Stocks kept rising because retail sales and jobless claims data were better than expected. This is the second week in a row that stocks have jumped after a good jobless claims report.

I’m not sure if that’s a good thing because jobless claims data is unpredictable and comes out every week. At some point, it might be worse than expected. If that happens, will stocks take a hit? Just something to think about.

The S&P 500 and Nasdaq have now surged for six straight days, fueling the ongoing comeback rally. As we wrap up the week, it's crucial to monitor key market indicators for any signs of exhaustion in this rally.

Here are four indicators to keep an eye on.

1. Volatility Index

It’s hard to say how much of the recent market rise is due to options expiring today. The VIX, which measures market volatility, has dropped a lot, which suggests that many investors closed puts, their bets against the market.

This forced market makers to undo their bearish positions, so part of the market’s rise might be because of this “volatility crush.”

2. USD/JPY's Recent Price Action

Another reason behind the rally could be that the USD/JPY has stabilized recently. It even went up yesterday and returned to its 20-day moving average.

3. USD/CAD's Uptrend

Another thing to watch is the USD/CAD, which has gone up over the last few days. We often see that when the USD/CAD hits a low, the S&P 500 tends to peak, and the opposite is true, too. So, it’s essential to keep an eye on whether the USD/CAD keeps rising.

The critical level it hasn’t been able to break through is around 1.385, except for one time in December. If the USD/CAD keeps climbing, one would think the S&P 500 will turn lower.

4. USD/MXN

We’ve also noticed that the USD/MXN (the exchange rate between the US dollar and the Mexican peso) has dropped back down to its support level and the 20-day moving average after a big jump up.

A move up in the USD/MXN is a risk-off gauge; if the USD/MXN continues to fall, it is a risk-on indication.

Bottom Line

The price movement in the last few days has been pretty interesting. Trading volume has been really low, and the difference between bid and offer prices has been quite wide.

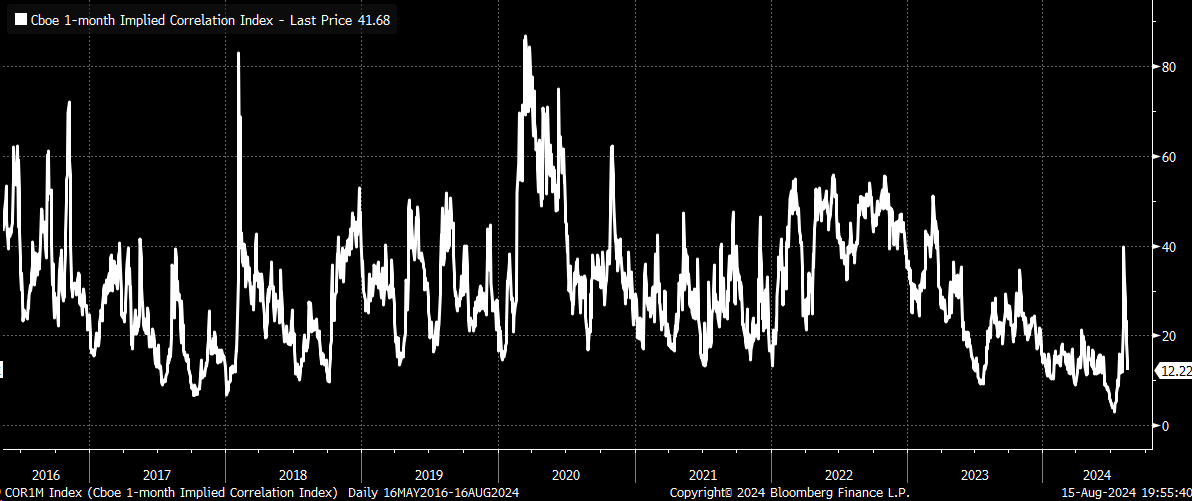

The 1-month implied correlation index is back down to 12, which is at the lower end of its usual range. The extreme levels we saw in July were just that—extremes.

In the past, like in 2017 and 2018, the lows were around 8 or 9, and in 2023, it was around 10.

This seems like a dangerous market that, if some of the reliable indicators and suggestions are correct, could be nearly burning itself out already.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI