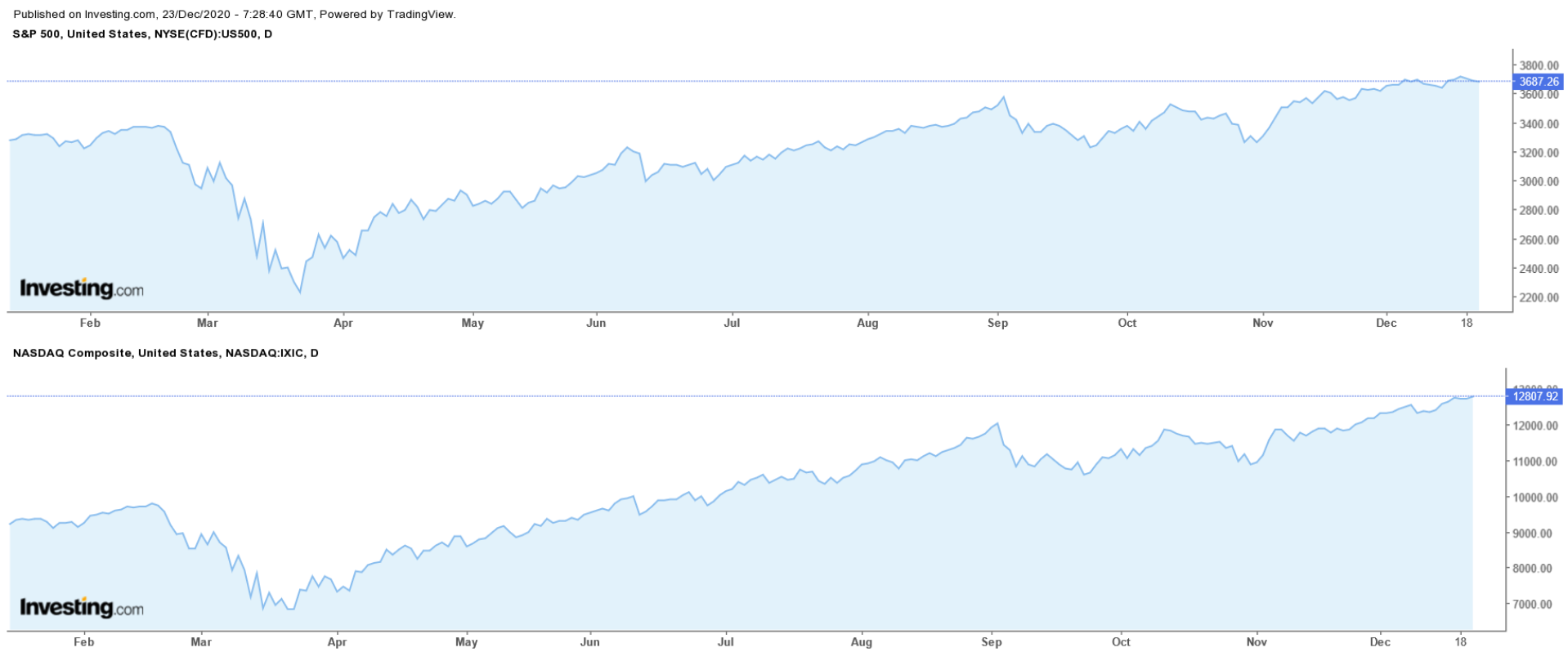

U.S. indices remain in a good position to end 2020 at all-time highs, even considering the pullback seen in many over the last few sessions. Movement on the Congressional stimulus and vaccine fronts is fueling positive sentiment.

The benchmark S&P 500 climbed by nearly 14% for the year, while the tech-heavy NASDAQ Composite rallied by almost 43% over the same timeframe, which would mark the best annual performance for the index since 2009.

With Wall Street closing the curtains on a blockbuster year, the following three growth stocks have been leading the charge higher in terms of year-to-date performance.

Not surprisingly, all three names are set up for an explosive 2021 thanks to accelerating revenue growth amid robust demand for their products and services.

1. CrowdStrike

- Opening Price, Jan. 2, 2020: $49.87

- Closing Price, Dec. 22, 2020: $224.90

- 2020 Gains YTD: +350.9%

Crowdstrike (NASDAQ:CRWD) shares have been on a roll this year, soaring around 351% in 2020 as it has benefited from the robust demand from corporations to make their IT networks more secure as more people work from home.

The cloud-based cybersecurity specialist—whose technology is used to detect and prevent security breaches—currently counts nearly half of the Fortune 100 companies as customers.

CRWD stock—which started the year at $49.87—closed at a fresh all-time high of $224.90 last night, valuing the Sunnyvale, California-based cybersecurity company at roughly $45.2 billion.

CrowdStrike reported a impressive third-quarter earnings report at the start of December, which saw revenue jump 85.8% year-over-year.

The cybersecurity firm said it added 1,186 net new subscription customers in the quarter. It now has a total of 8,416 customers, up 85% from the same period a year earlier.

The cybersecurity leader is on track to be one of the main beneficiaries of increased cybersecurity spending from businesses after the fallout of the massive hack}} earlier this month that originated at network management software provider SolarWinds (NYSE:SWI).

We anticipate the positive trend in CrowdStrike’s stock to continue in 2021 thanks to its status as one of the leading names in the cybersecurity sector.

2. {{0|Chewy

- Opening Price, Jan. 2, 2020: $29.00

- Closing Price, Dec. 22, 2020: $106.69

- 2020 Gains YTD: +267.9%

Chewy (NYSE:CHWY), widely considered the leading online seller of branded and private-label pet food and grooming supplies in the U.S., has been a big winner in 2020, with its shares surging by a whopping 267.9% this year.

The online pet products retailer, which held its initial public offering in June 2019, has benefitted as its in-home delivery model mitigates the public health concern of consumers shopping for their pets at brick-and-mortar retailers.

CHWY stock, which began the year at $29.00, rallied to an all-time high of $109.52 on Tuesday, before ending the session at $106.69, earning the Dania Beach, Florida-based e-commerce company a valuation of $44.4 billion.

Chewy's earnings reports beat revenue forecasts in each quarter this year, signaling strength even during the ongoing health crisis.

The online pet products seller, whose site and mobile apps showcase a wide variety of pet food for different animals and enables customers to order products for delivery, reported blowout third quarter results on Dec.8 that delivered a 45% jump in revenue.

Highlighting the growing demand for its services, Chewy added 1.2 million net new customers in the third quarter alone. It now counts 17.8 million active users, up around 40% from the year-ago period.

Chewy is likely to see a boost to its already-stellar financial performance in the year ahead, given the expected jump in U.S. pet spending and its relentless focus on execution and inventiveness, which has allowed it to thrive in the competitive market with competition from Amazon.com (NASDAQ:AMZN).

3. Roku

- Opening Price, Jan. 2, 2020: $133.90

- Closing Price, Dec. 22, 2020: $354.71

- 2020 Gains YTD: +164.9%

Roku (NASDAQ:ROKU) has been one of this year’s top performers, with shares rocketing nearly 165% in 2020, thanks to its rapid user expansion, which has translated into higher advertising revenue for the streaming media platform provider.

While that in itself is impressive, what makes its year-to-date gains even more astonishing is that the stock scored an annual gain of 375% in 2019 as well.

ROKU stock, which started the year at $133.90, climbed to a new record of $361.50 yesterday before closing at $354.71. At current levels, the San Jose, California-based streaming video pioneer has a market cap of around $43.5 billion.

Roku reported upbeat earnings surprises for all four periods of the year, crushing expectations for profit and revenue due to strong growth in its ad-supported, video-on-demand services.

The streaming video platform reported an unanticipated profit when it released third quarter results on Nov. 5, along with better-than-expected revenue, which soared 73% from the same period a year earlier.

Roku's active accounts as of the third quarter jumped 43% year-over-year to 46 million. Those accounts spent a remarkable 14.8 billion hours, or 3.5 hours per user per day, streaming through Roku's hub, up 54% from the year-ago period.

Further underpinning optimism surrounding the company, average revenue per user clocked in with a double-digit percentage gain in Q3, rising 20% year-over-year to $27.

Despite the lofty gains recorded over the past 24 months, we anticipate ROKU stock to extend its run higher in the new year as the current operating environment has created a perfect backdrop for the streaming media platform to prosper.