- Markets expecting US Fed to hike rates 75 basis points

- Fears mounting aggressive tightening could tip economy into recession

- Safe bets include Pepsico, Citigroup, and Pioneer Natural Resources

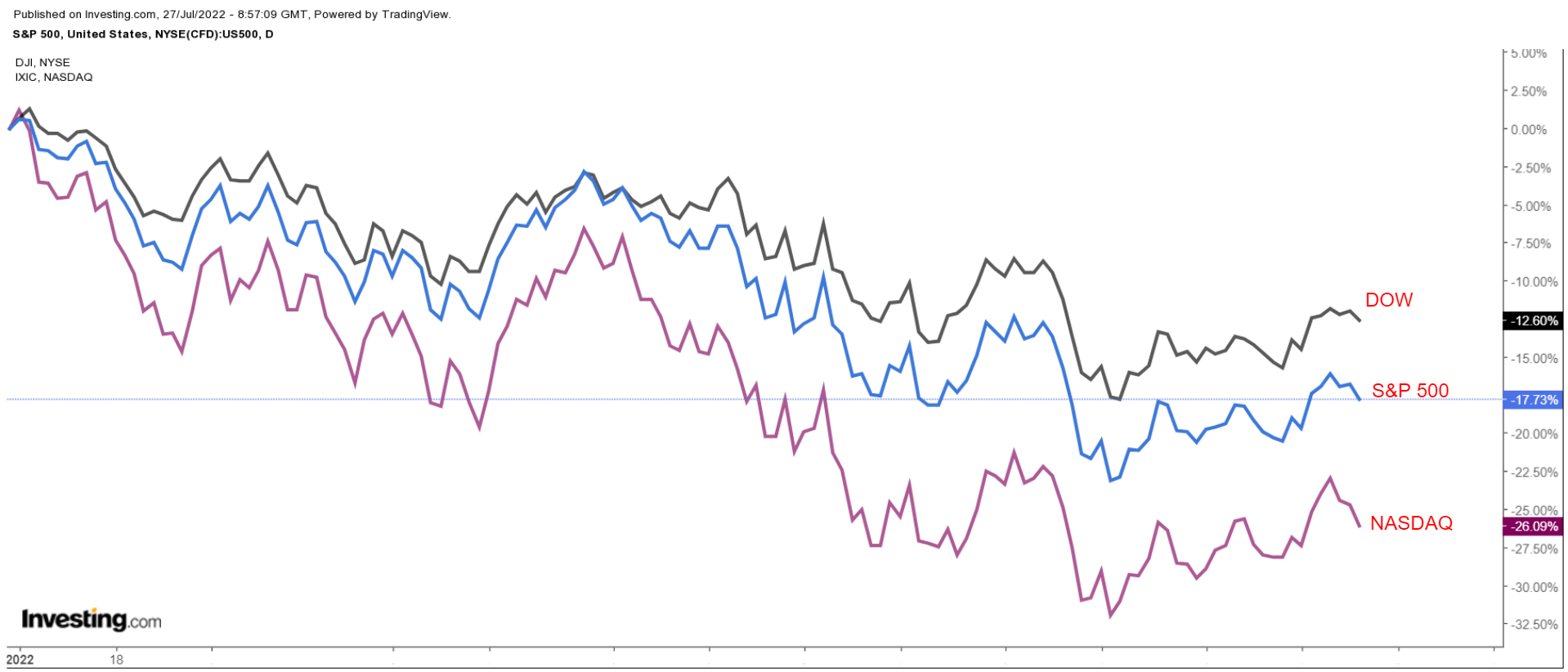

Wall Street is on track to suffer one of its worst years in history as investors worry about the US Federal Reserve’s strategy to combat persistently high inflation.

The Dow Jones Industrial Average is down 12.6% year-to-date, while the S&P 500 and the tech-heavy NASDAQ Composite are off by 17.7% and 26%, respectively.

The US central bank has already raised its benchmark rates by 150 basis points (bps) so far this year and further increases are likely. It will also continue to reduce its $9 trillion balance sheet, adding to policy tightening in a market that is much more volatile than the last time the Fed shrank its bond portfolio.

Here are 3 companies poised to outperform in the coming months.

PepsiCo

- Year-To-Date Performance: -1.1%

- Market Cap: $237.1 billion

PepsiCo (NASDAQ:PEP) is one of the largest global beverage and convenience food companies best known for producing its Pepsi Cola, as well as a wide variety of snacks.

We believe that shares of the Purchase, New York-based company will outperform as investors pile into defensive areas of the consumer staples sector to avoid volatility.

The business has performed well and reported Q2 results on July 12 which blew past consensus expectations. It also raised its full-year sales outlook saying demand was strong and there was room for price hikes despite ongoing macroeconomic and geopolitical volatility,

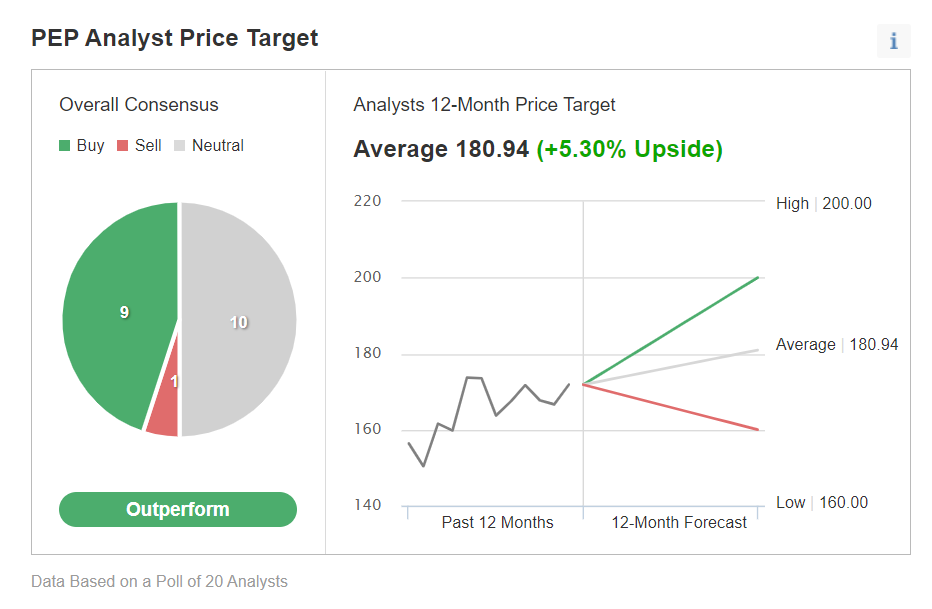

It has now either matched or topped Wall Street’s profit expectations in every quarter since Q1 2012, highlighting the strength and resilience of its business. Not surprisingly, most analysts surveyed by Investing.com rate Pepsi’s stock as either as ‘buy’ or ‘hold’.

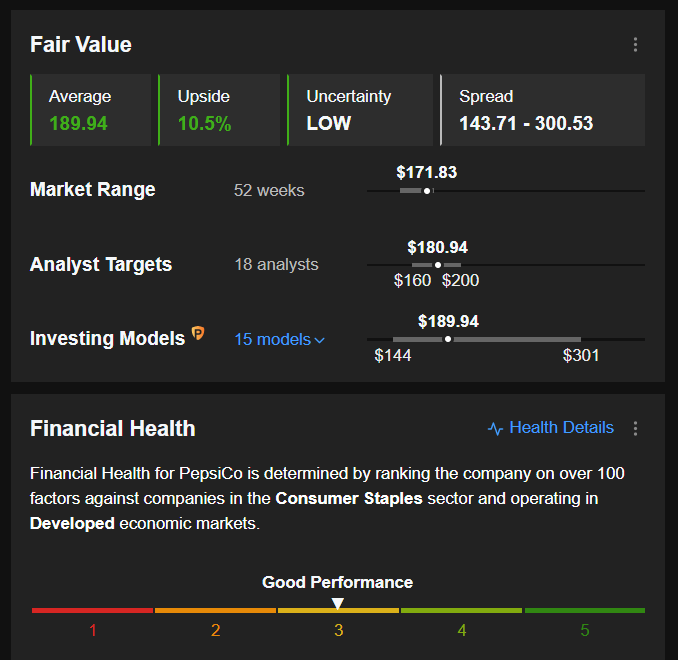

Their average target price of $180.94 gives PEP implied upside of 5.3%.

The InvestingPro quantitative models point to a shares price gain of 10.5% from current levels.

Pepsi's P/E ratio of 25.5 is at a moderate discount to notable peers, including Coca-Cola (NYSE:KO) and Kraft Heinz (NASDAQ:KHC).

It is also a quality dividend stock currently offering a quarterly payout of $1.15 per share, which implies an annual yield of 2.68%.

Citigroup

- Year-To-Date Performance: -14.9%

- Market Cap: $99.5 billion

Citigroup (NYSE:C), whose primary financial services include consumer banking, investment banking, and wealth management, is considered as one of the ‘Big Four’ U.S. banking institutions, along with JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), and Wells Fargo (NYSE:WFC).

The New York-based megabank, which has over $23.6 trillion in assets under custody, provides its various financial products and services to global consumers, corporations, governments, and institutions.

Citigroup shares stand to benefit from the Fed’s near-term aggressive rate hike outlook. In higher interest rate environments, banks tend to boost the return on interest that lenders earn from their loan products, or net interest margin.

The bank's Q2 results far exceeded consensus expectations as it benefited from higher interest rates. CEO Jane Fraser said:

“In a challenging macro and geopolitical environment, our team delivered solid results and we are in a strong position to weather uncertain times, given our liquidity, credit quality and reserve levels.”

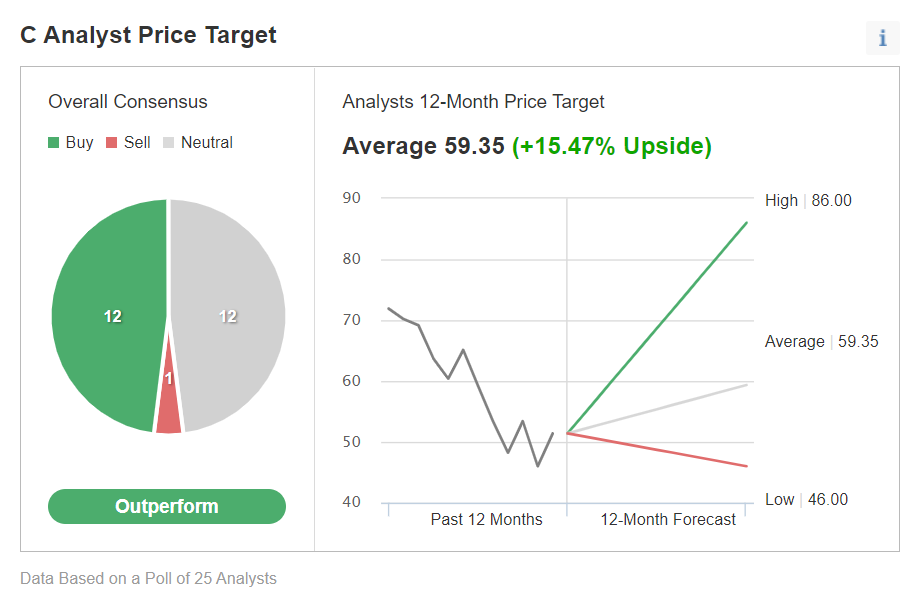

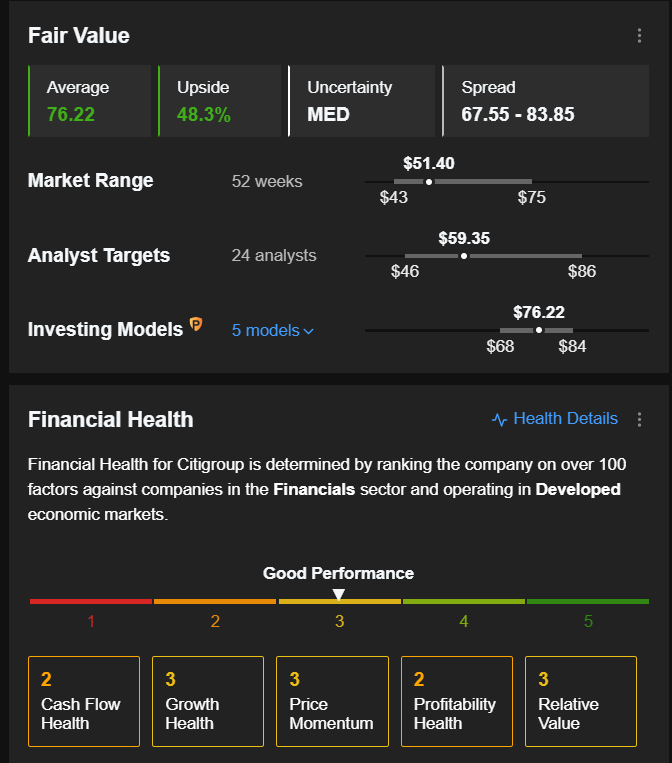

Per an Investing.com survey, the consensus recommendation for C is ‘outperform’ with fairly high conviction.

Analysts are forecasting upside potential of approximately 15.5% from current levels. The average fair value for Citigroup’s stock on InvestingPro is a whopping 48.3%, higher than the current market value.

The banking giant, with a comparatively cheap P/E ratio of 6.6, offers an annualized dividend of $2.04 per share at a yield of 3.97%, more than double the implied yield for the S&P 500, which is currently at 1.52%.

Pioneer Natural Resources

Year-To-Date Performance: +20.2%

Market Cap: $52.9 billion

Pioneer Natural Resources (NYSE:PXD) is one of the largest shale oil and natural gas exploration and production companies in the U.S., with operations primarily located in the Midland portion of the Permian Basin in West Texas. Core business operations include exploring, developing, and producing crude oil, natural gas, and natural gas liquids.

Shares of the thriving Irving, Texas-based energy firm have outperformed the broader market by a wide margin in the last several months, jumping by 20% in 2022 amid the dramatic rally in oil and gas prices.

PXD stock rose to an all-time high of $288.46 on May 31. At current levels, Pioneer is the sixth largest U.S. energy producer, behind ExxonMobil (NYSE:XOM), Chevron (NYSE:CVX), ConocoPhillips (NYSE:COP), EOG Resources (NYSE:EOG), and Occidental Petroleum (NYSE:OXY).

Despite its robust year-to-date performance, Pioneer remains one of the best names to own amid the ongoing recovery in the U.S. oil and gas sector. It is well positioned to benefit from its stellar Permian operations, while capitalizing on strong oil and gas prices.

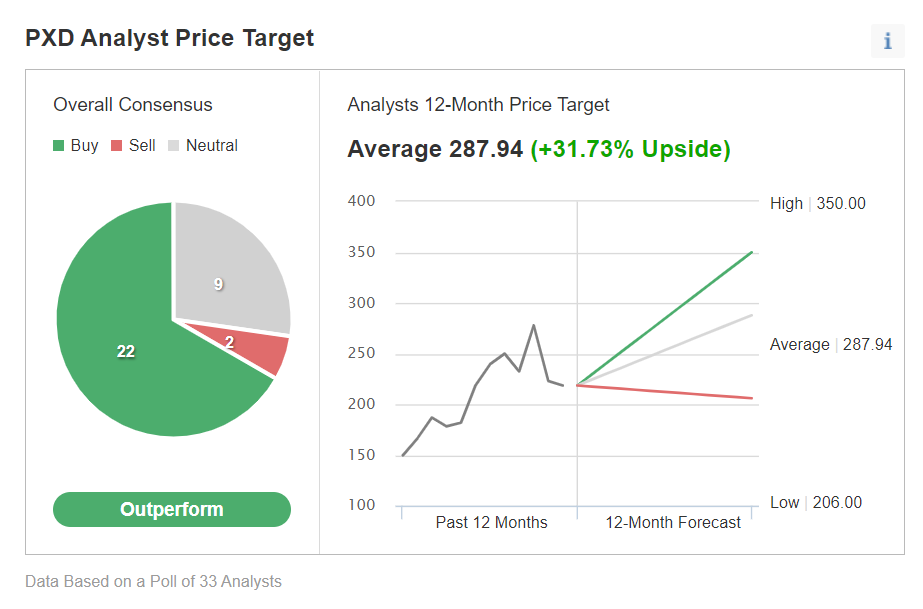

Analysts remain generally bullish on Pioneer, citing its strong long-term prospects. In an Investing.com survey most rated PXD stock as a ‘buy’.

Among those surveyed, the stock had a roughly 32% upside potential.

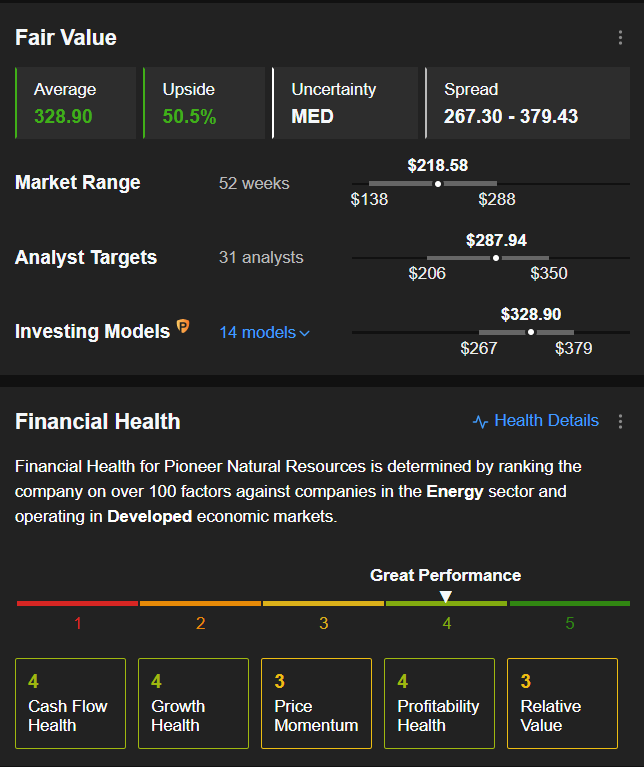

The average fair value for PXD stock on InvestingPro stands at $328.90, a potential upside of 50.5%.

Pioneer is set to release its latest financial results after the U.S. market closes on Monday, August 8. Consensus calls for EPS growth of over 200% yoy to $8.79. Revenue is expected to surge 99% yoy to $6.81 billion.

Investors will be eager to hear if Pioneer plans to return more cash to shareholders in the form of increased special-dividend and regular-dividend payouts, as well as stock buybacks.

The energy producer currently offers a sky-high yield of 7.97%.

Disclosure: At the time of writing, Jesse owns shares in $PXD. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.