- In 2024, the entertainment sector anticipates significant earnings growth.

- Investors have the option to gain exposure to this sector through ETFs or individual stock purchases.

- This article explores the top-performing ETFs and individual stocks ideal for investing in the entertainment sector.

- Want to invest while navigating market risks? Try InvestingPro! Subscribe HERE for less than $10 per month and get almost 40% off for a limited time on your 1-year plan!

The entertainment sector is poised for strong growth this year, offering investors a promising opportunity to maximize portfolio gains. Here's how you can capitalize on it:

1. Investing through ETFs:

Two noteworthy ETFs provide a straightforward way to tap into global entertainment markets:

- Communication Services Select Sector ETF (NYSE:XLC): Launched in June 2018 with a low commission of 0.10%, XLC primarily invests in media and entertainment companies. Over the past five years, it has delivered a solid return of 12.79%, with a remarkable 42.15% return in the past year. Key holdings include Meta Platforms (NASDAQ:META), Alphabet (NASDAQ:GOOG), Walt Disney Company (NYSE:DIS), Verizon Communications (NYSE:VZ), AT&T (NYSE:T), Comcast (NASDAQ:CMCSA), and Netflix (NASDAQ:NFLX).

- Vanguard Communication Services Index ETF (NYSE:VOX): Established in September 2004, VOX boasts a fee of 0.10% and tracks the MSCI US Investable Market Index (IMI (LON:IMI)). It has generated a commendable 10.50% return over the last five years, with a notable 37.12% return in the past year. Top holdings mirror those of XLC, featuring Meta Platforms, Alphabet, Comcast, Netflix, and Walt Disney.

2. Investing through individual stocks:

Another way is through individual stocks. So, let's take a look at six stocks within the sector using the InvestingPro tool to access crucial insights and make informed investment decisions.

1. Walt Disney

Walt Disney is one of the largest media and entertainment conglomerates in the world. Its current headquarters are in Burbank, California. It was created on October 16, 1923.

On July 25 it distributes a dividend of $0.45 per share and to receive it it is necessary to hold shares before July 8.

Source: InvestingPro

On May 8 it will present its quarterly results. The market believes that it could almost triple the profits obtained last year, so growth from $2.3 billion to $7-7.2 billion in 2024 remains in the offing.

Source: InvestingPro

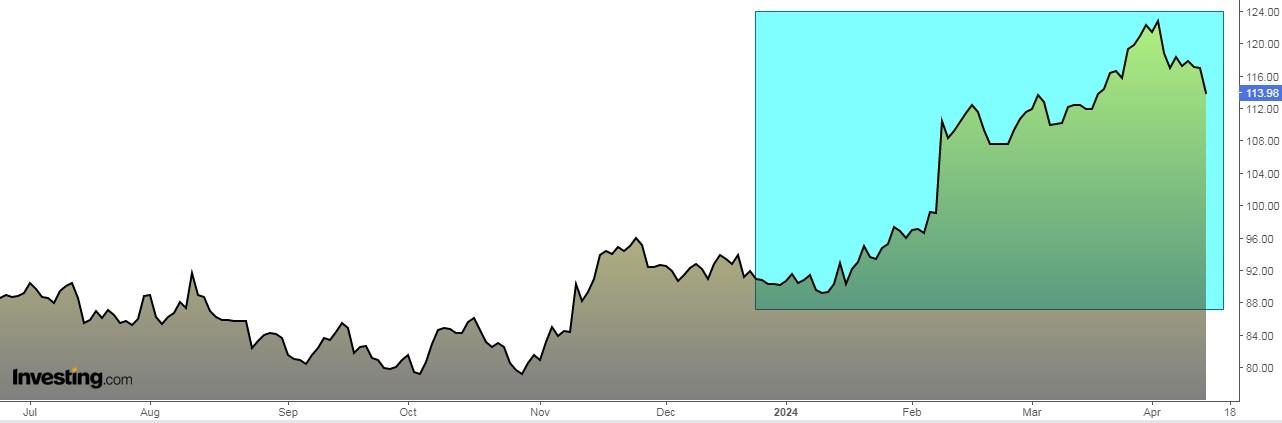

Its shares have risen by 13.50% in the last 12 months.

It has 31 ratings, of which 24 are buy, 5 are hold and 2 are sell.

InvestingPro models estimate its price target at $130.40, so at the close of the week its shares are trading 14% below its valuation.

Source: InvestingPro

2. Live Nation Entertainment

This production company formerly known as Live Nation changed its name to Live Nation Entertainment (NYSE:LYV) in January 2010.

It was established in 2005 and is based in Beverly Hills, California. Its business is focused on live events and ticket e-commerce.

On May 2 it presents its results and is expected to report an increase in EPS (earnings per share) by 79.22% and revenue by 47.83%.

Looking ahead to 2024, the company's earnings are expected to grow by 56%, from earning $315 million in 2023 to nearly $500 million this year.

Source: InvestingPro

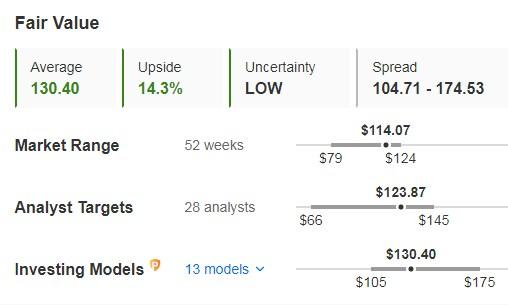

Its shares are up 43.17% in the last 12 months.

The market gives it a potential at $117.69, while InvestingPro models give it a reasonable price at $123.10.

Source: InvestingPro

3. Warner Bros Discovery

Warner Bros Discovery (NASDAQ:WBD) was formed through the merger of WarnerMedia and Discovery in April 2022. It is available to stream in more than 220 countries and 50 languages.

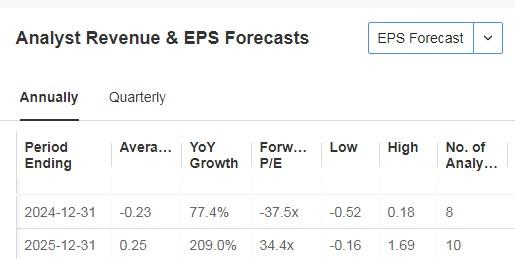

We will know its quarterly numbers on April 23. It expects EPS growth in 2024 of 77.4% and in 2025 of 209%.

Source: InvestingPro

Catalysts that could start to push its shares higher include a likely recovery in advertising and the launch of Max in Latin America and Europe ahead of the Summer Olympics later this year.

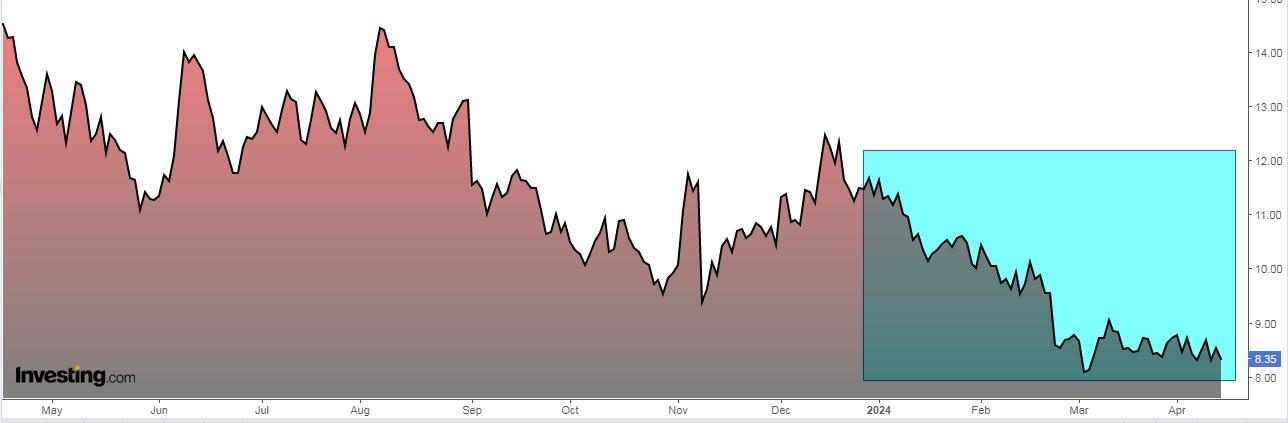

Its shares are down 40% over the past 12 months.

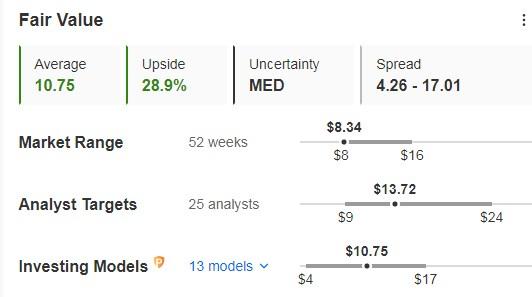

The market sees potential for it at $13.72, while InvestingPro models put its reasonable price at $10.75

Source: InvestingPro

4. Paramount Global (NASDAQ:PARA)

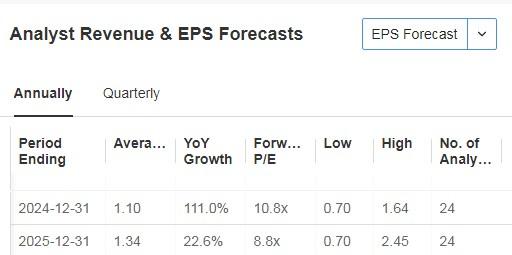

Paramount Global is set to report earnings on May 1. By 2024, EPS is expected to be up 111% and by 2025 it is expected to be up 22.6%.

Source: InvestingPro

Its dividend yield is 1.81%. It will pay out a dividend on July 1, and you have to own shares by June 17 to be eligible to receive it.

Source: InvestingPro

The company continues to cut costs and DTC losses, which should improve its return on equity.

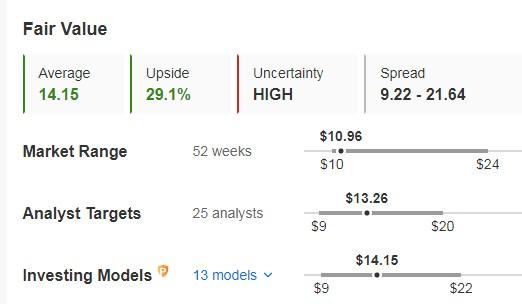

Its shares are down 49% over the past 12 months.

The market sees the stock at $13.26, with InvestingPro models being more bullish, assigning it a price target of $14.15.

Source: InvestingPro

5. Fox Corporation

Fox Corp (NASDAQ:FOX) was incorporated in 2018 and is based in New York. It is the legal successor to 21st Century Fox (NASDAQ:TFCF) (itself a successor to News Corporation).

We will have its accounts on May 7 and EPS growth of 9.09% is expected.

Source: InvestingPro

The potential for record advertising revenue from the presidential election will drive significant advertising investment, which in turn could positively impact the company's stock performance.

In addition, the video-on-demand (AVOD) service is experiencing growth in advertising revenue.

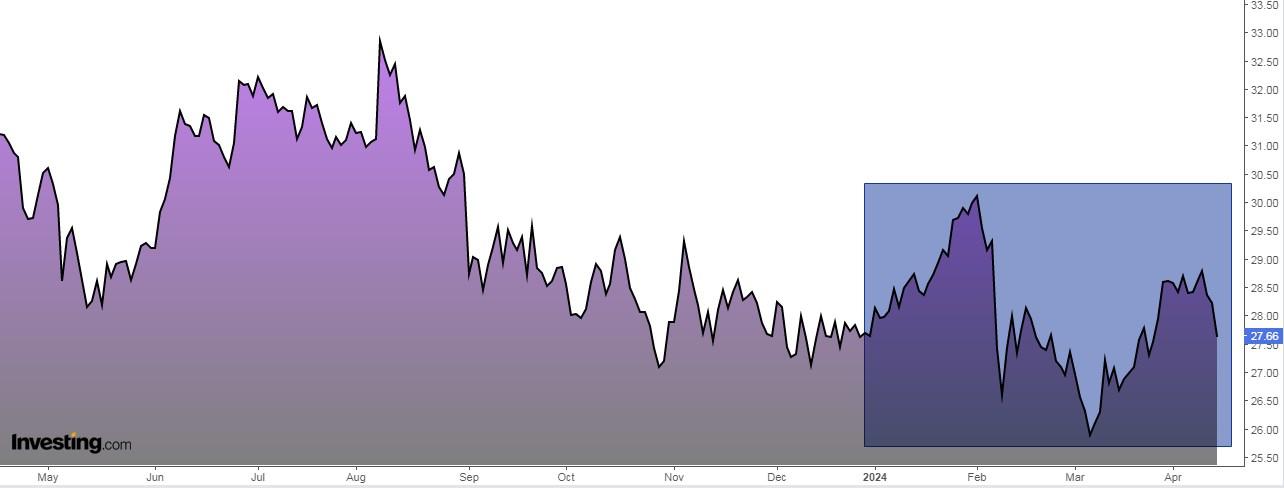

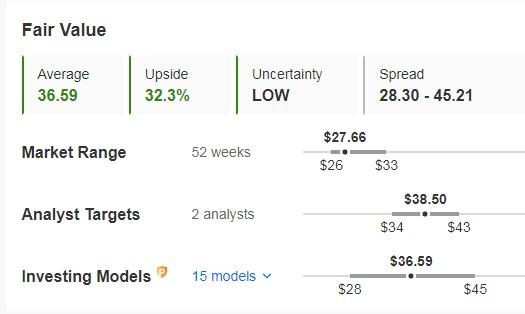

Its shares are down 9.60% over the past 12 months.

The market is very positive giving it potential at $38.50. InvestingPro models dictate that its fair value would be at $36.59.

Source: InvestingPro

6. Netflix

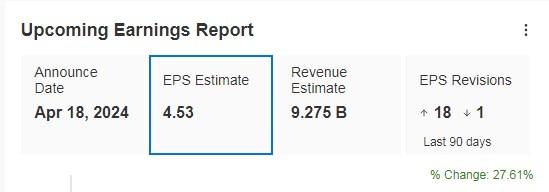

On April 18, Netflix will present its results and is expected to report an increase in EPS by 27.61%. By 2024 the increase would be 42.9% and revenues 14.3%.

Source: InvestingPro

In the first quarter, total viewing hours stayed steady compared to the previous quarter. This suggests a stronger seasonal trend compared to the past two years.

Looking ahead, Netflix will introduce Paid Sharing in the second quarter.

This could affect subscriber growth, especially with the addition of "Sex and the City" to Netflix's lineup and the split release of the third season of "Bridgerton" in May and June.

Its shares are up 79.90% over the past 12 months.

It has 47 ratings, of which 29 are buy, 16 are hold and 2 are sell.

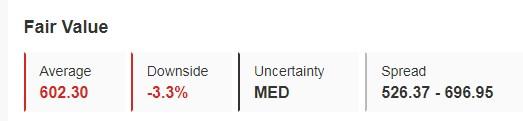

InvestingPro models suggest it is trading 3% above fair value. Even so, the market still sees it as having upside potential.

Source: InvestingPro

***

Ready to supercharge your portfolio? Seize the opportunity NOW to grab the InvestingPro annual plan for under $10 per month.

Unlock this deal with the code INVESTINGPRO1 and enjoy nearly 40% off your one-year subscription – that's less than the cost of a Netflix subscription! Plus, you'll get more bang for your buck with InvestingPro. Here's what's in store:

- ProPicks: AI-curated stock portfolios with a track record of success.

- ProTips: Simplified insights to make sense of complex financial data.

- Advanced Stock Finder: Discover top-performing stocks aligned with your goals, analyzing hundreds of financial metrics.

- Historical Financial Data: Access detailed financial histories for thousands of stocks, empowering fundamental analysts.

And that's just the beginning. We have even more services in the pipeline!

Don't miss out on this chance to revolutionize your investments – claim your offer NOW!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.