After numerous quarters of blistering growth, Netflix (NASDAQ:NFLX) is taking a break. The streaming entertainment giant is on pace for its slowest year of growth since 2013, a sudden reversal that's making its investors nervous.

The company added just 1.54 million customers in the second quarter that ended on June 30. When combined with new customers in the first quarter, Netflix saw an escalation of about 5.5 million customers—the worst subscriber performance since the first half of 2013, when the service was operating in fewer than half the countries it currently does busines in now.

The Los Gatos, California-based communications services heavyweight has blamed its recent results on accelerated growth from a year ago, when nearly 26 million new customers signed up for Netflix in the first half. That was a period when people were stuck at home during the pandemic and flocked to its movies and shows.

The company also told investors last month that it’s expecting to add 3.5 million subscribers in the third quarter, well short of the 5.86 million analysts had projected.

This weak growth outlook is keeping many investors on the sidelines and leaving them unsure about the company’s prospects in the post-pandemic environment. Netflix stock has barely budged this year when the benchmark NASDAQ Composite Index has gained more than 16%.

Is this underperformance by one of the most innovative media companies of our time a worrying sign for long-term investors or those wanting to bet on the stock now?

In the short-run, Netflix may continue to underperform as subscriber growth slows after massive gains during the pandemic. But over the long run, Netflix's superior position in the video-streaming market is intact and any further weakness, in our view, should be considered a buying opportunity.

Here are three major catalysts that support our bullish case for Netflix despite the recent weakness:

1. Global Reach

The strongest argument for Netflix’s bullish thesis is the company’s expanding global reach. While it has signed up about half of potential customers in the U.S., it’s still a small player in many markets in Asia, Africa and Eastern Europe. The Asia Pacific region, NFLX’s smallest location, has contributed the most new customers this year.

Netflix has signed up 209 million of what it says are the 800 million to 900 million households that have either broadband internet or pay-TV access. The company believes it will sign up more than half of those people. Not only will it continue to grow in places like Asia Pacific and Latin America, but it will keep growing in the U.S., Canada and Western Europe.

Netflix’s global subscription push is being fuelled by the company’s expertise in the content domestic audiences prefer, along with knowing what marketing they respond to. In addition, the company produces more local content than any of its competitors. After creating widely watched Asia programming such as the Korean zombie period thriller “Kingdom” and reality series “Indian Matchmaking” last year, Netflix is spending more in Asia to secure exclusive content. Since its Asia launch in 2015, Netflix has released more than 220 original titles there.

Netflix’s non-English titles have also been popular this year, and not just in their home countries, attracting a broad viewership. “Lupin” from France, “Elite” from Spain and “Who Killed Sara?” from Mexico—all have been huge hits.

Netflix co-CEO Reed Hastings estimates that international markets could someday account for 75-80% of his company’s user base—similar to Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL).

2. Improving Financial Metrics

If the battle in the post-pandemic world is to keep subscribers from cancelling subscriptions, then it’s clear that Netflix remains well-positioned to win this race.

According to Parrot Analytics, despite the drop in demand for subscriptions in Q2, Netflix’s churn rate has remained low globally compared with its competitors, pointing to the importance of a balanced library of originals and licensed content.

Another positive development that long-term investors should take into account is that Netflix is no longer dependent on debt to fuel its growth. After years of borrowing to fund production, Netflix has said it no longer needs to raise outside financing to support day-to-day operations. The company plans to reduce its debt load and will buy back up to $5 billion in shares.

According to Bank of Montreal research, Netflix has solidified its position as a streaming video leader and its stock price should rebound strongly in the months ahead.

In a recent note BMO said:

“We think a strong 2H content slate can help guide NFLX through choppy reopening trends, while management continues to lean into the share buyback and support the stock. With tough comps behind it and FCF ramping despite early video game investment, we think investors should be aggressively building positions once again.”

Chart: Investing.com

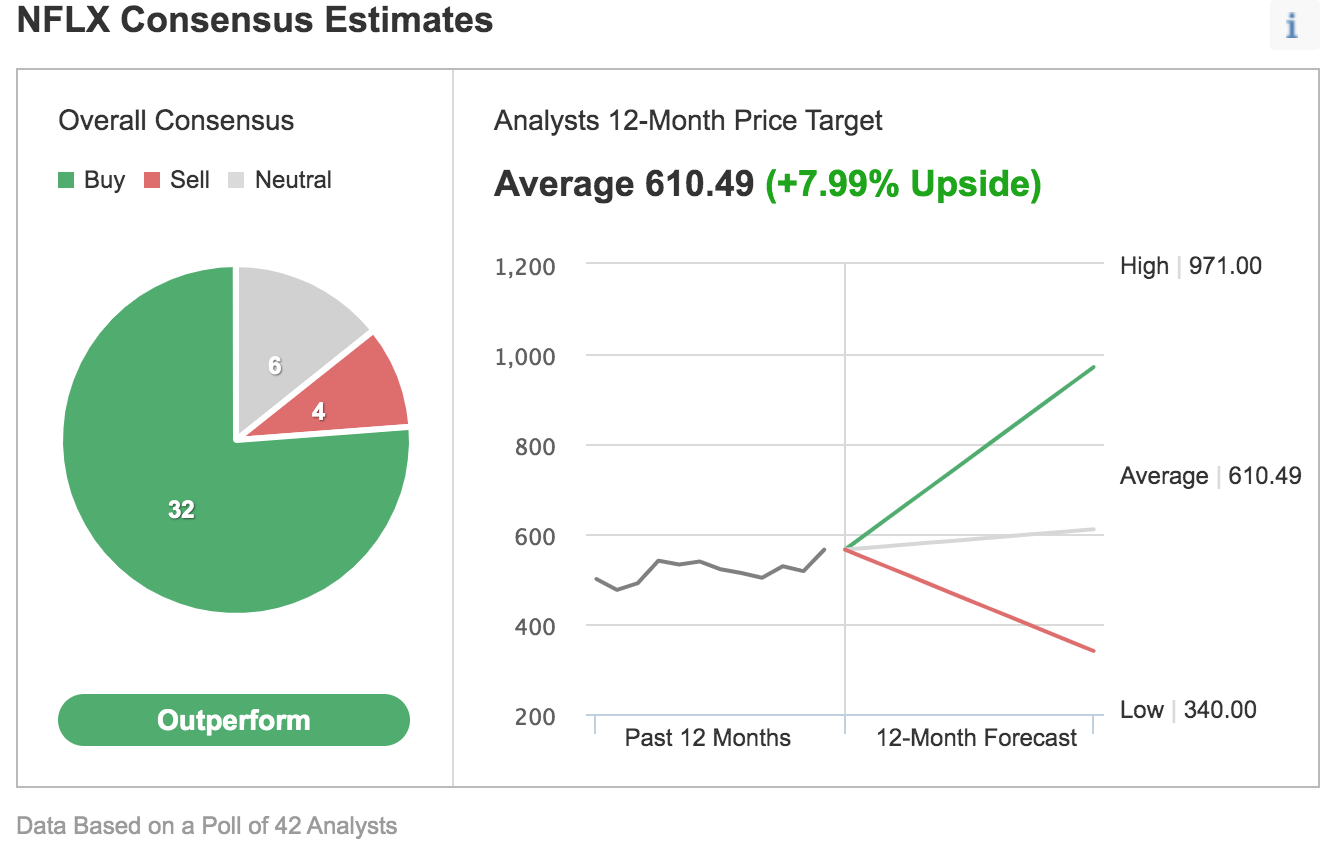

Due to Netflix’s strengthened financial situation, the analyst community remains positive on the stock. In an Investing.com poll of 42 analysts, 32 have a buy rating on the stock, with a consensus 12-month price target of $610.49.

3. Entry In The Gaming Market

Taking advantage of its large global subscriber base, Netflix is working to diversify its revenue sources beyond video content and adding games to its subscription offering.

Global consumer spending on game software is projected to reach $175.8 billion this year and exceed $200 billion by 2023, according to Newzoo BV. Mobile games—the kind Netflix is expected to focus on—are on track to make up roughly half of this year’s haul, according to a report in the Wall Street Journal.

Benchmark analyst Mike Hickey said in the report that the addition of games will make the Netflix service more sticky. Said Hickey:

“You can burn through a TV series in a day, but you can constantly engage with a game for months to years.”

According to a Deloitte survey, Generation Z ranked playing video games as their favorite entertainment activity—way above music, social media and television. To get this project rolling, Netflix has hired Mike Verdu, a former executive at video-game publisher Electronic Arts (NASDAQ:EA) and Facebook, to be its vice president of game development.

“We view gaming as another new content category for us, similar to our expansion into original films, animation and unscripted TV. Games will be included in members’ Netflix subscription at no additional cost similar to films and series,” Netflix told investors in its latest quarterly letter.

Bottom Line

There is no doubt that Netflix’s pandemic-era boom in subscriber growth is over as the economy reopens and people seek to resume their normal activities. But the streaming company has emerged much stronger from the unique environment of the past year, solidifying its cash and market positions. A couple of weak quarters, in our view, shouldn’t be taken as a sell signal.