By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

For the first time in 9 years the Federal Reserve is expected to raise interest rates and selling U.S. dollars could be the smartest trade. Most investors would normally look to buy a currency ahead of a rate hike but in the case of the Fed, its well-telegraphed decision could mean more losses for the greenback. We have already seen investors bail out of their long USD/JPY and short EUR/USD trades as EUR/USD peaked in mid November and USD/JPY bottomed in early December. And with only a few more days to go before the historic announcement there’s very little chance of a strong pre-FOMC dollar rally. Everyone who wants to be long dollars ahead of the rate decision is probably long already with more traders moving to the sidelines as the big day nears.

There are a number of reasons why the dollar could fall after the Fed hikes even though U.S. rates will move higher at a time when many other major central banks have taken steps to drive their rates lower.

5 Reasons To Sell USD After The Rate Decision

1. Not every Fed hike means a USD/JPY Rally

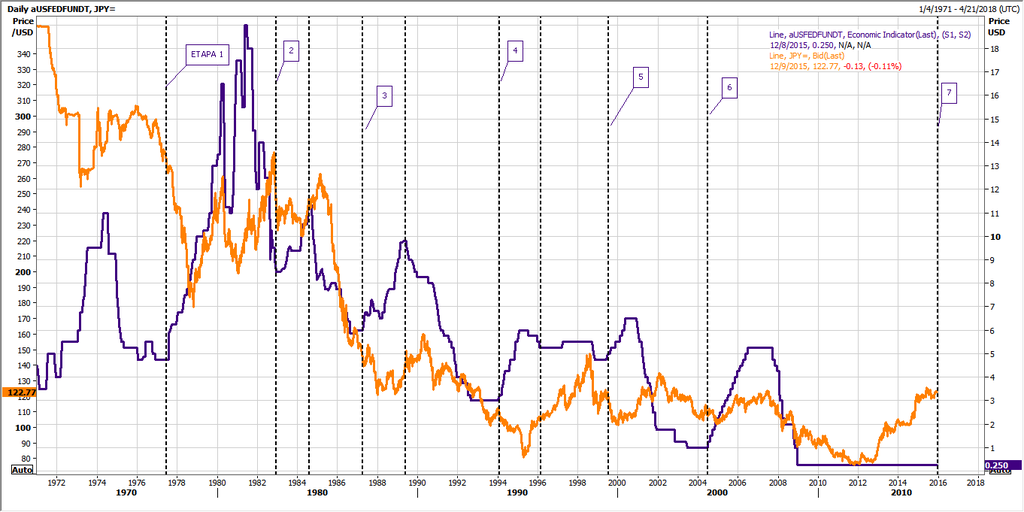

Here’s a chart that one of our readers helped us compile, overlaying the Fed Funds rate with USD/JPY. As you can see, not every Fed hike after a long period of pause coincides with a dollar rally. In many cases, USD/JPY rallied before the rate hike but failed to extend its move thereafter.

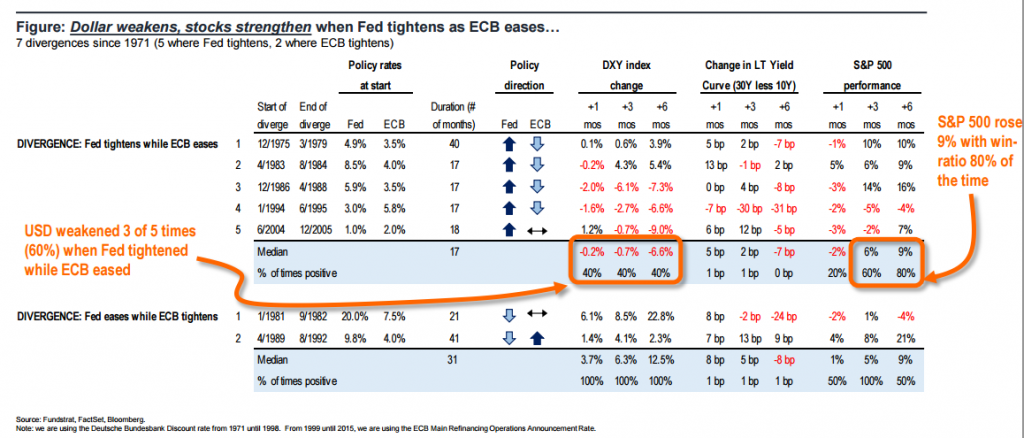

2. Dollar Weakened 3 out of Last 5 Times Fed Tightened When ECB Eased

In the last 45 years, there were 5 Fed tightening cycles that began when the ECB was easing. Three out of those five times -- or 60% -- the dollar index weakened. Here’s some stats compiled by Tom Lee from Fundstrat:

3. Rate Hike will be Accompanied by Dovish Statement

One of the main reasons why the dollar tends to perform poorly after the first hike is because it is often accompanied by a dovish statement. Given the historic significance of the decision and the current economic environment, the Fed will go out of its way to ensure that the market realizes it will normalize monetary policy gradually in the coming year. Inflation remains extremely low, global demand is weak and the U.S. recovery is slow. This is not the time for rapid rate rises and the Fed cannot afford a sharp spike in rates. It has already started to downplay the significance of the first hike and emphasize the importance of the overall policy path. Recent U.S. economic reports including last week’s retail sales numbers were mixed, reinforcing the central bank’s need to move slowly.

4. Mean Reversion

It is not unusual and oftentimes expected that mean reversion would occur after strong moves. There was significant dollar strength in 2015 and as the main event that motivated these trades pass, mean reversion -- simply a fancy way of saying 'correction' -- is expected.

5. Year-End Flows

Finally with year's end approaching, more investors will be looking to take profits, going flat to reassess their positions after this year’s moves. The dollar’s gains in 2015 will also force investors and funds to rebalance their portfolios. That process will involve selling dollars.

Is there any chance that the dollar could rally post FOMC? Yes!

If the Fed surprises the market by suggesting that it could raise interest rates again in the first quarter, the dollar could rise on renewed expectations for Fed tightening. The market is pricing in 2 to 3 more rounds of tightening next year so this possibility is not inconceivable.

Also, just because the dollar could fall post FOMC does not mean that it won’t rally at all in 2016. This year’s ECB and Fed rate-hike expectations expire with the December rate decision but if Eurozone growth slows, the euro rises too rapidly or the U.S. economy gains momentum forcing the ECB or Fed to act again, monetary policy divergence could renew the uptrend for the dollar.