- Gold has returned above $2,000 this week

- New record highs for the yellow metal cannot be ruled out as Fed rate cut looms

- So in that context, we will discuss the 5 stocks that could benefit from a rally in gold prices

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

After testing the key threshold of $2,000 an ounce timidly last week, gold confirmed a break above this major obstacle this week, reaching a high of $2052 on Wednesday, marking its highest level since May.

Indeed, expectations of a dovish Fed pivot are intensifying, weakening the US dollar and supporting the yellow metal.

Falling Inflation and Dovish Fed Comments Fuel Rate Cut Speculation

After the recent lower-than-expected CPI data, comments by the usually dovish Fed member Christopher Waller sparked bets on Fed rate cuts in early 2024.

He suggested that a rate cut might be appropriate in a few months' time if inflation continues to slow.

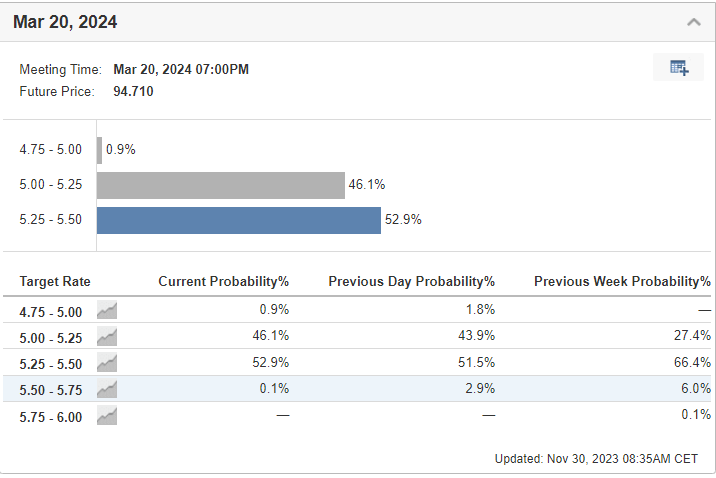

As a result, investors are now factoring in a more than 46% probability that the Fed will cut rates at its March 20, 2024 meeting, according to the Investing.com rate monitor tool.

Source: Investing.com

If the Fed is indeed poised to start a rate-cutting cycle, gold has a good chance of continuing to rise and reach new record highs, above the previous all-time high of May 2023, at over $2085.

If this proves to be the case, we can expect gold stocks to make a strong comeback, and investors who subscribe to these forecasts would do well to include them in their portfolios.

Gold Stocks to Watch if Gold Heads for New Record Highs

In this article, we'll take a look at several gold miner stocks, to determine which might represent the best opportunity for 2024.

To do so, we've used InvestingPro's investment strategies and fundamental data platform.

Here's what we came up with: Newmont Goldcorp Corp (NYSE:NEM), Barrick Gold Corp (NYSE:GOLD), Kinross Gold Corp (NYSE:KGC), AngloGold Ashanti (NYSE:AU) and Agnico Eagle Mines (TSX:AEM) Limited (NYSE:AEM).

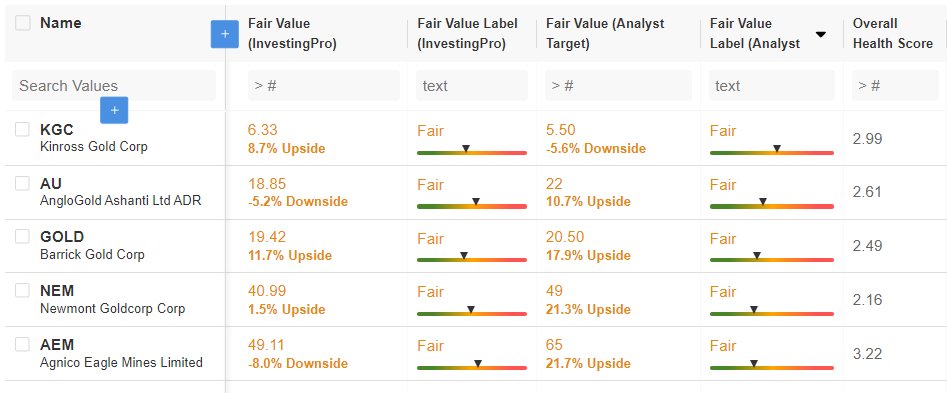

We will start analyzing these stocks by assembling them into a watchlist for easy comparison in terms of InvestingPro fair value, analyst objectives, and financial health score.

Source: InvestingPro

The first thing to note is that all these stocks are currently considered to be correctly valued, both by the analysts and by the InvestingPro models.

However, we mustn't forget that the fate of these companies is closely linked to the price of gold and that the outlook could change radically if the yellow metal's rise accelerates towards new record highs.

From the point of view of InvestingPro Fair Value, which calculated by taking an average of several recognized financial models, the stock on this list with the greatest upside potential is Barrick Gold, with a fair value 11.7% above the current price.

From an analyst's point of view, Agnico Eagle Mines has the greatest upside potential, at +21.7%.

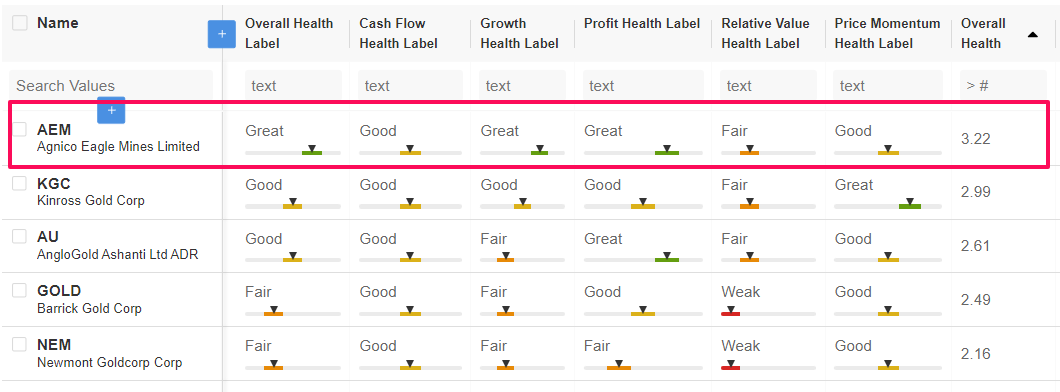

Agnico Eagle Mines also has the best financial health score, at 3.22.

In more detail, we can also note that the company has the best score in almost all sub-categories of the health score (with the exception of the price dynamics score).

Source: InvestingPro

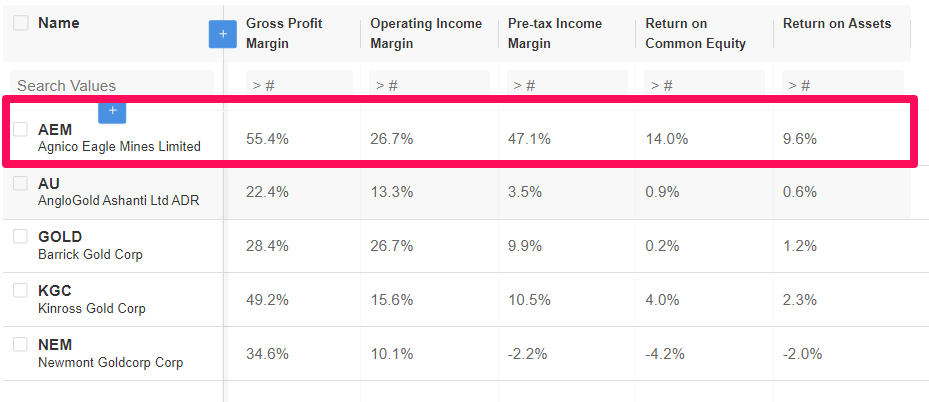

It's also interesting to note that the company enjoys solid profitability, with margins and returns on assets well ahead of the other stocks on the list.

Source: InvestingPro

Conclusion

Of the stocks reviewed in this article, Agnico Eagle Mines appears to have the best profile on the basis of financial metrics.

However, there are plenty of other options in the sector, especially if you broaden the search to include metal miners in general, not just gold specialists, so interested investors would do well to investigate further.

The InvestingPro investment strategy platform is a great help here. It contains data on thousands of financial metrics and tens of thousands of stocks, enabling in-depth analysis of every investment option.

There's also an advanced screener for finding stocks that meet specific criteria.

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclosure: The author does not own any of the securities mentioned in this report.