- US Indexes have done well this year despite a negative backdrop

- And history suggests their good performance is set to continue

- With that in mind, here are three stocks that Wall Street loves and you can consider buying

Despite an eventful year marked by Russia's ongoing war with Ukraine, the US debt ceiling issue, and interest rate hikes by the Fed and other central banks, the stock market has performed well so far.

The S&P 500 had a good first quarter, registering its best performance since 2019. Historically, when the index was up at least +5% in the first quarter, it ended the last three quarters of the year in the green. The only exception was 1987.

Since 1985, there have been 15 instances where the Nasdaq 100 took anywhere from 6.8 to 38 months to reach a new 52-week high.

Out of the 14 previous instances (excluding this year) where it took at least six months to reach a new high, the Nasdaq 100 was in the green 12 months later.

These are statistical facts and not guarantees. As Mark Twain said, history often rhymes, it doesn't repeat.

If it does rhyme, investors can profit, and the best way to do that is to invest in businesses known for their solidity on Wall Street. Using InvestingPro tools, we will take a look at three stocks worth considering.

You can do the same for virtually any stock using InvestingPro tools. Click on this link and start your free trial today!

1. Dutch Bros

While Starbucks is already widely known, Dutch Bros (NYSE:BROS) is a steadily growing player in the industry. With 716 stores across 14 states, it is expanding at a steady pace.

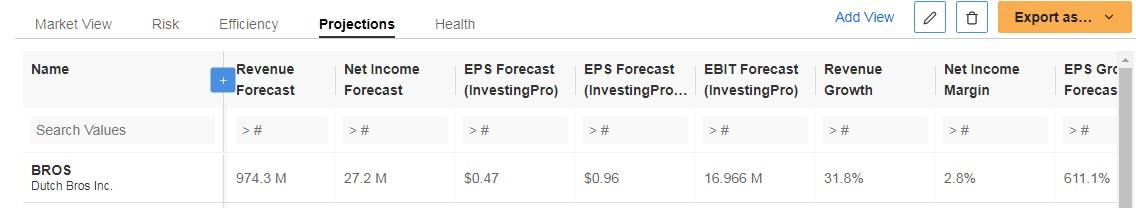

The company has been experiencing impressive year-over-year revenue growth of nearly 30%, which is expected to continue in 2023 and 2024.

Anticipations for this quarter indicate a revenue increase of 3.9%, and the company's Q2 2023 results are scheduled to be announced on August 9.

Source: InvestingPro

For comprehensive forecasts and data about the company, you can access a detailed table on InvestingPro.

Source: InvestingPro

The news section of the InvestingPro tool provides an analysis of the latest published results and market estimates for the current year. It offers valuable insights into the company's performance and future expectations.

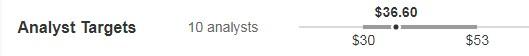

Source: InvestingPro

Analyst consensus gives it a potential target price of $36.60.

Source: InvestingPro

From a technical perspective, the price has remained relatively stable since September of last year, trading sideways.

However, the $26 level has proven to be a strong support. It's important to watch the $26 and $22.74 levels, as they have acted as reliable supports.

2. Booking Holdings

Following the impact of the COVID-19 pandemic, the travel industry is gradually recovering. Recent reports from the American Automobile Association indicate that more Americans are expected to travel by plane during Memorial Day weekend compared to pre-pandemic levels in 2019, with a 5.4% increase reaching 3.4 million travelers. Similar trends are observed globally, such as in China, where record travel within the country was recorded during the May holiday.

Furthermore, the World Travel and Tourism Council predicts that global tourism revenues will continue to grow for the third consecutive year in the current fiscal year, leading to a full recovery next year.

Booking Holdings (NASDAQ:BKNG), a well-established company in the sector with a global presence, stands to gain from this.

The company's upcoming financial results will be announced on August 2. Analysts have revised their earnings per share (EPS) forecasts for the next quarter. Additionally, revenues are expected to rise by approximately 20% in 2023 and 12% in 2024.

Source: InvestingPro

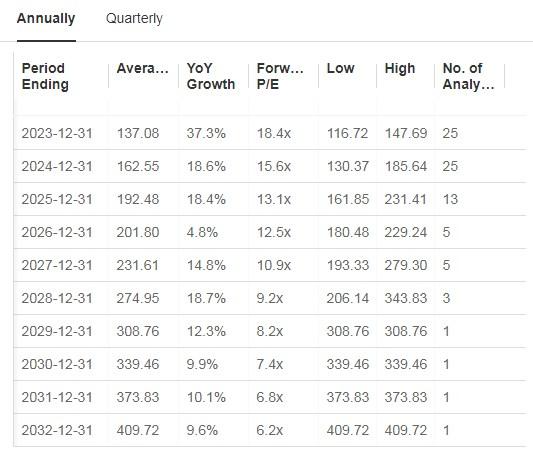

Here, we can see the forecasts for this year and the years to come.

Source: InvestingPro

Analyst consensus sees the stock reaching $2,869.

Source: InvestingPro

Based on an average of 13 models used by InvestingPro, the stock has the potential to reach $3,059.

Source: InvestingPro

The stock has hit its resistance and has been unable to surpass it. Any pullbacks will likely be seen as opportunities to buy the stock at lower prices.

3. Mobileye Global

Mobileye Global (NASDAQ:MBLY) is capitalizing on the growing prominence of artificial intelligence and is positioned to benefit from this trend going forward.

Analysts believe the company is well-positioned to take advantage of the AI boom, with a consensus potential of +20%.

The company's most recent earnings, announced on April 27, were impressive as they beat market expectations in both earnings per share (by +12.1%) and revenue (by +0.7%).

Source: InvestingPro

It will present its next results on July 27. Market estimates project compound annual sales growth of +36.3% through 2025.

Source: InvestingPro

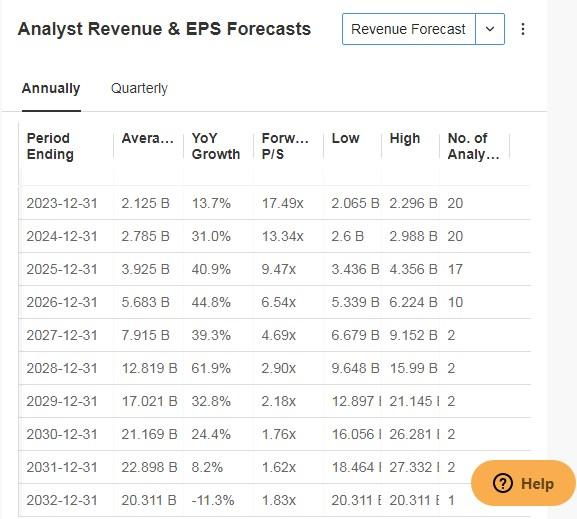

The table below displays revenue forecasts for the current fiscal year and the years to come.

Source: InvestingPro

We need to keep a close eye on whether it can break its resistance in the first attempts now that it has reached it.

InvestingPro tools assist savvy investors in analyzing stocks, as we did in this article. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such, it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple points of view and is highly risky and, therefore, any investment decision and the associated risk remain with the investor.