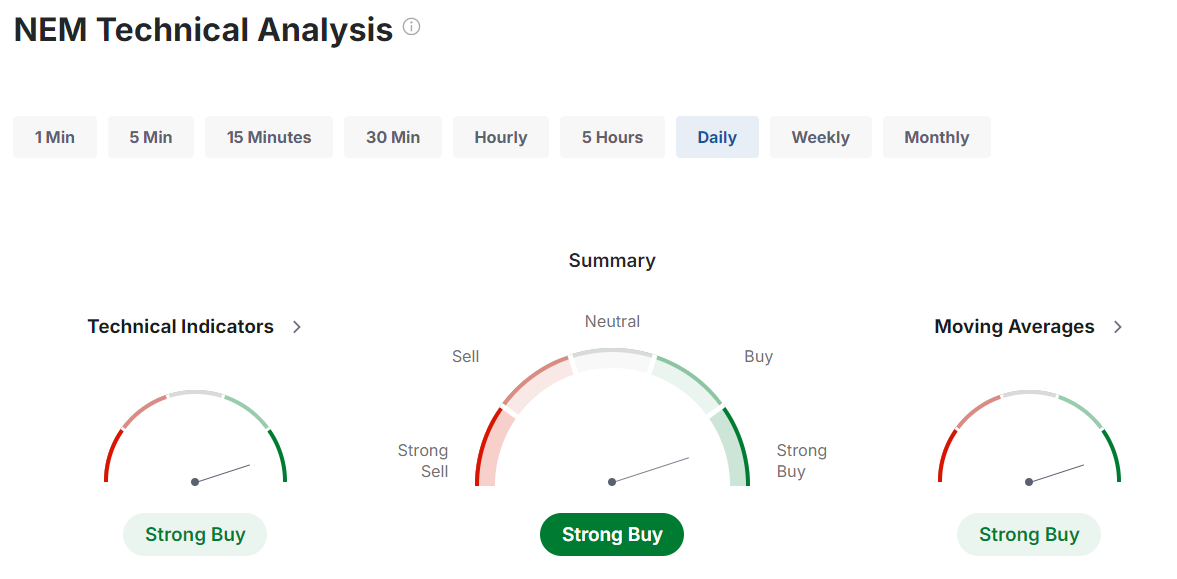

From a technical perspective, Newmont’s stock is trading well above its key moving averages, and several momentum indicators suggest continued upside potential.

Source: Investing.com

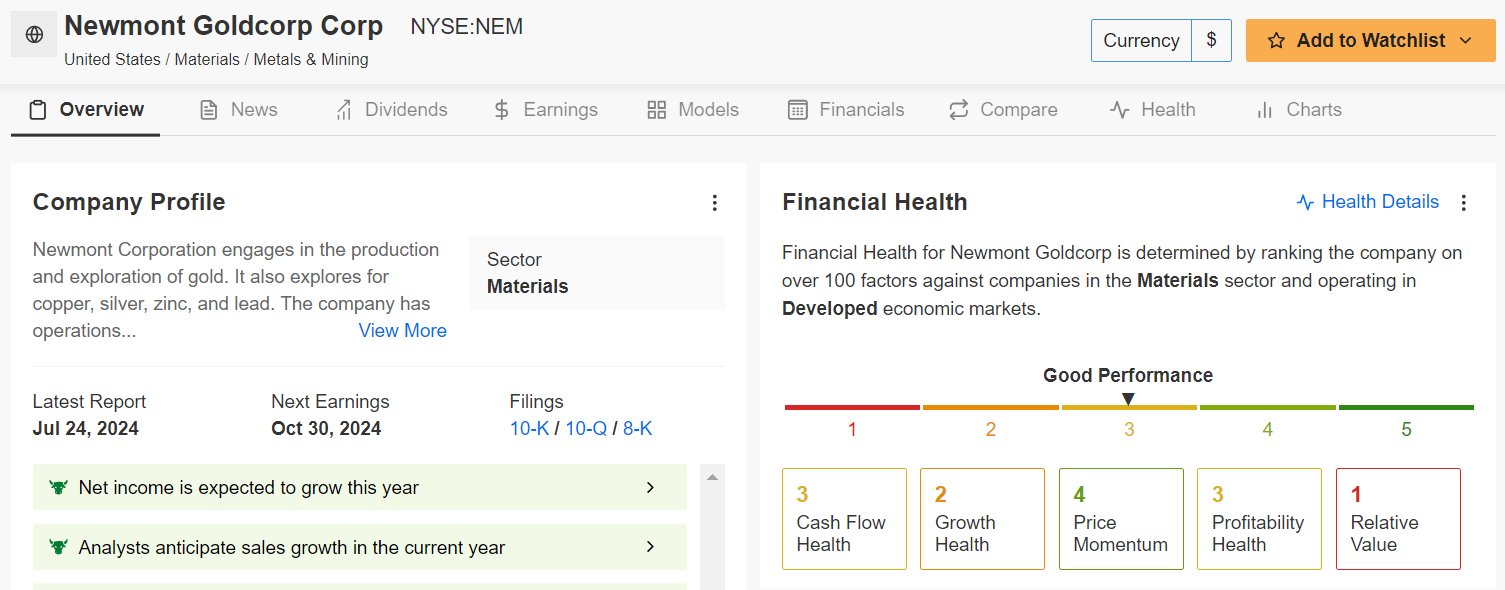

Like Palantir, Newmont Goldcorp also boasts an above-average Financial Health score on InvestingPro, supported by its strong balance sheet, low debt, and consistent cash flow.

Source: InvestingPro

Additionally, it should be noted that Newmont has maintained its annual dividend payments for 54 consecutive years, dating back to 1970, a testament to strong execution across the company and its robust business model.

Conclusion

Both Palantir Technologies and Newmont Goldcorp are strong-buy momentum stocks worth considering for investors looking to capitalize on upward price trends. With Palantir leading the charge in the AI revolution and Newmont benefiting from rising gold prices, both stocks offer significant upside potential.

Furthermore, their technical strength—backed by positive price action and solid fundamental outlooks—makes them ideal candidates for momentum-focused portfolios.

You can start picking out these gems for free using Investing.com's free screener.

This powerful tool can help you identify stocks with strong technical setups, making your investment decisions easier and more informed.

By registering for free on Investing.com, you can unlock the full potential of this tool and take your stock market investing to the next level.

Start using the Investing.com stock screener today and discover the power of smart stock selection!

*To ensure the best possible user experience with the new screener, make sure to log in to Investing.com on all your devices.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.