This article was written exclusively for Investing.com

The reflation trade has been hot as interest rates have soared. However, with parts of Europe going back into lockdown and ultra-dovish monetary policy from central banks worldwide, the dollar is on the rise. That is likely to kill the reflation and commodity-driven trade in the equity market.

The declines have already started, with oil and copper prices plunging. This has led to a rotation out of energy and materials. It is also likely to lead to declines in multi-national stocks, as well as emerging markets. Even the financial sector may get sucked into this unwind, as banks have risen sharply.

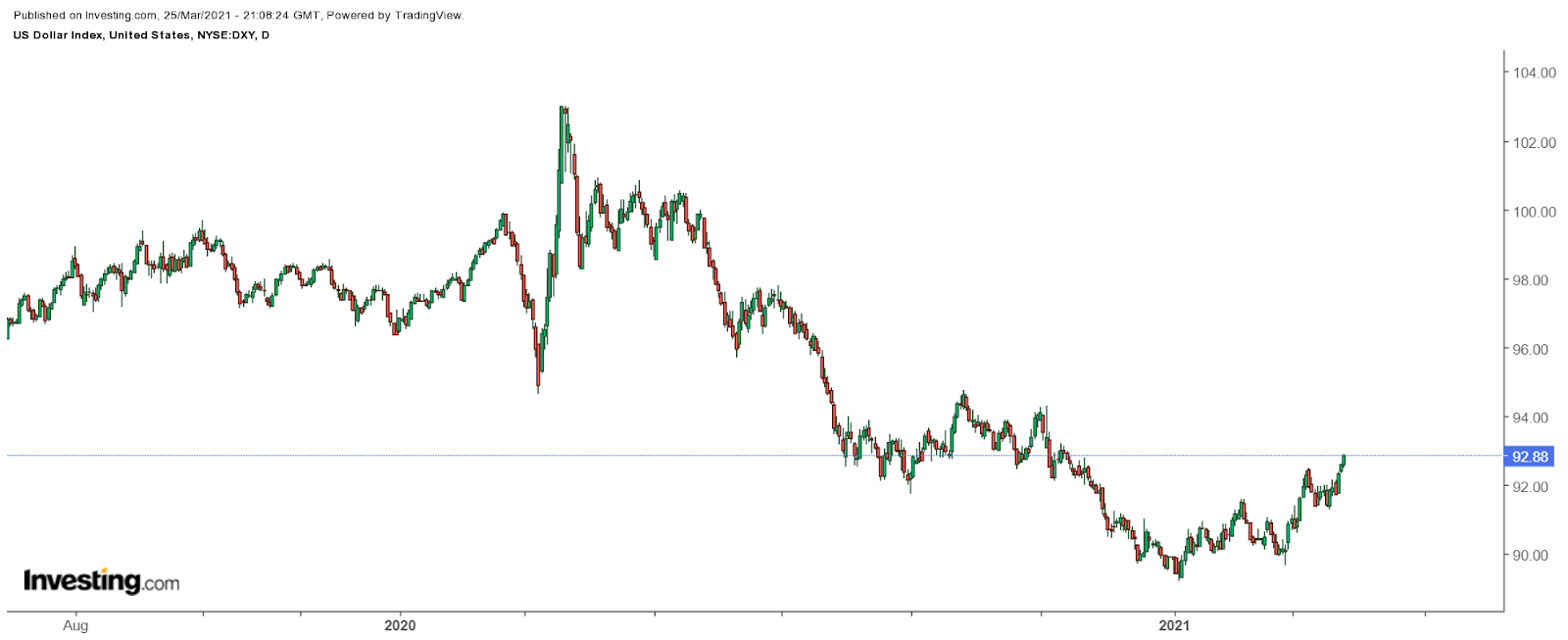

The Dollar’s Rise

The dollar’s gains have come as rates in the US have risen sharply in recent weeks as the prospect for better growth takes shape in the US, even while parts of Europe struggle to recover from the coronavirus pandemic. Thus, commodities prices have been hit hard, as they are negatively affected by the strong US currency and worries of weaker growth hurting demand.

This weakness has found its way into the reflation trade, with sectors like Energy, Industrials, and Materials seeing weakness this week. If the dollar continues to strengthen and global growth concerns persist, it could signal the end of the reflation trade.

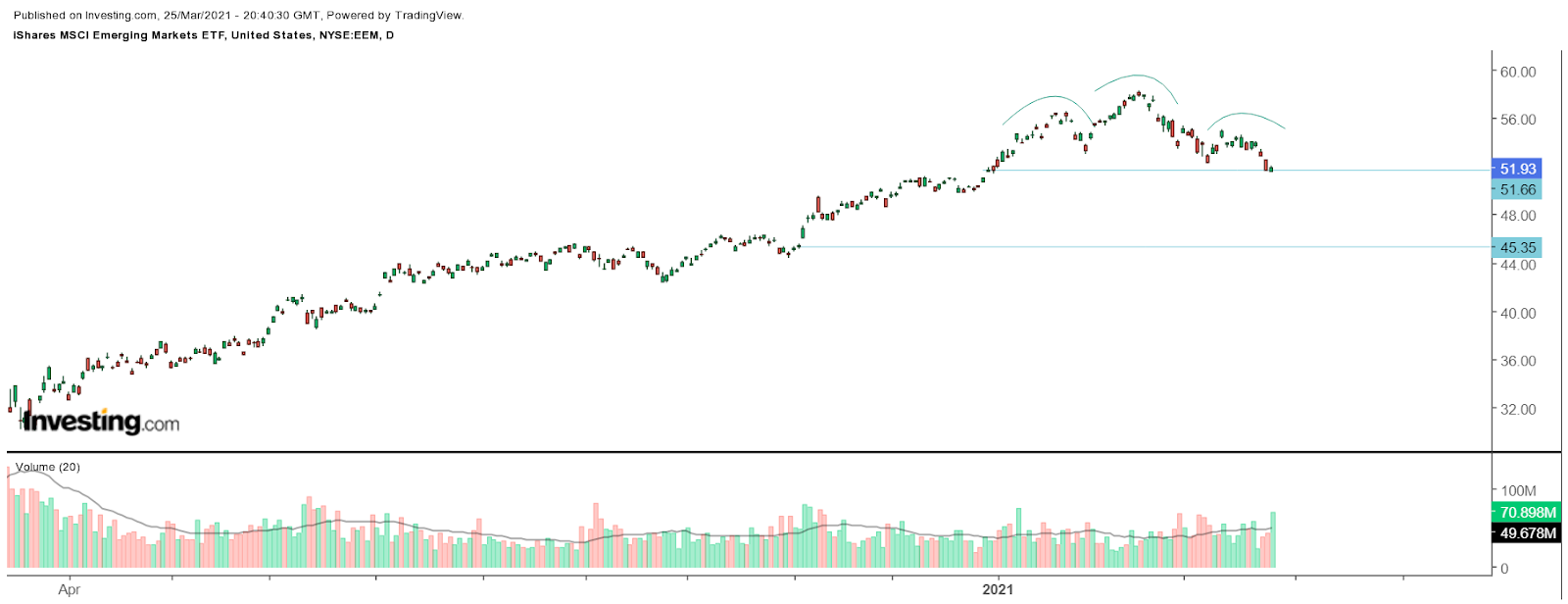

Additionally, emerging markets have been hit hard in recent trading sessions due to the stronger dollar. If the USD remains strong, it will likely weigh, even more, sending ETFs like the iShares MSCI Emerging Markets ETF (NYSE:EEM) lower. There is potentially a bearish pattern forming in the EEM ETF, known as a head and shoulders pattern. The ETF would need to drop below $51.50 to confirm this negative pattern, indicating lower prices lie ahead.

Banks May Falter Too

The bank stocks have also come under pressure. This despite yields stabilizing at higher levels and spreads widening. The group has rocketed higher, and at least over the short-term, is trading well ahead of itself.

Just this past week there have been increases in the put position for the Financial Select Sector SPDR® Fund (NYSE:XLF) on the $33 puts for expiration on Apr. 16. With the open interest rising by around 25,000 contracts, the data showing the puts were bought for about $0.60 per contract. It would suggest that the XLF drops to approximately $32.40 by the middle of April.

Stocks like Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) have risen in nearly a straight line since Oct. 30. Both currently rest on a significant uptrend that could lead to a substantial drop lower if broken. Additionally, they both have an RSI trending and diverging lower, suggesting momentum in the stocks have turned bearish.

Reflation Trade Finished?

If the dollar continues to strengthen, it will further weaken the reflation trade, causing a ripple effect through different parts of the equity market. Coupled with higher interest rates that have negatively impacted the technology sector too, the equity market could find itself in trouble.

If rates begin to ease and the dollar drops, it will allow for the reflation trade to resume, pushing stocks in those sectors to even higher levels. But in the absence of a reversal of the dollar or interest rates, the reflation trade could be over. That is likely to be terrible news for the rest of the equity market.