Stocks rose for the second day in a row, but other indicators painted a different picture despite the gains.

Oil prices fell, the Japanese yen strengthened, credit spreads widened, and the broader market signaled a clear “risk-off” sentiment. Still, the S&P 500 managed to gain approximately 40 basis points.

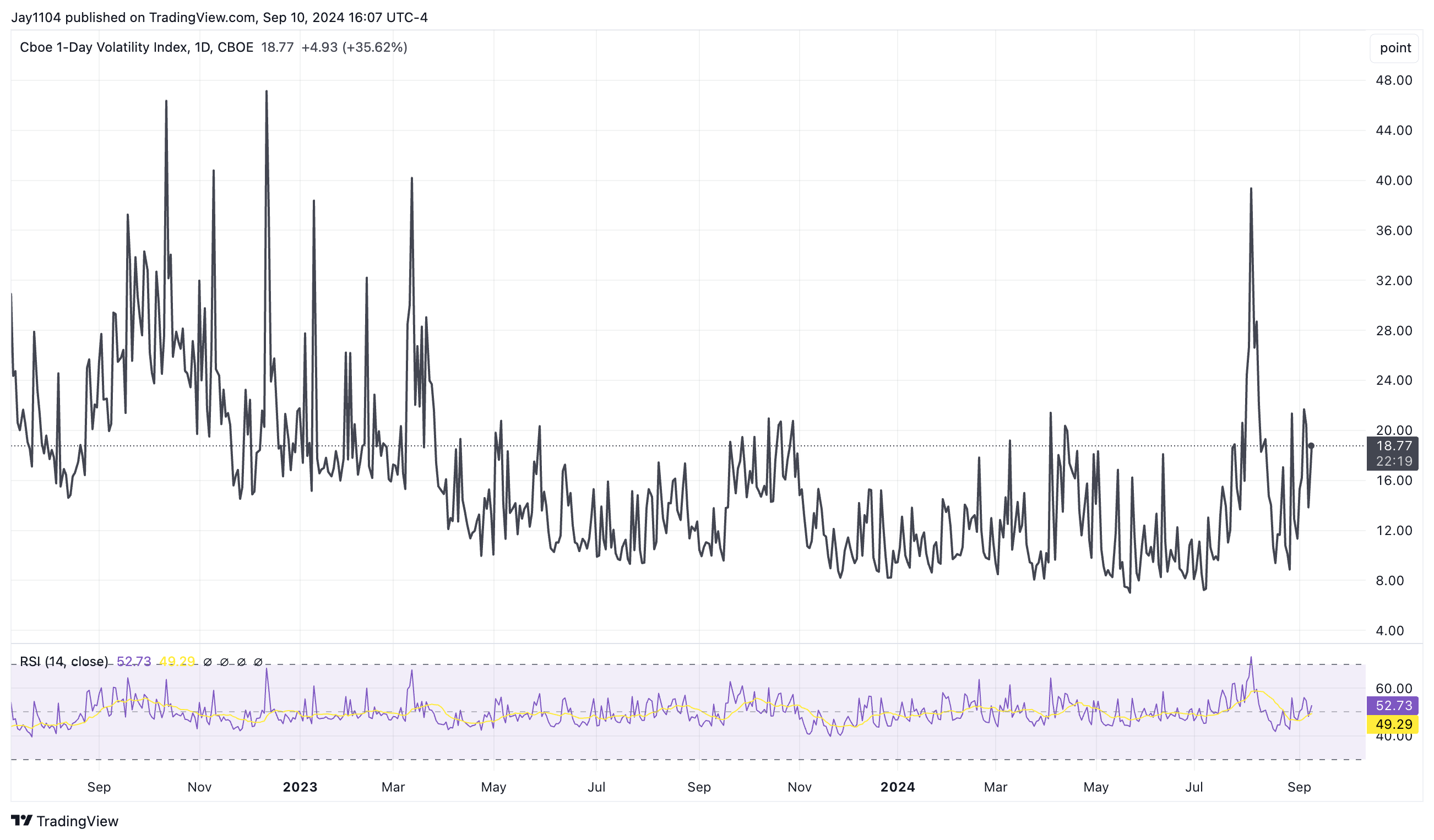

Today brings the CPI report, and it appears the market is more concerned about this release than anticipated, with the VIX 1-Day rising above 19.

While not as elevated as before the jobs report, it’s still notably high. It’s clear that yesterday’s reading places the one-day volatility measure at the upper end of its typical range

This tells us that, like the Jobs report, the first move in the S&P 500 futures following the CPI report, regardless of the data, could be higher, with the VIX moving lower as the event risk passes.

It is a mechanical thing, as implied volatility resets due to hedging flows and has nothing to do with the data itself.

Once again, the market seemed uneasy yesterday, with growing uncertainty around what the CPI data might reveal. Swaps are still pricing in just a 0.11% month-over-month increase and 2.5% year-over-year.

If these swap estimates are correct, the monthly figure could come in below analysts’ expectations for 0.2% m/m, while the current forecast for the headline year-over-year rate stands at 2.5%.

Amid this, five market indicators are signaling that risk-off sentiment is taking hold ahead of the inflation report.

1. 10-Year Rates Below August 5 Lows

Meanwhile, 10-year rates have already broken support, dropping below their August 5 lows.

Based on current trends, they appear poised to head toward 3.25%, with resistance around 3.8%. Certainly, today’s data will play a big role in whether these trends persist or not.

2. USD/JPY Approaches Key Support

Meanwhile, the USD/JPY has moved back to the mid-142 area, around the lows more recently. A break of this support level would further strengthen the yen versus the US dollar and potentially sending it even lower to around 138.

3. CAD/JPY Looking to Rebound Higher

It is more than just the Yen versus the US dollar—look at the yen versus the Canadian dollar (CAD/JPY). It is also in a position that could result in a significant strengthening as it rests on support.

4. AUD/JPY - Yen Strengthens Vs. Australian Dollar

This is also true of the AUD/JPY; typically, the S&P 500 trades reasonably close to the AUD/JPY. The yen was strong yesterday versus the Aussie dollar, which also made yesterday’s stock market rally kind of odd.

5. Crude Oil on the Brink

Meanwhile, oil is sitting on the edge of the abyss, with significant support in this $65 area being threatened. A break of support in oil sets up a return into the upper $50s.

Yesterday saw some risk-off action, and more importantly, the market is again positioning itself ahead of some important data today.

This seems to all carry the same message, not only about risk and the mood around taking it but also about growth.

All of these are proxies for global growth, and they are all heading in a general direction that suggests growth could be slowing, and as such, investors are reducing risk.