- Dick's Sporting Goods, Genuine Parts, and Palo Alto Networks have reported strong quarterly results and are expected to continue delivering positive earnings growth.

- Technical analysis suggests bullish momentum for these companies.

- Investors should keep an eye on these stocks as they have the potential to outperform the market.

- Since the end of May 2022, it has risen sharply and is in a bullish channel.

- At the end of August, the bullish pattern known as the Golden Cross was activated. This gave a bullish signal.

- It has just reached the strong resistance formed in September 2021. It hasn't managed to cross this level since then. It would gain momentum if it managed to break it with volume support.

These three stocks have reported good quarterly results recently, beating market expectations, and are set to report good earnings in the next quarter as well.

But that's not the only thing they have going for them. There are other factors supporting the bullish case for these companies. Let's have a look at the companies, one by one.

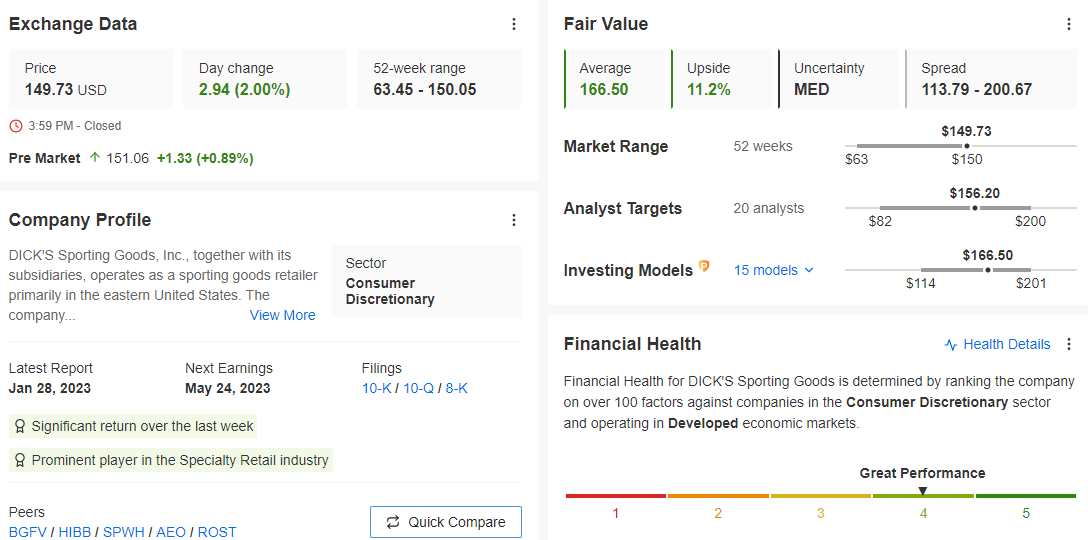

1. Dick's Sporting Goods

Dick's Sporting Goods (NYSE:DKS) is an American sporting goods retailer based in Coraopolis, Pennsylvania. It was founded in 1948 and has approximately 854 stores and 50,100 employees. It is the largest sporting goods retailer in the United States and a Fortune 500 company.

Source: Investing Pro

The company reported its fourth quarter results a few days ago, and its shares rose sharply (11%). Sales rose 7.3% to $3.59B, beating market forecasts.

On May 24, the company will report its results for the next quarter, and earnings per share (EPS) are expected to rise from $2.57 to $2.96 per share.

The company has also increased its dividend to shareholders to $4 per share.

From the technical point of view:

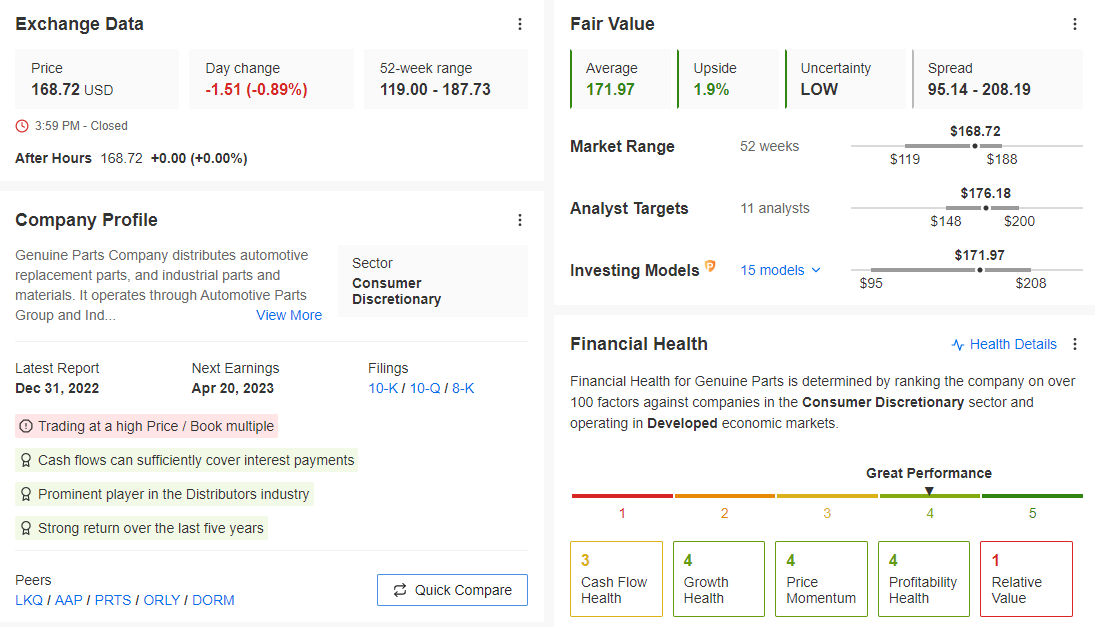

2. Genuine Parts

Genuine Parts (NYSE:GPC) was founded in 1925 and is headquartered in Atlanta, Georgia. It is engaged in the distribution of automotive parts, industrial parts, office products, and electronic materials. It has 58,000 employees and more than 10,000 stores in 17 countries.

Source: Investing Pro

At the end of February, Genuine announced its quarterly results. Both profits and sales were up by 15%. It has achieved average annual sales growth of 9% and average annual EPS growth of 22% over the last three years.

On April 20, it will report its results for the quarter, and earnings per share (EPS) are expected to rise from $1.81 to $2.03 per share.

But what is really interesting, apart from the fact that the results are expected to be good, is that the company has paid cash dividends every year since it went public in 1948. This year will mark 67 consecutive years of dividend increases, which now stand at 2% a year.

From a technical point of view, the stock started to fall at the end of February, and investors are closely watching a key area where support and the 200-day moving average overlap.

These elements create a synergy that strengthens this level, so if the price were to fall a little further to around $161.37, we could see buyers jump aboard.

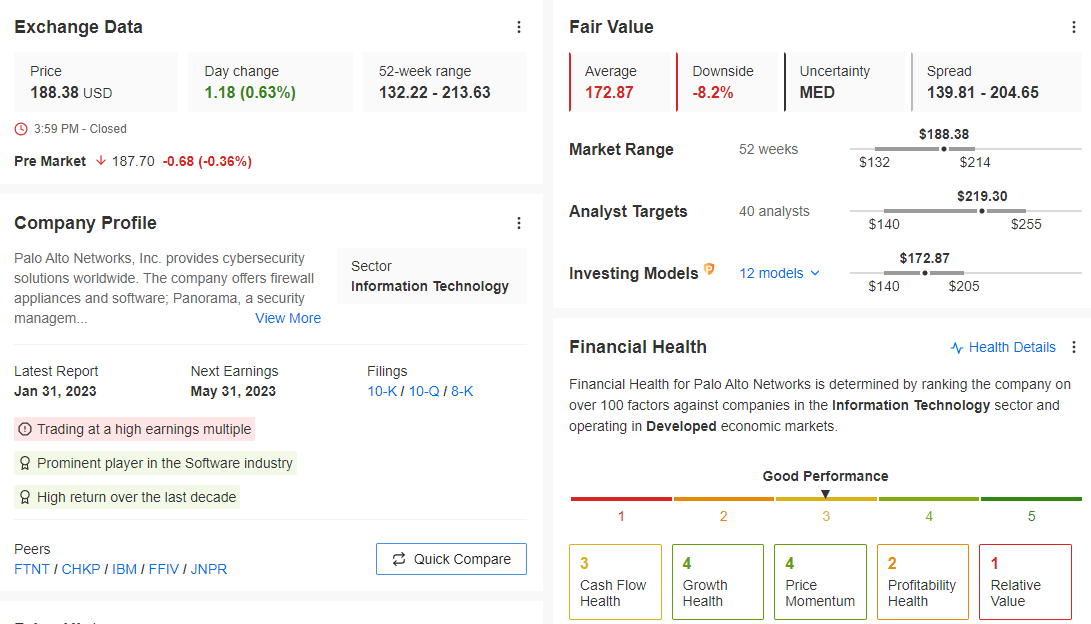

3. Palo Alto Networks

Palo Alto Networks (NASDAQ:PANW) is a cybersecurity company that provides network security solutions to enterprises and governments around the world.

The company is headquartered in Santa Clara, California. It has more than 12,000 employees and a market capitalization of $58 billion.

Source: Investing Pro

It reported excellent results in February, beating all the forecasts. It is used to beating earnings expectations. But this time, it did so by a much wider margin.

On May 31, it will report its next quarterly results, and earnings per share (EPS) are expected to rise from $0.72 to $0.93 per share.

The stock is around 10% off its all-time highs, and the market consensus puts the next target at $220.

From a technical point of view, the stock has been rising vertically since the beginning of the year. It tried to break the August resistance in February and March, but it has been unsuccessful so far. So, a break above $191.86 would be another bullish signal.

Disclosure: The author does not own any of the securities mentioned.