- With 2025 around the corner, savvy tech investors should consider these three undervalued stocks with robust upside potential.

- All three companies are strategically positioned to outperform next year.

- Their combination of innovative solutions, healthy growth drivers, and discounted valuations make them compelling picks.

- Looking for more actionable trade ideas? Subscribe here for 55% off InvestingPro as part of our Cyber Monday Extended sale!

As we enter 2025, the technology sector continues to brim with opportunities, particularly among underestimated companies with strong growth trajectories. Among them, Okta (NASDAQ:OKTA), Jfrog (NASDAQ:FROG), and Verint Systems (NASDAQ:VRNT) stand out, as per the InvestingPro advanced stock screener.

Source: InvestingPro

These three companies are poised for significant upside potential, offering a compelling mix of innovation, robust fundamentals, and undervalued stock prices.

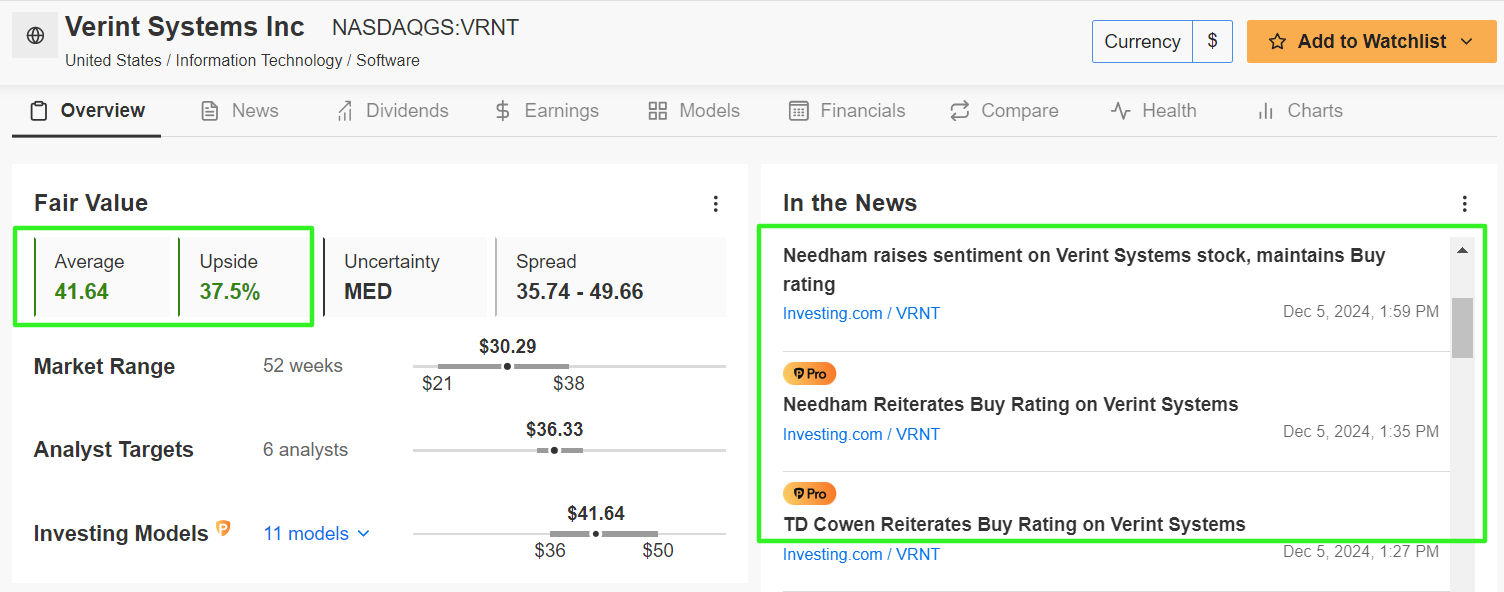

1. Verint Systems

- Current Price: $30.29

- Fair Value Estimate: $41.64 (+37.5% Upside)

- Market Cap: $1.9 Billion

Verint Systems is a customer engagement company leveraging AI-powered analytics to help businesses enhance customer experiences. Its solutions span workforce optimization, call center management, and advanced analytics, making it a go-to partner for enterprises aiming to improve customer satisfaction.

Source: Investing.com

Verint has scored a year-to-date gain of 12% thanks to increased demand for its AI-driven customer engagement solutions and a strong push toward cloud-based offerings. The Melville, New York-based technology company’s innovative product launches and successful cost-optimization initiatives helped it maintain robust profitability, further enhancing its appeal to investors.

Looking forward, Verint is expected to capitalize on the expanding AI and customer analytics markets. Its strong pipeline of contracts and increasing subscription revenue create a bullish outlook for 2025.

Source: InvestingPro

Verint’s undervaluation offers an attractive entry point, with 37.5% upside potential as per InvestingPro's Fair Value model, and analysts forecasting a $36.33 price target, accompanied by a strong buy rating.

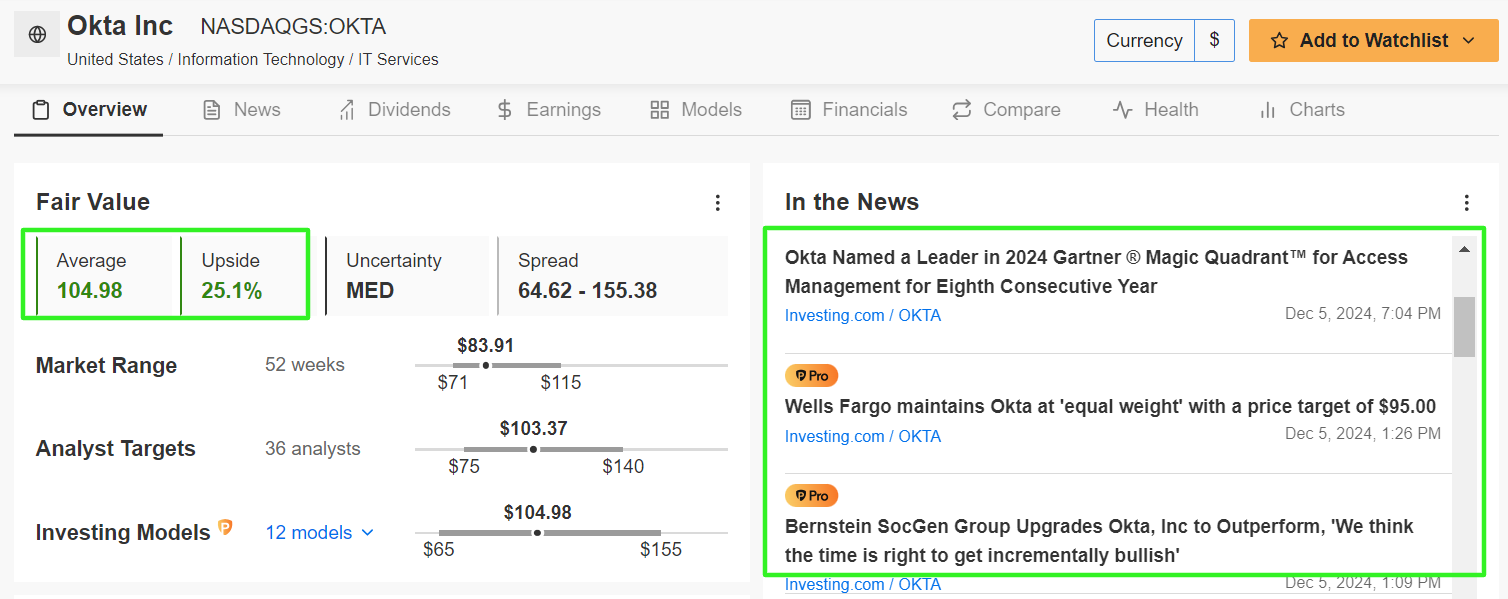

2. Okta

- Current Price: $83.91

- Fair Value Estimate: $104.98 (+25.1% Upside)

- Market Cap: $14.4 Billion

Okta operates as a leading provider of identity and access management solutions. The company’s cloud-based platform enables organizations to securely manage user authentication and application access across multiple devices and platforms. Its services cater to a wide range of industries, making it a critical player in the cybersecurity space

Source: Investing.com

While shares are down 7.3% in 2024, San Francisco-based Okta has found support recently due to its increasing adoption among enterprise customers and strong execution in expanding its customer base. The ongoing shift toward hybrid work environments and heightened demand for cybersecurity fueled its revenue growth.

Looking ahead, Okta is poised to gain momentum in 2025 as it benefits from ongoing digital transformation trends and rising concerns about data security. Its improved profitability metrics and focus on streamlining operations further bolster investor confidence.

Source: InvestingPro

The InvestingPro Fair Value model suggests that OKTA stock is substantially undervalued, making it an attractive buy at current levels. Trading at $83.91, InvestingPro estimates its fair value price at $104.98, indicating a potential upside of 25.1%.

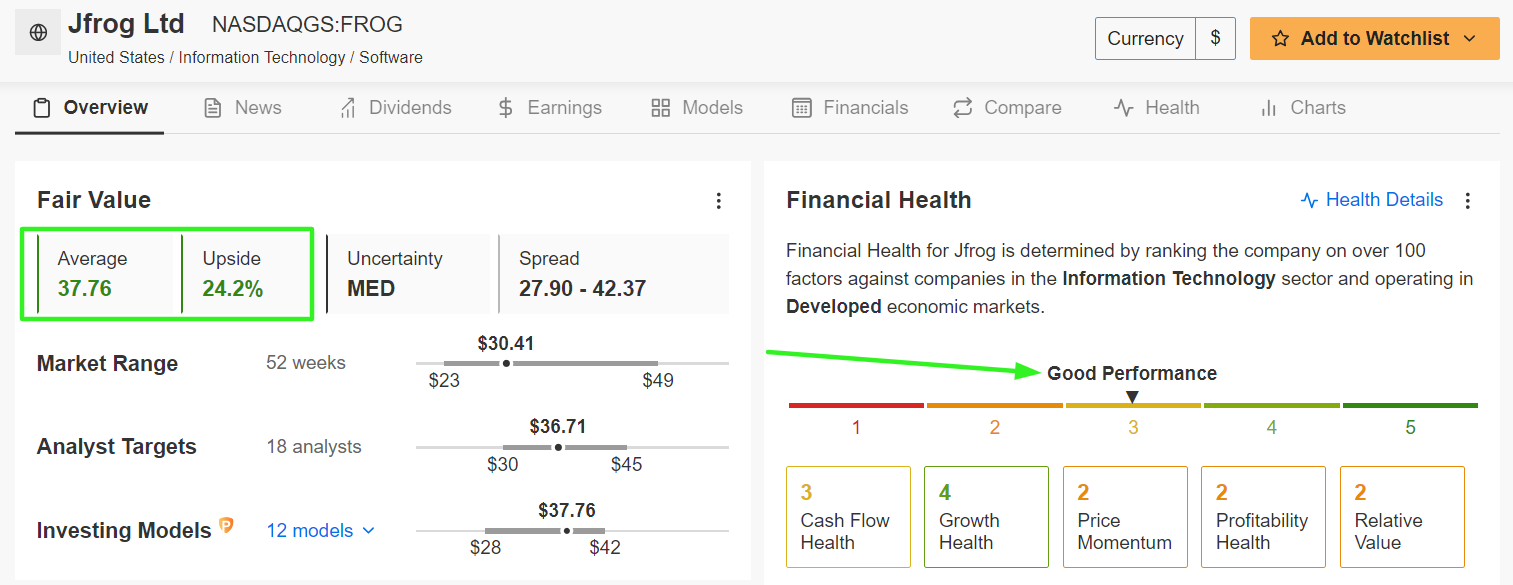

3. JFrog

- Current Price: $30.41

- Fair Value Estimate: $37.76 (+24.2% Upside)

- Market Cap: $3.4 Billion

JFrog specializes in DevOps solutions, offering products that facilitate software development, deployment, security, and distribution. The Israel-based tech company is renowned for its platform, the "JFrog Artifactory," which enables efficient management of software packages, fostering faster and more secure development cycles.

Source: Investing.com

Despite FROG being down 12.1% year-to-date, the stock’s recent rally can be attributed to growing adoption of its SaaS offerings, particularly among large enterprises undergoing digital modernization. JFrog’s investments in automation and integration with cloud providers like Amazon (NASDAQ:AMZN) AWS and Microsoft (NASDAQ:MSFT) Azure drove both revenue and market expansion.

Heading into 2025, JFrog’s focus on scaling its AI-driven automation solutions and its strategic partnerships are expected to drive substantial growth. Its significant increase in recurring subscription revenue further solidifies its reputation as a leader in the DevOps space.

Source: InvestingPro

Its undervalued status is underscored by a 24.2% upside potential according to InvestingPro’s Fair Value metrics, and analysts maintain a strong buy rating with a price target of $36.71.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now to get 55% off all Pro plans and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust (NASDAQ:QQQ) ETF. I am also long on the Technology Select Sector SPDR ETF.

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.