The Stock Market May Be Tracking The 1937, 2000, and 2008 Bear Markets

Stocks traded flat on Friday, dropping by only 16 bps. It could have been worse if not for a push higher in the final hour of trading. Stocks initially fell sharply following the stronger-than-expected jobs report and wage growth. There were a lot of mechanical pieces to the equity market being able to hold together, most notably the continued melt of the VIX index.

It is not unusual to see volatility selling on Friday, and last Friday proved to be no different. The VIX finished the day lower by more than 1%, around 21. It is indicative of puts positions being sold.

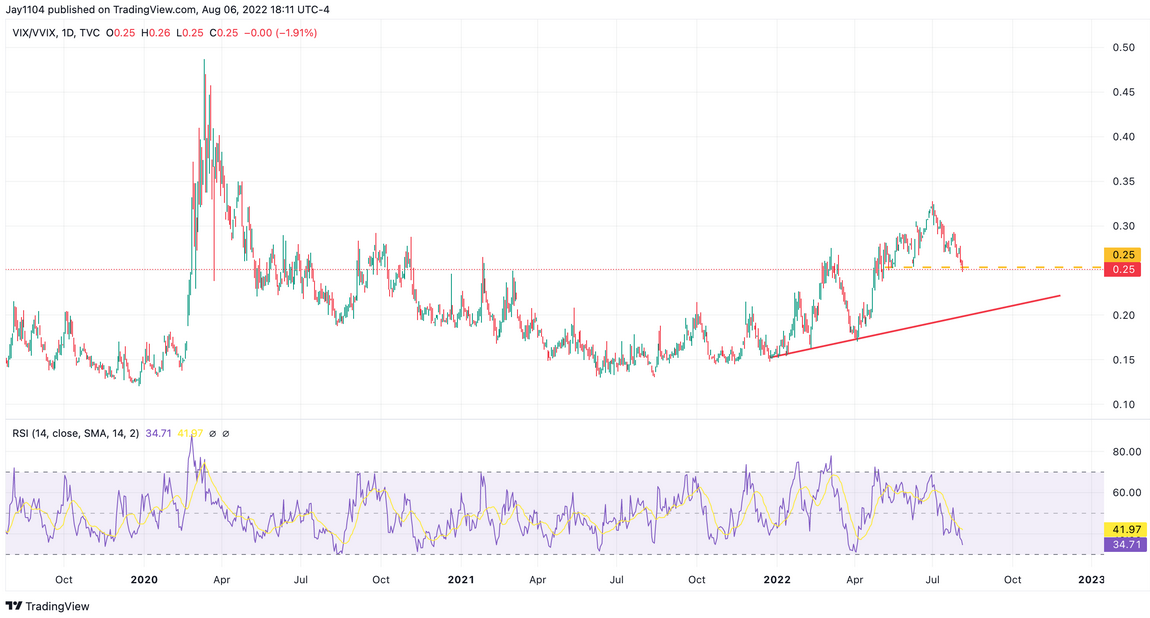

Despite the decline in the VIX, the VVIX index, which measures the volatility of the VIX, finished the day higher, closing at 84.13. The VVIX divergence from the VIX is worth paying attention to, as it could be an early sign volatility measures are starting to creep higher.

The VIX to VVIX ratio is coming down after hitting very high levels. It is more indicative of the big move down in the VVIX, and as the VVIX begins to normalize and moves higher, then the ratio should normalize, which should support the VIX and help it to find a bottom.

S&P 500

The S&P 500 still flashes a bearish technical pattern, a rising wedge. The rising wedge is well defined, and if this plays out correctly, I think the index returns to the origin of this pattern, which comes somewhere around 3,750.

Real Yields

A bearish setup for equities should be all that surprising, given how much yields have recently increased. The TIP ETF has fallen notably and no longer supports the recent gains in the QQQ ETF or S&P 500. Given all of the hawkish commentary from Fed governors, last week and FOMC board member Bowman, the trend in rates should continue higher.

The CPI report will be the deciding factor, and I would expect that CPI will show little to no improvement when this report comes out. Yes, commodity prices may have rolled over some, but the biggest problem with inflation is housing and shelter, which are showing minimal improvement.

Financial Conditions

I think that rising rates should lead to widening spreads and financial conditions starting to tighten again. Remember, the Fed wants financial conditions to slow the economy down and cool inflation. The more financial conditions ease, the more tightening the Fed will have to do. The Fed needs asset prices to decline if it expects inflation to come down.

Alphabet

Alphabet (NASDAQ:GOOGL) has stalled out at its prior highs and shown no momentum after posting the better-than-expected results. The RSI remains negative, indicating that bearish momentum is still in control. The bear flag pattern is also still very much alive as well.

KB Homes

It may also be noteworthy that KB Home (NYSE:KBH) appears to be rolling over from its recent gains. If rates increase again, it will make sense for the home building stocks to start moving lower if rates keep rising. The uptrend broke, and there is a big gap that needs to fill around $26.25.

Netflix

Netflix (NASDAQ:NFLX) has a bearish divergence forming, with the stock trending higher and hitting up against resistance at $227 and the RSI trending lower. To me, this indicates that the stock is at a turning point, and we are likely to see the shares return to the origin of the rally at around $175.