- Global trade war could escalate further as Trump announces new tariffs.

- Utilities and healthcare may offer stability in a potential downturn.

- In this piece, we use the Investing.com screener to discover a stock ripe for a rebound.

-

Looking for more actionable trade ideas to navigate the current market volatility? Access the Investing.com stock screener through this link.

The new U.S. administration’s aggressive tariff policies are increasing the chances of a recession. President Trump has hinted that the economy is entering a transition period. As markets react to these changes, major U.S. stock indices have already dropped about 10%, with the possibility of further declines.

In this situation, investors may want to adjust their portfolios or build new ones to minimize losses or even find opportunities for gains. The InvestingPro stock scanner tool can help by allowing investors to create customized portfolios using various indicators and conditions.

How to Prepare Your Portfolio for an Escalating Trade War?

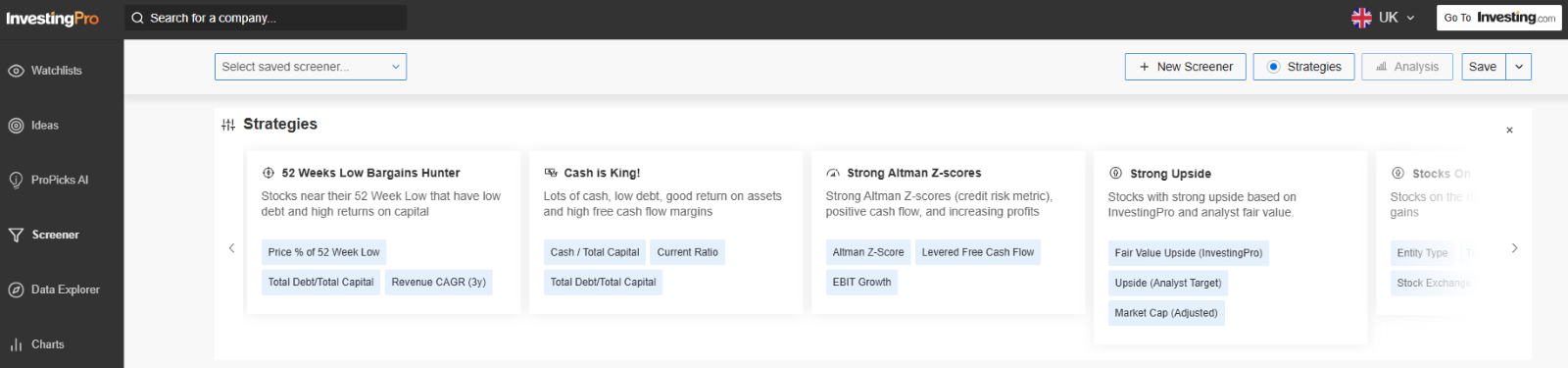

One of the key features of the InvestingPro tool is its stock scanner, which helps users find companies worldwide based on specific criteria using a vast database of indicators. It also offers ready-made portfolio suggestions, designed with diverse investment strategies in mind.

Source: InvestingPro

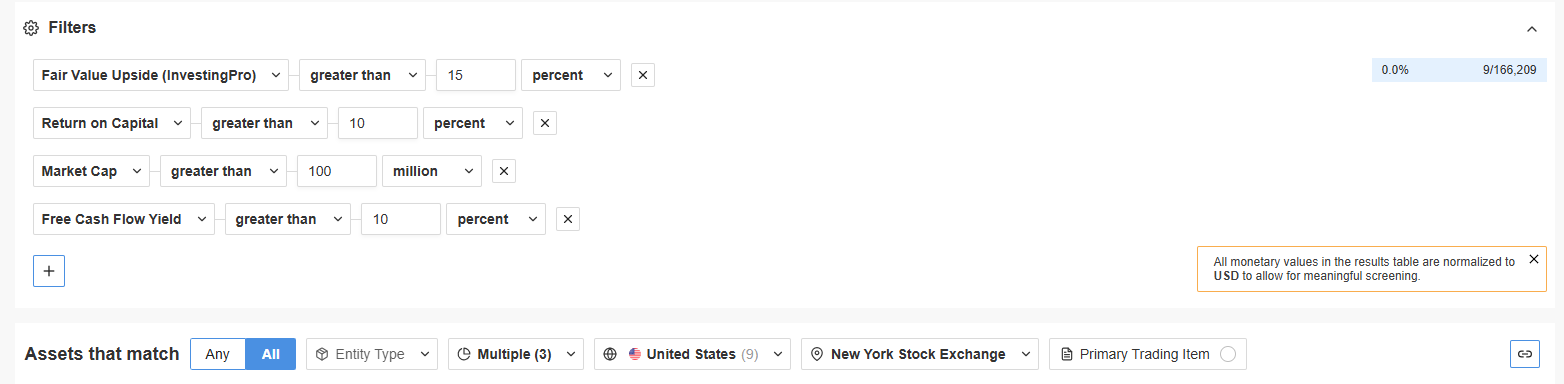

As part of the suggested approach, we set our own conditions for selecting companies using the panel below. In this example, we focus on U.S. companies with growth potential from the utilities, consumer staples, and healthcare sectors.

Source: InvestingPro

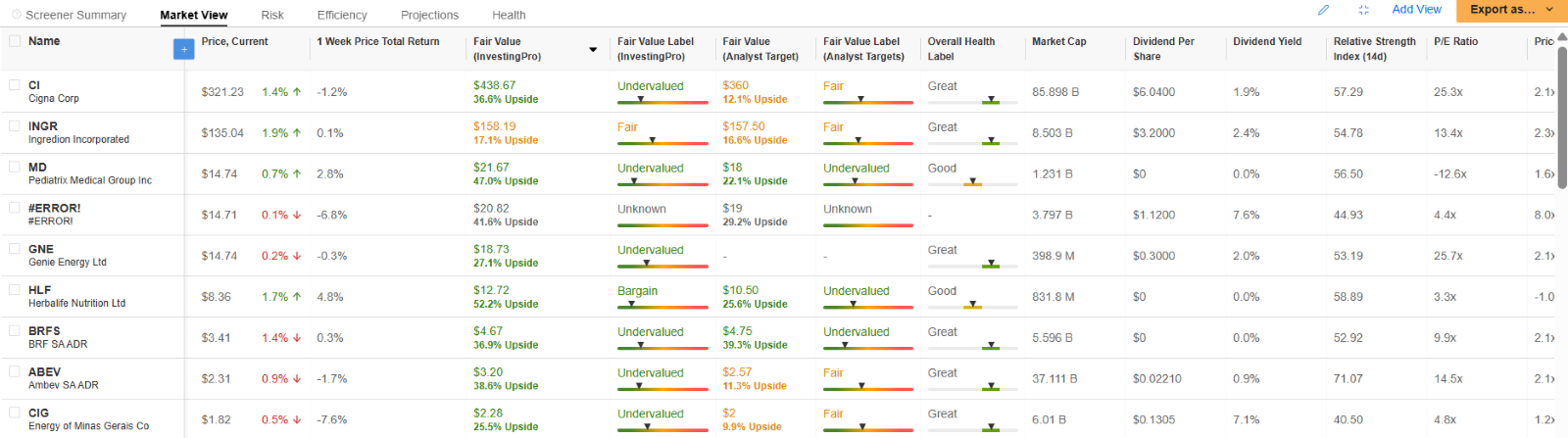

After setting the search conditions, a list of companies that match our criteria is generated.

Source: InvestingPro

Users have a wide range of options for comparing companies based on different indicators. They can choose from categories like Scanner Summary, Market View, Risk, Efficiency, Forecast, and Condition.

For a basic overview that includes key indicators such as fair value and financial condition, the Scanner Summary and Market View tabs are the best choices. Once the portfolio is finalized, it can be saved using the options in the upper right corner

Which Is the Best Pick From the List of Results?

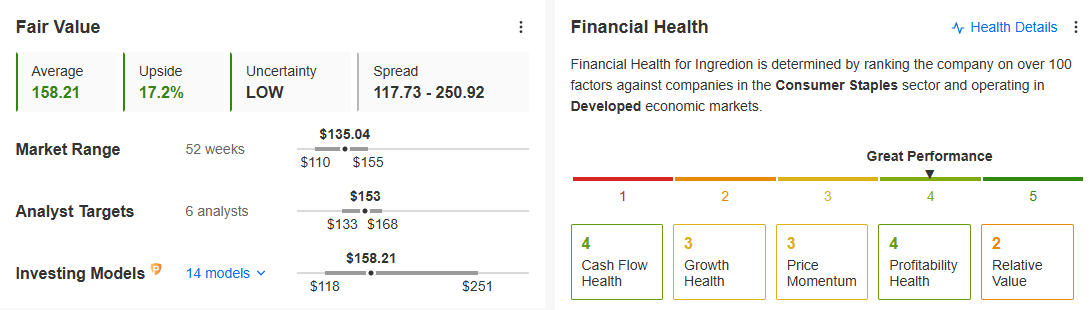

Among the selected companies, Ingredion (NYSE:INGR) Incorporated stands out. The company specializes in supplying food and beverage ingredients. Its fundamentals suggest over 17% upside potential, with a strong financial health rating of 4 out of 5.

Source: InvestingPro

The technical analysis indicates a period of local consolidation following a correction, with the potential for a renewed upward trend. To confirm this, buyers will need to break through the resistance level of around $139 per share, which has been tested multiple times.

If buyers break through the $139 resistance, the stock could gain momentum, with the next target around $150 per share. This level may serve as the final hurdle before a push toward historical highs if the uptrend continues. The key support level to watch is around $125 per share.

Bottom Line

Whether markets are rising or falling, opportunities always exist for investors who know where to look. Bull markets make it easier to generate gains, but the right tools like Investing.com’s screener can help uncover strong picks even in downturns.

This screening method is just one example. Investing.com’s screener offers over 50 preconfigured searches (some exclusive to InvestingPro members).

You can access the Investing.com screener through this link.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.