By Kathy Lien, Managing Director of BK Asset Management.

Of all the major currencies, the Canadian dollar was hit the hardest in 2015. The loonie lost over 15% of its value versus the U.S. dollar, Japanese yen and British pound. We have not seen the Canadian dollar this cheap since 2004 and the weakness was so severe that it drove USD/CAD to a 12-year high. There’s no doubt that 2015 was an extremely difficult year for Canada. The first half was spent in recession and the last quarter at risk of another downturn. The biggest problem for Canada has and will continue to be oil. In early 2015, the Canadian economy was hit hard by a sharp fall in oil prices -- between June and December of 2014, the price of oil dropped from $107 a barrel down to $55 a barrel. The Bank of Canada tried to preempt recession by cutting interest rates in January but under the heavy weight of falling crude prices, the economy contracted 2 quarters in a row. It came out of recession in the third quarter after the BoC cut rates one more time in July, but with oil prices falling once again, 2016 could be another challenging year for Canada.

Over the past few months we have seen oil's price fall to its lowest level in 6 years and many analysts believe that WTI crude could slip as low as $25 and possibly even $20 a barrel in 2016. Oil is Canada’s most important export and as we saw in early 2015, the economy and the currency can be hit hard when prices of this high-value export falls quickly and aggressively. The following chart shows how closely the Canadian dollar tracked oil in 2015.

Since economic data is released with a lag, we will continue to see the aftermath of lower oil prices in early 2016. The market is only pricing in a 25% probability of easing in March because of BoC Governor Poloz’s surprising optimism -- but those chances will grow as the year progresses. Poloz believes that stronger U.S. growth, a weaker Canadian dollar and rate cuts delivered in the first half of the year will help the economy recover and avoid the need for unconventional policies such as quantitative easing. But disappointing data in the early part of the year should force the Bank of Canada to cut interest rates by another 25bp. While we agree that a weaker currency will help turn Canada’s economy around, the effect may not be seen until the second half of the year and could be diminished if Federal Reserve rate hikes slow U.S. growth. The Bank of Canada may not be looking to take the leap into the world of unconventional monetary tools such as negative rates or QE, but they still have more room to ease before those options need to be considered.

We are looking for USD/CAD to break 1.40 and head toward 1.45 in the first half of 2016. The oil industry is experiencing its biggest downturn since the 1990s and prices could fall another $10 a barrel before bottoming. While this may not seem large, it would represent another 25% drop from year-end levels. Oil suffers from the issue of supply and demand. In an effort to push American producers out of the market, OPEC nations are pumping oil aggressively. Even though prices have fallen 30% in 2015, OPEC nations refuse to cut production -- and that battle for market share could drive prices well below $30 a barrel. The end of the U.S. crude-oil export ban and the lifting of sanctions on Iran will only add pressure on crude prices. The other side of the equation -- demand -- is also a problem. On one hand we have slower European and Chinese growth and on the other, a move toward energy efficiency. While production levels are starting to fall with companies being pushed out of business, it is not declining fast enough and there’s more than enough supply to meet any improvement to demand. In order for oil prices to bottom, production needs to be cut, and unfortunately there’s no indication that will happen soon. We could see $20 a barrel before $50 and even if a bounce occurs quickly, the initial move lower will most certainly send USD/CAD to fresh multi-year highs. Of course that won’t take much as USD/CAD ends the year within 100 pips of its 12-year high.

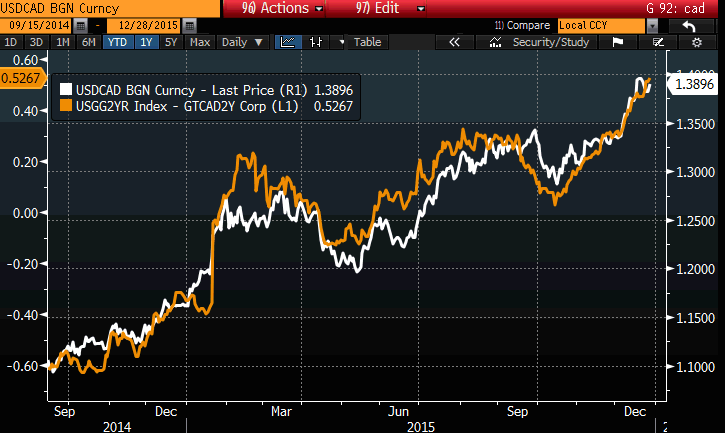

Keep an eye on the U.S./Canadian yield spread. While the correlation between USD/CAD and oil has been strong, the spread between U.S. and Canadian yields has also been a leading driver of USD/CAD flows. The following chart shows how closely USD/CAD (white line) followed the yield spread (orange line) this past year with the yield spread often leading movement in the currency. If the yield spread makes new highs, we can expect the currency pair to follow suit; and if the yield spread peaks, that will be the time to start selling USD/CAD.

We need to turn to the monthly chart to find resistance for USD/CAD. Right now the 12-year high of 1.40 is the most important resistance level. When that level breaks, the next key level will be 1.43, a level that the currency pair broke down from in 2003, found support in 2000 and resistance at in 1995. The uptrend in USD/CAD remains intact until the currency pair closes firmly below 1.35.