- August is not exactly one of the best months of the year for the markets

- The S&P 500 has performed poorly in this month over the last 70 years

- But some stocks always manage to defy that trend; let's see which stocks could do so this August

August has been a historically subdued month in the financial world. Take the S&P 500 as an example, which from 1950 to 2021 has shown an average return of -0.03% in the final month of summer, placing it as the third weakest of the year, behind only February and September.

Shifting our focus to the Dow Jones, intriguing patterns emerge across time frames. In the last two decades, it has yielded a return of +0.07% in August, while the preceding five decades and the full last century clocked returns of -0.20% and +0.97%, respectively in the month.

However, amidst this seemingly lackluster scenario, a cluster of S&P 500 stocks has been rewriting the narrative. Remarkably, these stocks haven't just outperformed but have trounced the broader market in the past five Augusts.

With leading performers boasting average returns of +12%, +11%, +7%, and a modest +4.4%, their achievements easily surpass the S&P 500's average returns of approximately 2-2.2%.

Unraveling the driving forces behind these impressive performers beckons us to go deeper, leveraging the insights provided by InvestingPro.

It's worth noting, though, that while history guides us, it doesn't dictate the future.

1. Walmart

Walmart (NYSE:WMT) has been listed on the New York Stock Exchange since 1972, with its headquarters situated in Bentonville, Arkansas.

Over the past 5 months of August, its shares have recorded an average increase of +4.4%.

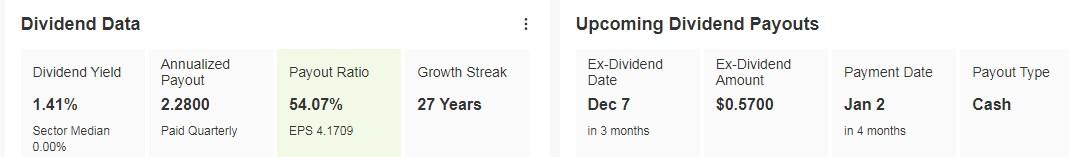

On January 2, it will distribute a dividend of $0.57 per share. To qualify for this dividend, shareholders must hold their shares before December 7. The annual dividend yield stands at +1.41%.

Source: InvestingPro

The results it released on May 18 were good, beating the market's expectations.

Source: InvestingPro

It presents its earnings on August 17, which are expected to be positive.

Source: InvestingPro

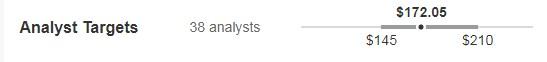

The market sees potential at $172.05.

Source: InvestingPro

The stock has consistently maintained its uptrend, evident from its movement above the rising guideline for a while. Currently, it's making efforts to breach the resistance level.

2. EPAM Systems

Based in Newtown, Pennsylvania, EPAM Systems (NYSE:EPAM) is a U.S. company specializing in software engineering services and digital product design, with a core focus on aiding other companies in data protection.

Over the past 5 months of August, it has garnered an impressive average return of +11.1%. Notably, even in August of the preceding year, it marked a gain of +22%.

On August 3 of last year, it reported its earnings, surpassing market expectations in both revenue and EPS.

Source: InvestingPro

The next earnings report will be presented on November 2.

Source: InvestingPro

InvestingPro models give it a potential of $342.41.

Source: InvestingPro

Since the beginning of June, the stock has been rising, supported by an ascending channel.

3. Motorola Solutions

Specializing in the import, marketing, and servicing of electronic, radio communications, and computer equipment, Motorola Solutions (NYSE:MSI) serves a wide spectrum of clients including government agencies, commercial entities, and industrial sectors.

Over the preceding five months of August, its shares have recorded an average increase of +7.3%.

On August 3, it unveiled its latest earnings, which showcased strong performance. These results exceeded both revenue and earnings per share forecasts anticipated by the market.

Source: InvestingPro

The next results date is November 2, and they are also expected to be favorable.

Source: InvestingPro

Source: InvestingPro

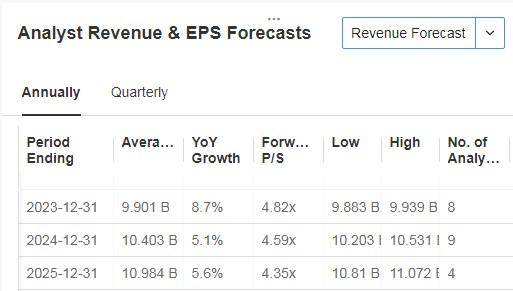

The revenue and EPS forecasts for 2023, 2024, and 2025 are positive.

Starting from May, the stock has been trading within a rectangular range. Each time it touches one of its boundaries, it bounces in the opposite direction. The lower border of this range, acting as a reliable support, is at $277.63, consistently driving the upward rebounds.

4. Insulet

Founded in 2000 and headquartered in Acton, Massachusetts, Insulet (NASDAQ:PODD) specializes in developing, manufacturing, and selling insulin delivery systems for individuals with diabetes. Its market spans across the United States, Canada, Europe, the Middle East, and Australia.

Over the past 5 months of August, it has marked an impressive average return of +12.5%.

The earnings reported on August 8 exceeded market predictions, showcasing robust performance in terms of both revenue and earnings per share.

Source: InvestingPro

On November 2, it will present its next results, and they are also expected to be positive.

Source: InvestingPro

While August has presented some challenges, it's worth highlighting a notable aspect. The stock is nearing a compelling support level, potentially setting the stage for a potential upward rebound. This pivotal support sits at $212.22.

***

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor's own.