- Investors highly value companies with a long history of consistent dividend payments.

- This article explores companies across sectors like consumer staples, financial services, and energy.

- Specifically, we will delve into the financial health and market performance potential of these dividend stocks.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Investors seeking stability in a volatile market often turn to dividend-paying companies across sectors like consumer staples, financial services, and energy. These companies, known for their resilience and consistent dividends, offer a reliable income stream and are valued for their robust growth strategies.

Let’s delve into some of these companies with impressive dividend histories, emphasizing their financial health, forward-thinking strategies, and potential market performance.

1. Kraft Heinz

Kraft Heinz (NASDAQ:KHC) emerged from the merger of Kraft Foods and the sauce giant Heinz. Founded in 2015, it is headquartered in both Chicago, Illinois, and Pittsburgh, Pennsylvania.

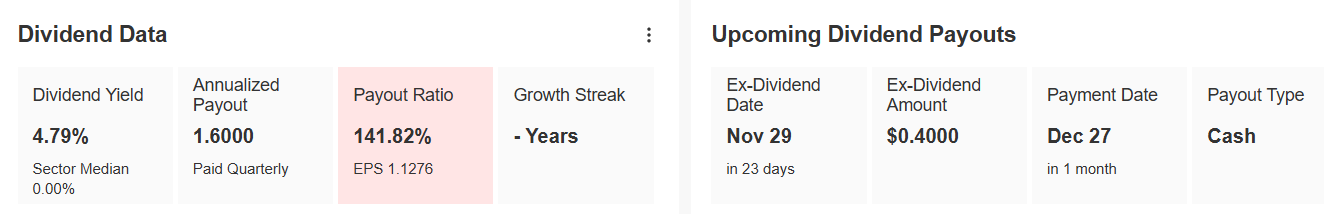

The company offers a compelling dividend yield of 4.60%, thanks to its quarterly payout of $0.40 per share—significantly above the consumer staples average of 2.99%. Kraft Heinz has maintained consistent dividend payouts for 11 consecutive years, with the next payment of $0.40 on December 27, requiring shares to be held by November 29.

Source: InvestingPro

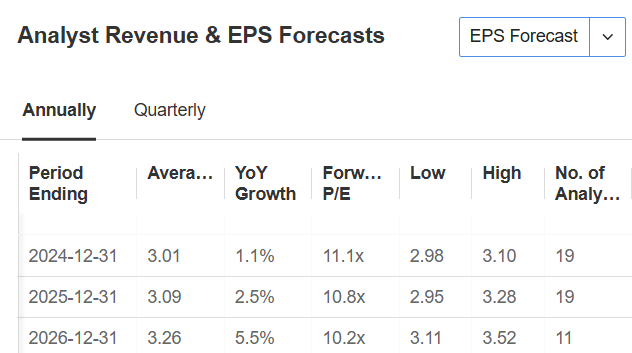

In the third quarter, Kraft Heinz reported earnings per share (EPS) of $0.75, slightly above estimates, while revenue fell short at $6.38 billion. The EPS forecast for 2024 ranges between $3.01 and $3.07, with the next quarterly report expected on February 12.

Source: InvestingPro

The company focuses on maintaining cost efficiency to stay profitable in challenging times.

Valuation ratios suggest the stock is undervalued, with a price-to-earnings (P/E) ratio of 11.51, below both the industry average of 17.7 and its historical average of 13.3.

Considering the potential sale of its Oscar Mayer unit for roughly $3 billion, Kraft Heinz could unlock additional capital to invest in growth or bolster its balance sheet.

Its fair value, based on fundamentals, is 12.5% higher, at $37.55, with market expectations pushing it to $38.74 in the medium term.

Source: InvestingPro

2. S&P Global

S&P Global (NYSE:SPGI), headquartered in Manhattan, New York, specializes in information services, financial analysis, and credit ratings.

Source: InvestingPro

S&P Global boasts a market capitalization of $151 billion, with shares having appreciated by 27.33% over the past year and 98% over the last five years.

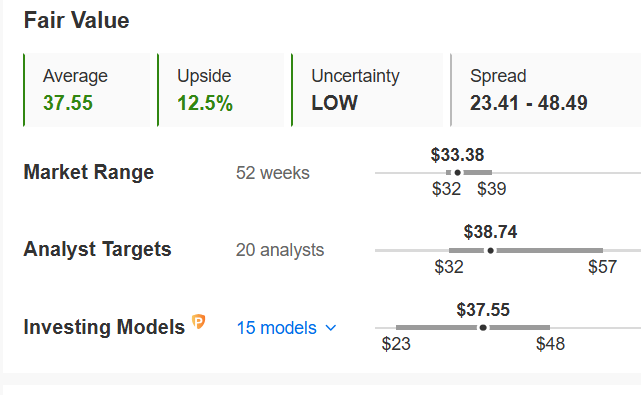

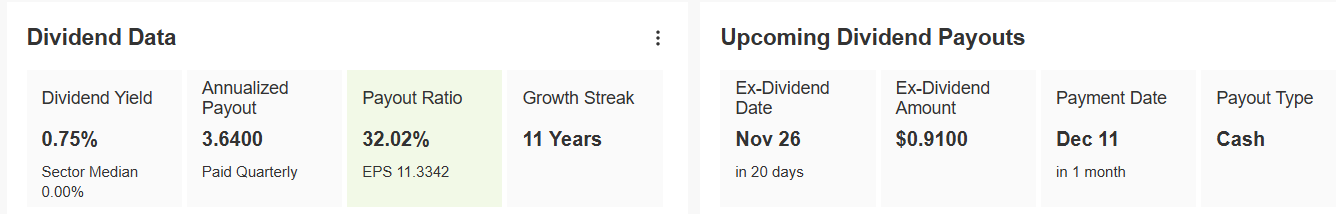

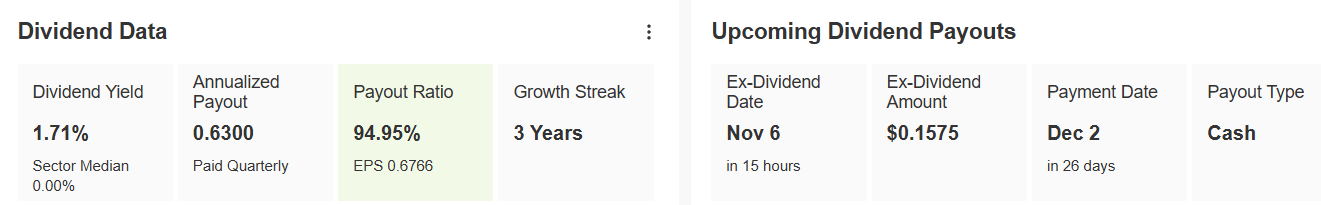

On December 11, the company will distribute a dividend of $0.91 per share, with shares needing to be held by November 26 to qualify. As a member of the dividend kings, it has increased payouts for at least 50 consecutive years.

Source: InvestingPro

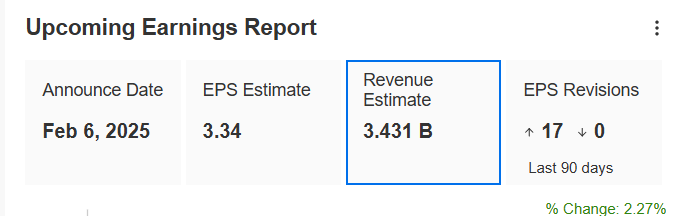

The recent third-quarter results surpassed expectations, with revenue climbing 16% year-over-year to $3.575 billion and EPS rising by 21% to $3.89. Notably, its EPS has exceeded estimates in 12 out of the past 16 quarters.

With the upcoming results on February 6, the company has raised its revenue expectations by 2.3%.

Source: InvestingPro

In May 2024, S&P Global acquired Visible Alpha, a leading data provider, to leverage insights from over 6,000 analyst models. This acquisition significantly boosts S&P’s data portfolio, enhancing value for clients who need reliable data sources.

Furthermore, the company recently launched generative AI tools, including advanced search features and an AI-powered chatbot, aligning with industry trends toward augmented data processing and real-time information.

S&P Global enjoys 20 ratings, with 19 recommending a buy and 1 a hold, targeting an average market price of $574.06.

Source: InvestingPro

3. EQT Corporation

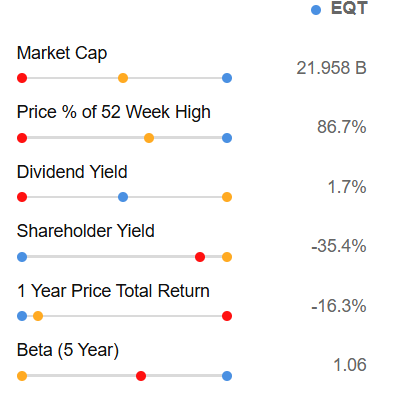

As one of the largest natural gas producer in the U.S., EQT Corporation (NYSE:EQT) boasts a market capitalization of $17.03 billion. It focuses on responsibly developing natural gas resources through advanced drilling and production.

While shares have dipped -11.90% in the past year, they've surged 235% over the last five years.

EQT plans to pay a $0.1575 dividend per share on December 2, requiring shareholders to hold by November 6. It has incrementally increased dividends for two consecutive years following a pandemic-era pause.

Source: InvestingPro

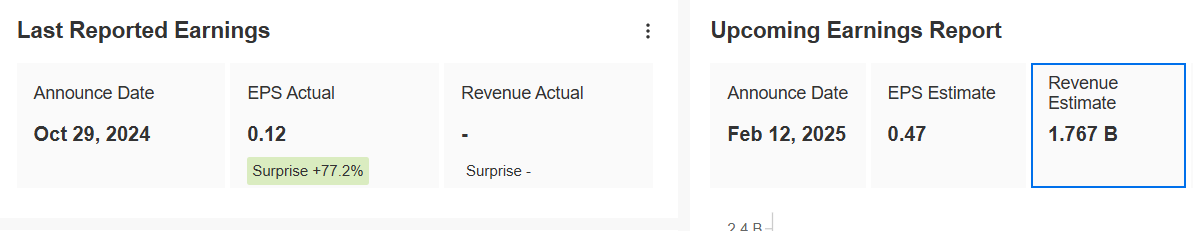

EQT's recent earnings report highlighted a strong performance, with sales volume exceeding forecasts, while capital expenditures and costs remained below expectations. The next results will be shared on February 12.

Source: InvestingPro

EQT is also advancing plans to produce clean hydrogen and low-carbon jet fuel, potentially unlocking new revenue avenues and reinforcing its commitment to sustainability.

With a beta of 1.06, its shares tend to move with the market, albeit with more volatility.

Source: InvestingPro

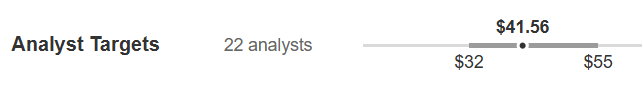

The company holds 20 ratings: 12 buys, 7 holds, and 1 sell, with a market price target of $41.56.

Source: InvestingPro

4. Exelon Corporation

Exelon Corporation (NASDAQ:EXC), a company focused on electricity generation and distribution, is headquartered now in Chicago. Its shares have fallen -1.20% over the past year, yet risen 42.25% in the last five years.

Source: InvestingPro

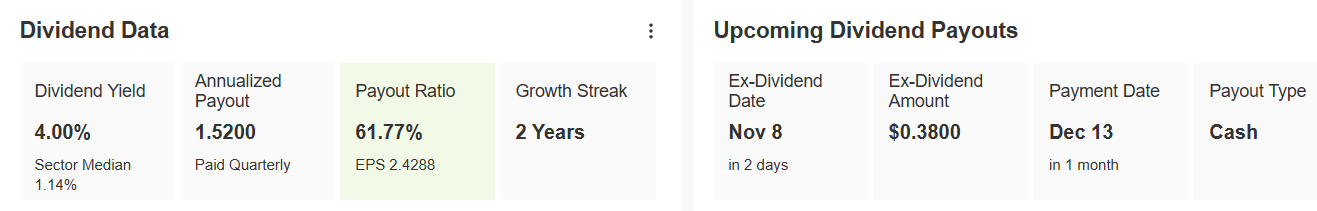

The company will pay a dividend of $0.38 per share on December 13, requiring shares to be owned by November 8. Exelon has paid dividends for 22 consecutive years, with a yield of 4%.

Source: InvestingPro

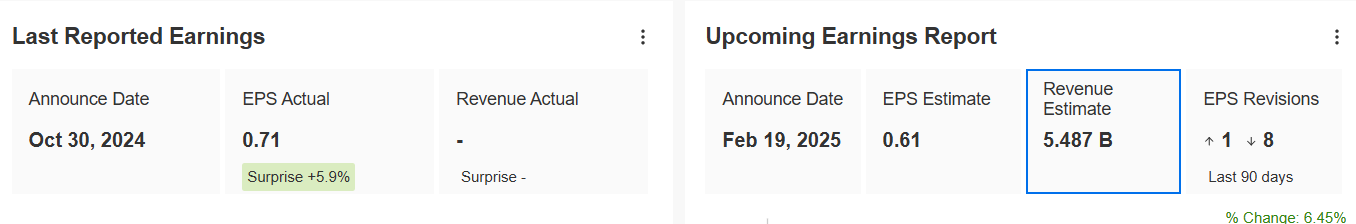

In its third-quarter earnings report, Exelon reported operating earnings of $0.71 per share, 5.9% higher than expected. The company anticipates a compound annual growth target of 5-7% through 2027 and plans to release its next report on February 19, expecting a 6.4% revenue increase.

Source: InvestingPro

Notably, ComEd, an Exelon company, recently secured $50 million in federal funding from the Department of Energy to enhance grid resiliency and support clean energy investments in Illinois, part of a $116 million initiative over five years.

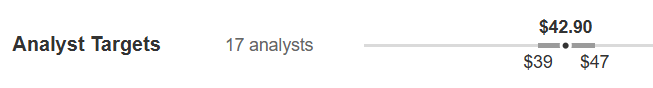

Exelon is rated by 18 analysts, with 16 recommending a buy, 1 hold, and 1 sell, and the market's average price target stands at $42.90.

Source: InvestingPro

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.