- Technology stocks have struggled

- Aggressive valuation reset offers bargain-buying opportunities

- Consider buying the dip in Etsy, PayPal, and Twilio

- Earnings Date: Wednesday, July 27 after the close

- EPS Growth Estimate: +11.8% yoy

- Revenue Growth Estimate: +6.1% yoy

- Year-To-Date Performance: -60.1%

- Market Cap: $11.1 billion

- Earnings Date: Tuesday, Aug. 2 after the close

- EPS Growth Estimate: -24.3% yoy

- Revenue Growth Estimate: +9.0% yoy

- Year-To-Date Performance: -58.8%

- Market Cap: $90.1 billion

- Earnings Date: Thursday, Aug. 4 after the close

- EPS Growth Estimate: -81.8% yoy

- Revenue Growth Estimate: +37.9% yoy

- Year-To-Date Performance: -66.2%

- Market Cap: $16.2 billion

High-growth technology stocks were some of the market’s best performers before a general tech selloff in 2022, which saw the NASDAQ 100 slump into a bear market earlier this year.

Rising interest rates, worries over soaring inflation, and jitters surrounding a potential recession are some of the worries plaguing the sector.

Despite that, there are three pummelled tech companies worth considering ahead of their upcoming earnings as all they have plenty of room to grow their respective businesses, making them solid long-term investments.

Etsy

Etsy (NASDAQ:ETSY), which provides an online e-commerce platform for handmade and vintage goods, has seen its stock struggle in the last several months as fears that the Federal Reserve’s monetary tightening plans sparked a selloff in many top-rated growth companies that are most sensitive to rising interest rates.

After soaring to an all-time high of $307.75 in November 2021, ETSY stock tumbled to a low of $67.01 on June 16.

Shares in the Brooklyn, New York internet retailer have since staged a modest rebound, but they remain approximately 72% below their record peak.

Etsy easily topped Wall Street estimates in the previous quarter but provided a weak outlook. Consensus estimates call for revenue to increase 6.1% yoy to $561.4 million and EPS of $0.76, up 11.8% yoy. Growth in gross merchandise sales (GMS), a key metric used in the e-commerce sector to measure transaction values, will also be in focus after increasing 3.5% to $3.3 billion in Q1. Investors will also scrutinize Etsy’s update regarding its outlook for the rest of 2022.

Out of the 20 analysts covering Etsy’s stock, per an Investing.com survey, the consensus recommendation comes to ‘outperform’ with fairly high conviction as none have rated it a 'sell'. Their average target price of $126.67 gives ETSY an implied upside of roughly 45%.

Additionally, the average fair value price for Etsy shares on InvestingPro stands at $125.43, a potential 43.4% upside.

PayPal

PayPal (NASDAQ:PYPL) has also seen its valuation crumble in recent months in the tech sector selloff.

Shares of the San Jose, California-based company, which are languishing near their lowest level since October 2017, have underperformed the broader market by a wide margin in 2022.

Shares in the e-payments operator, which is roughly 75% below its all-time peak of $310.16 in July 2021, fell to a five-year low of $67.58 on June 30 this year.

PayPal reported solid first quarter earnings but trimmed its full-year outlook. Consensus calls for the digital payment processing company to report a 9% yoy increase in revenue to $6.8 billion but a 24.3% slide in EPS to $0.87.

Investors will pay close attention to PayPal’s active accounts additions and growth in total payments volume (TPV), or the value of all transactions processed on the e-commerce company’s platform. Both key metrics beat expectations in the last quarter.

Management's forward guidance will also be in focus as PayPal continues to grapple with lower demand and sliding consumer spending.

But the company's pristine balance sheet and leadership position in its market combined with the shares' attractive valuation means they are well placed to move higher.

Indeed, 49 out of 50 analysts surveyed by Investing.com rate PayPal’s stock either as ‘outperform’ or ‘hold’, and the average target of $117.11 offers an upside of nearly 51%.

Similarly, the quantitative models in InvestingPro point to a gain of 35.4% from current levels, bringing shares closer to their fair value of $105.28.

Twilio

Twilio (NYSE:TWLO), which provides a cloud communications platform that enables developers to build, scale, and operate customer engagement within software applications, has fallen out of favor this year amid a broad selloff in software stocks, especially those that are unprofitable or have lofty P/E ratio.

Shares of the cloud communications giant recently plunged to their lowest level since March 2020 and are nearly 80.5% below their all-time high of $457.30 reached in February 2021.

Twilio beat earnings expectations last quarter but provided weak guidance. Consensus calls for a Q2 revenue increase of 38% to an all-time high of $922.3 million due to robust demand but an EPS loss of $0.20 due to rising costs related to the tech firm’s continuous efforts to expand.

Source: InvestingPro

Watch for an update on its active customer accounts (ACA) to see if it can maintain the 14% yoy increase it reported in Q1. Twilio is considered one of the leading names in the communication platform-as-a-service (CPaaS) sector and counts Twitter (NYSE:TWTR), Coca-Cola (NYSE:KO), and Lyft (NASDAQ:LYFT) as customers.

Source: InvestingPro

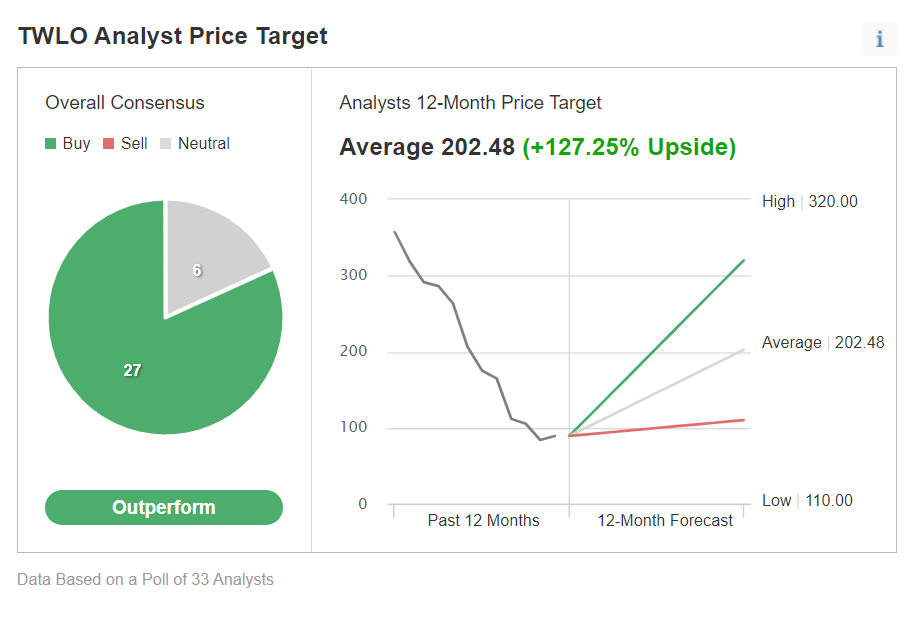

Analysts are generally bullish on Twilio, citing its strong long-term growth outlook with an Investing.com survey of 33 analysts showing that 26 rated it a ‘buy' and the stock had an average price target of over $200 offering a whopping 127% upside potential.

According to P/E, and P/S multiples, the average fair value for Twilio’s stock on InvestingPro is $107.83, 21% higher than current levels.

Disclaimer: At the time of writing, Jesse does not own shares in any of the companies mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.