- Growing recession fears have fueled investor anxiety of late.

- While markets correct amid rising volatility, some defensive stocks could become available at a discount.

- In this article, we'll discuss three such stocks you can consider for your portfolio.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

Weaker-than-expected economic data has fueled recession concerns, prompting investors to seek refuge in defensive sectors. This uncertainty has weighed heavily on stock markets, fueling a downward trend.

In such scenarios, investors eye stocks from sectors that can position their portfolios for gains despite potential market corrections.

Public services and healthcare often draw the most attention, as these sectors tend to be more resilient to economic downturns compared to technology or financial stocks.

With that in mind, we will discuss three stocks to consider adding to your portfolio as a hedge against a potential recession.

1. Star Gas Partners: Awaiting Breakout From Consolidation

Star Gas Partners LP (NYSE:SGU), a major player in heating solutions and the largest US distributor of heating oil by sales volume has delivered strong fiscal Q3 results.

Increased sales volumes and improved gross margins have bolstered its performance. InvestingPro's fair value has pegged the target price above $14 as a result.

The stock has remained stable since the start of the year, trading within a consolidation range of $10 to $12. Recently, it has formed an inverted head-and-shoulders pattern, which theoretically signals potential growth.

A breakout above the $12 level would signal an upward trend, opening the way for a move toward the supply zone around $14.60 per share.

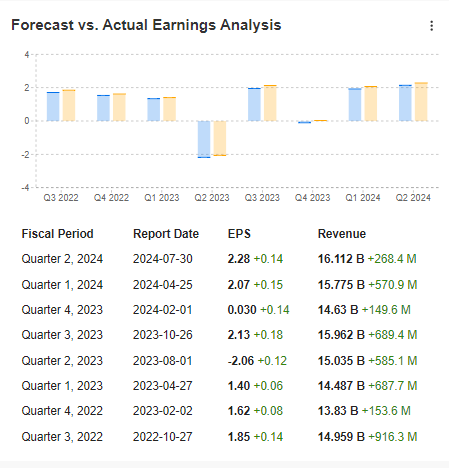

2. Merck & Company Continues to Deliver Positive Surprises

Despite recent declines, Merck & Company (NYSE:MRK) remains in a long-term uptrend. During the downturn in the first three quarters of 2022, Merck's stock held its upward trajectory, showcasing resilience.

Source: InvestingPro

However, the company faces challenges, particularly with Gardasil supply issues in China. Resolving these issues could spur significant sales growth, even though revised forecasts for the coming quarters have dampened expectations.

Nonetheless, Merck's diversified portfolio, ongoing acquisition announcements, and consistently strong results have surpassed market consensus, providing solid support for continued demand for the stock.

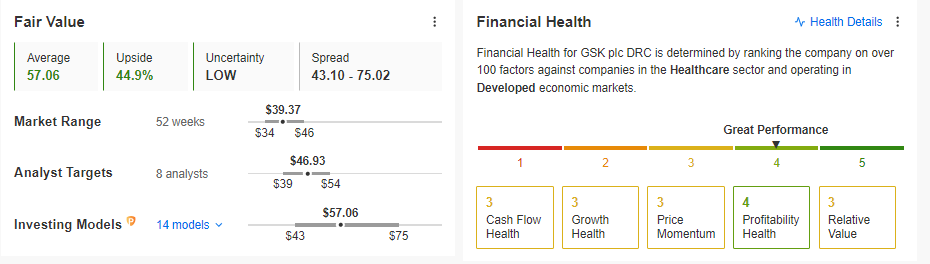

3. GSK (LON:GSK) Boasts 40%+ Upside Potential

GSK (NYSE:GSK) stands out in the pharmaceutical sector, showing more than 40% upside potential according to InvestingPro's fair value index and scoring 4 out of 5 on the financial health scale.

Source: InvestingPro

The company's stock faces pressure from ongoing litigation related to the recalled heartburn drug Zantac, which is alleged to have caused cancer. Although GSK recently won another lawsuit, several proceedings remain, with some expected to result in settlements.

Despite these challenges, GSK, like Merck & Company Inc., benefits from a diversified portfolio, a strong market position, and robust financial health, laying a solid foundation for continued growth.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month.

Don't miss this limited-time offer.

Try InvestingPro today and take your investing game to the next level.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest and is not intended to incentivize asset purchases in any way. I would like to remind you that any type of asset is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and associated risk remains with the investor.