“A rising tide lifts all boats” is a phrase that reflects the idea that an improved economy will benefit all participants. Well, for the semiconductor industry, the phrase “the demand for chips is making everyone rich” may be appropriate given the astounding 2023 performance of firms within the semiconductor supply chain. This article will provide a look at the current semiconductor industry and the wealth-generating opportunity it is currently providing.

Looking across the landscape

The semiconductor industry has undergone remarkable growth and transformation since its inception, playing a pivotal role in shaping the modern technological landscape. While NVIDIA (NASDAQ:NVDA) has seemingly become the most familiar name for many familiarizing themselves with the semiconductor industry, in truth, other industry stakeholders are of seminal importance. The semiconductor supply chain is a complex network of companies and processes involved in the design, manufacturing, testing, packaging, and distribution of semiconductor components. It encompasses a series of stages and stakeholders, each playing a crucial role in bringing semiconductor products from concept to end-users. The supply chain involves collaboration between semiconductor manufacturers, foundries, equipment suppliers, design houses, and various other entities.

A summarized look at the various participants within the semiconductor supply chain is detailed below:

Chip Designers

Semiconductor chip designs are created for either specific or general product usage. Integrated Device Manufacturers (IDMs), such as Intel (NASDAQ:INTC), AMD (NASDAQ:AMD), and Samsung (KS:005930) take charge of all processes in producing semiconductors from planning to producing the final products. Conversely, fable design companies, like Qualcomm (NASDAQ:QCOM) and NVIDIA focus on designing semiconductor components but outsource the manufacturing process to third-party foundries.

Equipment and Material providers

Within the semiconductor industry, a few key equipment makers have become crucial, enabling the creation of ever-smaller, more efficient chips. Companies like ASML (AS:ASML), Applied Materials (NASDAQ:AMAT), and Lam Research (NASDAQ:LRCX) provide the tools and machinery required for semiconductor manufacturing processes. Various companies supply materials such as silicon wafers, chemicals, and gases essential for semiconductor production.

Fabrication/Wafer Manufacturing

Silicon wafers are processed through a complex and extensive series of manufacturing steps. Companies such as Taiwan Semiconductor Manufacturing Company (TSMC), GlobalFoundries (NASDAQ:GFS), and Samsung Foundry specialize in the manufacturing of semiconductor wafers based on the designs provided by fabless design companies or IDMs.

Testing and Packaging

Semiconductor chips are assembled into packages to form the electronic components that can be mounted onto circuit boards. Outsourced Semiconductor Assembly and Testing (OSAT) Companies, such as Amkor Technology (NASDAQ:AMKR) and ASE Group specialize in packaging and testing semiconductor devices; ensuring chips can perform under different electrical and temperature conditions.

Growing AI and semiconductor demand

The proliferation of AI solutions has been the impetus for the increased demand for semiconductors, a trend that is likely to continue into the near future. With nations, including Japan, France, India, and Canada talking about the importance of investing in “sovereign AI capabilities” countries will increasingly need supercomputers and data centers that allow them to grow their AI capabilities within their respective geographic regions. For companies such as NVIDIA, this represents a new market for them to engage with, which in turn benefits the various participants within the semiconductor supply chain, or stated euphemistically, ‘all boats will rise” in the semiconductor industry should sovereign governments enter the AI arena.

The material importance of semiconductor self-reliance has already begun in the U.S. and Europe, as in the U.S., the CHIPS and Science Act was passed to support local American semiconductor research, development, manufacturing, and workforce development, which will lead to the geographical realignment of manufacturing capacity. Whereas in Europe, the European Chips Act was provided to develop more fabs and increase semiconductor production in the region, with an aim to double the EU’s global market share from 10% to 20% by 2030.

Investing in the whole, not the parts

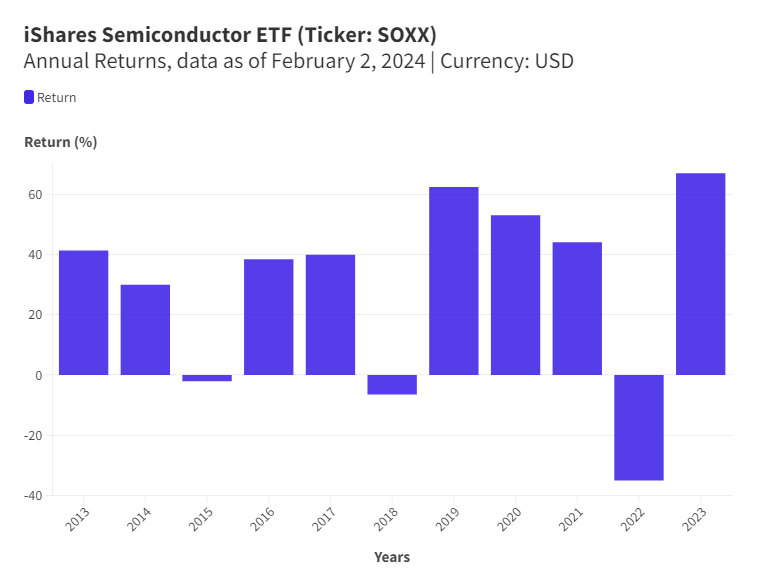

Semiconductors have become an essential component of the global economy, as evidenced by their integration into vehicles, smartphones and devices, and the technological infrastructure of our modern society. Given their integral nature, investors would benefit from having exposure to the industry within their portfolio. In looking at the annual returns of the U.S. iShares Semiconductor ETF (Ticker: SOXX) for the past decade, investors have benefitted immensely from having comprehensive exposure to the semiconductor industry.

For Canadian investors, the Canadian iShares Semiconductor Index ETF (TSX:XCHP) (Ticker: XCHP) provides exposure to U.S.-listed equity securities that are in the semiconductors industry. It should be noted that XCHP was recently listed, having an inception date of September 6th, 2023; thus, having less than one year of performance. Alternatively, the Horizons Global Semiconductor Index ETF (Ticker: TSX:CHPS) seeks to provide exposure to the performance of global, publicly listed companies engaged in the production and development of semiconductors and semiconductor equipment. Launched on June 21, 2021, this fund has an established track record and provides comprehensive exposure to the global semiconductor industry.

With demand for semiconductors growing globally, investors who maintain some exposure to this industry are poised to benefit materially in the years to come.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment decision.

This content was originally published by our partners at the Canadian ETF Marketplace.