- There are always hidden opportunities lurking in undervalued stocks despite extended stock market valuations.

- In this article, we spotlight five potential winners, each poised for over 30 potential gains.

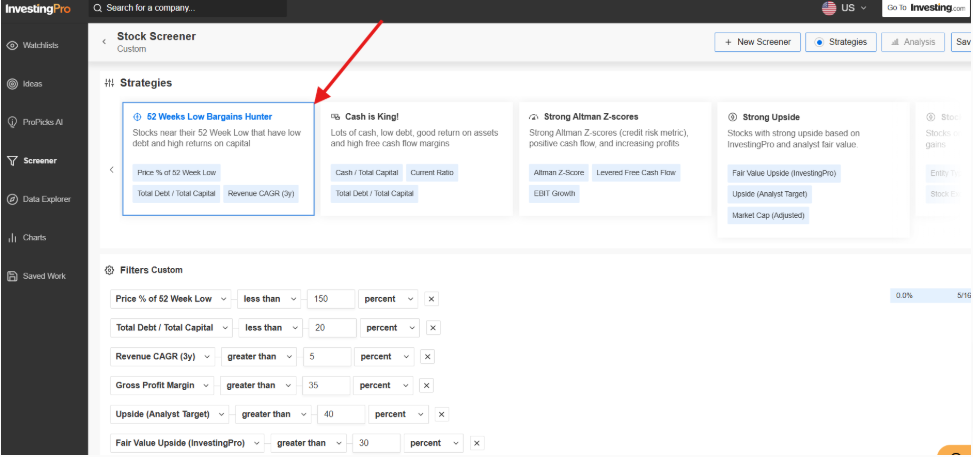

- We will use InvestingPro's advanced screener to identify these bargains trading near yearly lows.

- Unlock Cyber Monday savings! Get 60% off InvestingPro and access top features like ProPicks AI, Fair Value, and the Top Stock Screener for just $6/month. Claim your deal now!

Are sky-high stock valuations and market concentration signaling trouble, or could they still feature opportunities for savvy investors?

While concerns about a potential bubble in equity markets grow louder—especially in AI-focused big tech—the potential for outsized gains remains.

In this article, we pinpoint five U.S. stocks that could deliver over 30% upside, offering a promising roadmap for those ready to navigate this volatile market.

For this, we will use the InvestingPro advanced screener.

Big Tech Bubble Warnings

The European Central Bank (ECB) recently flagged risks tied to market concentration, particularly among U.S. tech giants like the "Magnificent 7" (Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Meta (NASDAQ:META), Alphabet (NASDAQ:GOOGL), and Tesla (NASDAQ:TSLA)).

In its November Financial Stability Review, the ECB warned that economic shocks, shifting monetary policy expectations, or escalating geopolitical tensions could disrupt investor sentiment, rippling through all asset classes.

ECB Vice President Luis de Guindos underscored the issue, highlighting the vulnerability of AI-related assets.

“The concentration among a few large firms raises concerns about the possibility of a bubble,” he noted.

Yet, for investors, this isn’t just a warning—it's a wake-up call to reassess opportunities in a shifting market landscape.

Rather than retreating, seasoned investors often view heightened volatility as an entry point. The key lies in identifying undervalued stocks poised for a rebound, steering clear of traps common in overheated markets.

With analysts forecasting substantial upside for select companies, the challenge is narrowing down the right picks in an environment where returns are ready to shift gears.

5 Undervalued Stocks Poised for a Rebound Near Yearly Lows

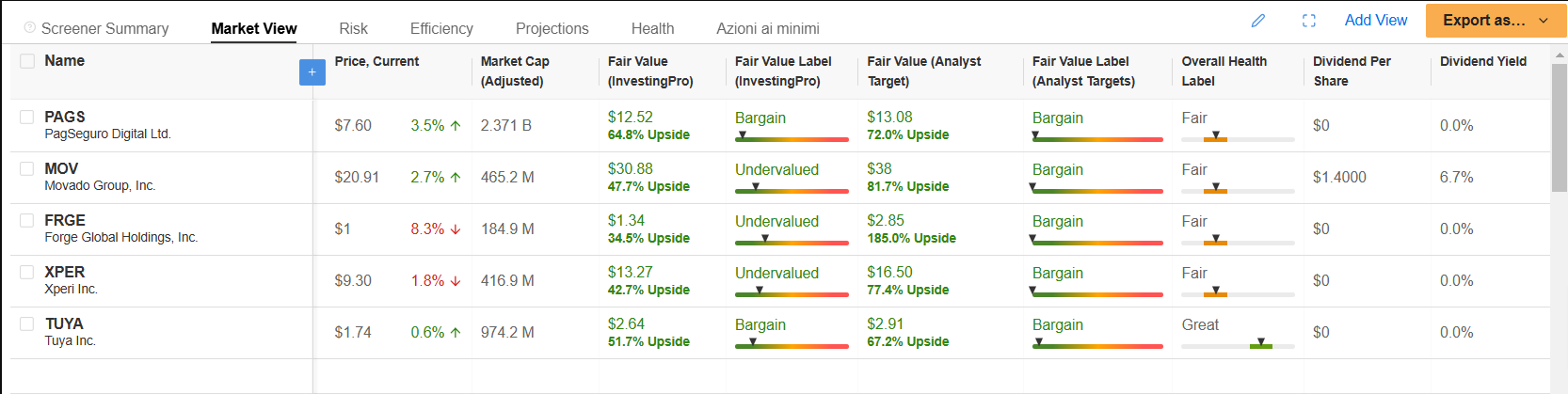

Wall Street analysts remain bullish on U.S. equities, even as 2025 approaches. Among the standouts are five stocks trading near their 52-week lows.

Each has been identified as undervalued, with analysts predicting upside potential exceeding 30% based on Fair Value and consensus estimates.

Source: InvestingPro

Using InvestingPro’s stock screener, which includes tools like the "Hunt for Bargains Near 52-Week Low" filter, these hidden gems emerge as compelling opportunities:

- PagSeguro Digital Ltd (NYSE:PAGS): This financial technology provider shows a possible upside of over 64%, making it one of the most undervalued stocks on the list.

- Movado Group (NYSE:MOV): Known for its strong fundamentals and potential for rebound, Movado stands out as a stable growth candidate.

- Forge Global Holdings (NYSE:FRGE): Analysts expect this investment services provider to surge by 185%, with Fair Value metrics supporting a 30%+ upside.

- Xperi (NYSE:XPER): With steady returns on capital and low debt, Xperi offers a balanced risk-reward profile.

- Tuya (NYSE:TUYA): As an IoT solutions provider, Tuya combines strong growth potential with a solid financial base.

Risk-Managed Strategies

Investing in stocks near year-low comes with inherent risks, but proper vetting minimizes them. Analysts emphasize focusing on companies with strong fundamentals—manageable debt levels, healthy returns on capital, and robust financials.

Additionally, relying on Fair Value calculations derived from InvestingPro’s suite of financial models provides an extra layer of confidence.

The Takeaway

In a market marked by high valuations and concentrated risk, volatility can uncover opportunities for investors willing to think outside the box.

The five stocks highlighted here, each with significant upside potential and strong fundamentals, exemplify the kind of opportunities that can be uncovered with the right tools.

InvestingPro’s advanced stock screener is a game-changer for investors looking to navigate these challenging conditions. With Cyber Monday now live, you can access this powerful tool at an incredible 60% discount.

This advanced screener offers strategy filters like those discussed in this article, enabling you to identify bargains even in a market trading at extended valuations. With over 167 custom metrics, InvestingPro can help you find your next winning stock in seconds.

Save 60% now—this deal ends soon!

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor