Among dozens of executive orders President Trump signed in January, one of them related to the funding freeze of federal grants and loans. This was compounded by the pause on offshore wind leasing and the withdrawal from the Paris climate agreement.

Altogether, these actions point to an administration that is more focused on gas & oil, nuclear and geothermal as the pillars of the US energy infrastructure. Nonetheless, solar energy already provides 7% of the nation’s electric grid capacity, at around 220 GW, according to SEIA:

“Solar accounted for 64% of all new electricity-generating capacity added to the U.S. grid through Q3 2024. U.S. solar now produces enough electricity annually to power over 37 million homes.”

Moreover, solar power remains one of the most practical and accessible solutions for energy independence, whether one wants to go fully off-grid or complement the existing electric grid. In turn, the solar energy market will continue to grow with or without special federal assistance.

According to the latest February report from Fortune Business Insights, the global solar power market should expand at a CAGR of 6% between 2024 to 2032, with the US being the dominant player at 41% market share.

Additionally, President Trump’s effort to ease permitting regulations swings both ways. But which solar stocks are best suited to take off in the long run?

1. Daqo New Energy

Just as Howmet Aerospace (NYSE:HWM) is the critical supplier of engine/airframe parts, so is Daqo a vital cog in the solar market by supplying high-purity polysilicon. Solar companies rely on this material to gain greater efficiency of photovoltaic (PV) cells, longevity and manufacturing yield of solar cells.

Although Daqo is a Chinese company, China accounted for 92% of the global polysilicon supply in 2023, per the Silicon Industry Branch of China Nonferrous Metal Industry Association. In the latest Q3 2024 earnings, Daqo reported $60 million net loss as the average selling price (ASP) of polysilicon remained under the production cost.

It is also the case that the polysilicon market is currently in the balancing stage, exiting oversupply. However, it is at this point in time that investors should stake a hold before a turnaround. Daqo has ample cash reserves to wait, holding $853.4 million, against total liabilities at $724.3 million.

The company has total equity worth $6.3 billion, making its debt-to-equity ratio very low. Over the last year, DQ stock is up 8.2%, currently priced at $20.63 per share (available as ADR). According to the WSJ forecast, the average DQ price target is $25.76. Considering that the low estimate is aligned with the current price level, at $19.30, this is as good an entry point as any for polysilicon market exposure.

2. First Solar

When it comes to solar, it’s all about scaling production, similar to lithium batteries for EVs. As one of the top American solar companies, First Solar (NASDAQ:FSLR) accomplishes scaling with Cadmium Telluride (CadTel) semiconductor material. In contrast to silicon, this incurs lower cost per module.

Likewise, First Solar developed a thin film PV approach to modules, which needs lesser semiconductor material for equivalent power output. In last reported Q3 earnings, First Solar netted $887.6 million sales with a net income of $312.9 million. For nine months ending September, the companies’ net income nearly doubled from $481.5 million in 2023 to $898.9 million in 2024.

At that time, the company held $1 billion in cash reserves vs current liabilities at $265.3 million. First Solar’s total debt of $3.8 billion is 3x lower than the company’s assets worth $11.4 billion.

On February 25th, First Solar is scheduled to report its FY2024 earnings.

Over a one-year period, FSLR stock is up 4.2%, presently priced at $150.70 per share. This is a return to March 2024 price level. On February 25th, First Solar is scheduled to report its FY2024 earnings.

At its current, seemingly bottomed-out state, FSLR stock is a prime candidate for US solar market exposure. The WSJ forecast places the average FSLR price target at $272.79, making for an 81% potential return on investment.

3. NextEra Energy

NextEra (NYSE:NEE) is diversified across solar, wind and nuclear, producing over 67 GW of power. The company’s nuclear component is through the NextEra Energy Resources subsidiary. The company not only generates sales directly to residential, commercial and industrial clients but also through power purchase agreements (PPAs).

This business model offers stable cash flows, which reflects NEE stock. In contrast to most solar stocks, NEE is up nearly 30% over a one year period. The company’s present stock price level of $71.41 is similar to the lowest level in July 2024.

A big component of the company is Florida Power & Light (FPL), its largest subsidiary. In 2024 alone, the company invested to upgrade its capacity by 2.2 GW worth of solar power. Overall, NextEra added over 12 GW of renewables during 2024.

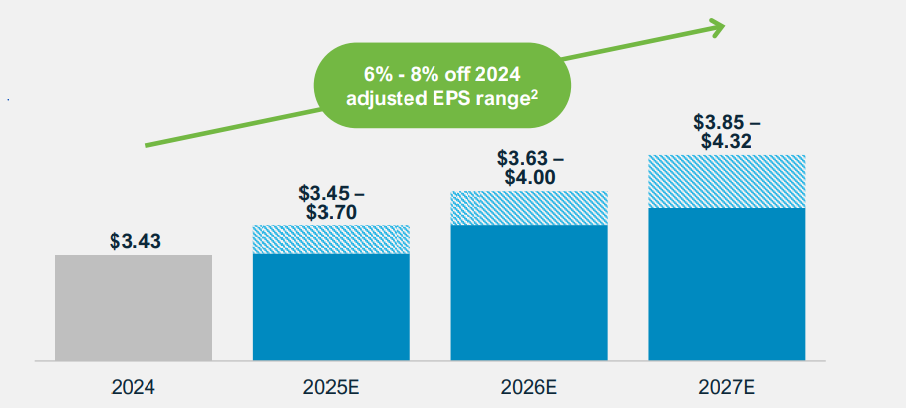

As of the last earnings report for Q4 2024, NextEra expects up to 8% annual growth rate between 2023 to 2027. This growth should be accompanied by around 10% annual dividend per share payout increase until 2026.

Image credit: NextEra Energy

As a diversified company with strong utility subsidiaries, NextEra currently offers a $2.06 annual dividend payout per share, at a dividend yield of 2.91%. Against the current price of $70.80, the average NEE price target is $85.83 per share.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.