Genomics is the study of genes and their functions. With technology advancements dramatically improving the cost, accuracy, and time to map a person’s entire genome, many rapidly growing companies are emerging in the genomics sector.

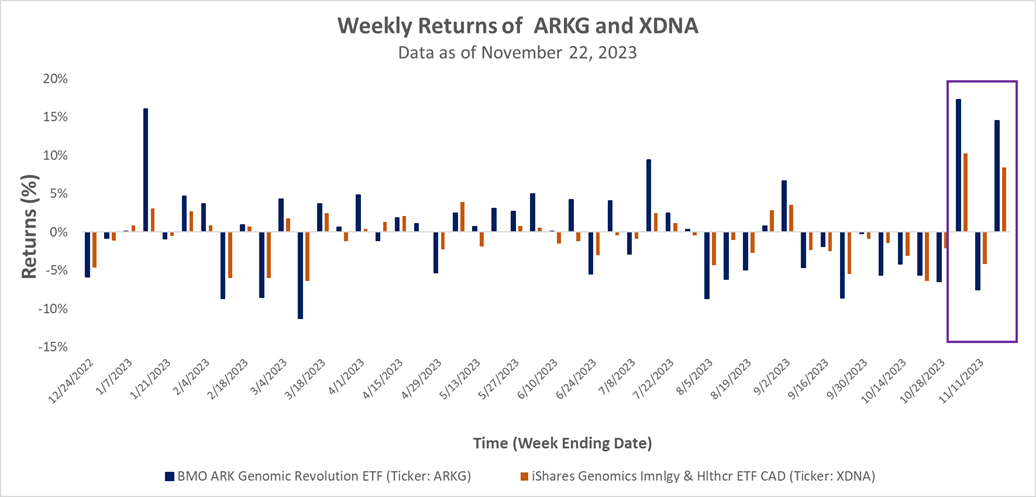

In looking at the recent weekly return data of the BMO (TSX:BMO) ARK Genomic Revolution ETF (TSX:ARKG) (Ticker: ARKG) and iShares Genomics Immunology and Healthcare Index ETF (TSX:XDNA) (Ticker: XDNA), both prominent genomic-focused solutions, their performance in the month of November 2023, thus far, has been above their recent historical averages.

Recent Genomic Innovations and Their Implications

The upswing in returns can be attributed to CRISPR Therapeutics, a biotechnology company focused on developing transformative gene-based treatments for serious diseases using its proprietary CRISPR/Cas9 platform. Recently, U.K. health regulators approved CRISPR’s treatment for sickle cell disease and beta-thalassemia, a therapy called Casgevy. Sickle-cell disease, also known as sickle-cell anemia, can cause debilitating pain, and people with beta-thalassemia often require regular blood transfusions.

Casgevy uses CRISPR/Cas9 to edit a patient's hematopoietic stem cells (HSCs), which are responsible for producing blood cells. The edited HSCs are then infused back into the patient, where they produce functional hemoglobin and reduce or eliminate the need for blood transfusions. If Casgevy is approved in the U.S. and European Union, it has the possibility to be a huge commercial opportunity for CRISPR Therapeutics; this possibility has resulted in increased fervor around the stock and the ETF solutions that are exposed to it.

Investing in Genomic Innovation

In recent years, the word innovation has oftentimes become associated with technological advancement, however, healthcare innovation is an area that is also evolving and proving to be filled with long-term investment opportunities. BMO’s ARKG ETF reflects the investment thesis of innovation investor, Cathy Wood of ARK Investment Management. The actively managed solution invests in a cross-section of sectors, including healthcare, information technology, materials, energy, and consumer discretionary that are relevant to the fund's investment theme of the genomics revolution ("Genomics Revolution Companies"). Conversely, iShares’XDNA ETF replicates the performance of the NYSE FactSet Global Genomics and Immuno Biopharma Index, which provides exposure to companies poised to benefit from the long-term growth and innovation of companies involved in genomics, immunology, and bioengineering.

For investors seeking exposure to companies with long-term growth prospects and that have demonstrated innovative capabilities within the biomedical space, both ARKG and XDNA provide exposure to leading companies in genomics that are poised to shape and advance the medical landscape of the future.

This content was originally published by our partners at the Canadian ETF Marketplace.