Current Market Stats

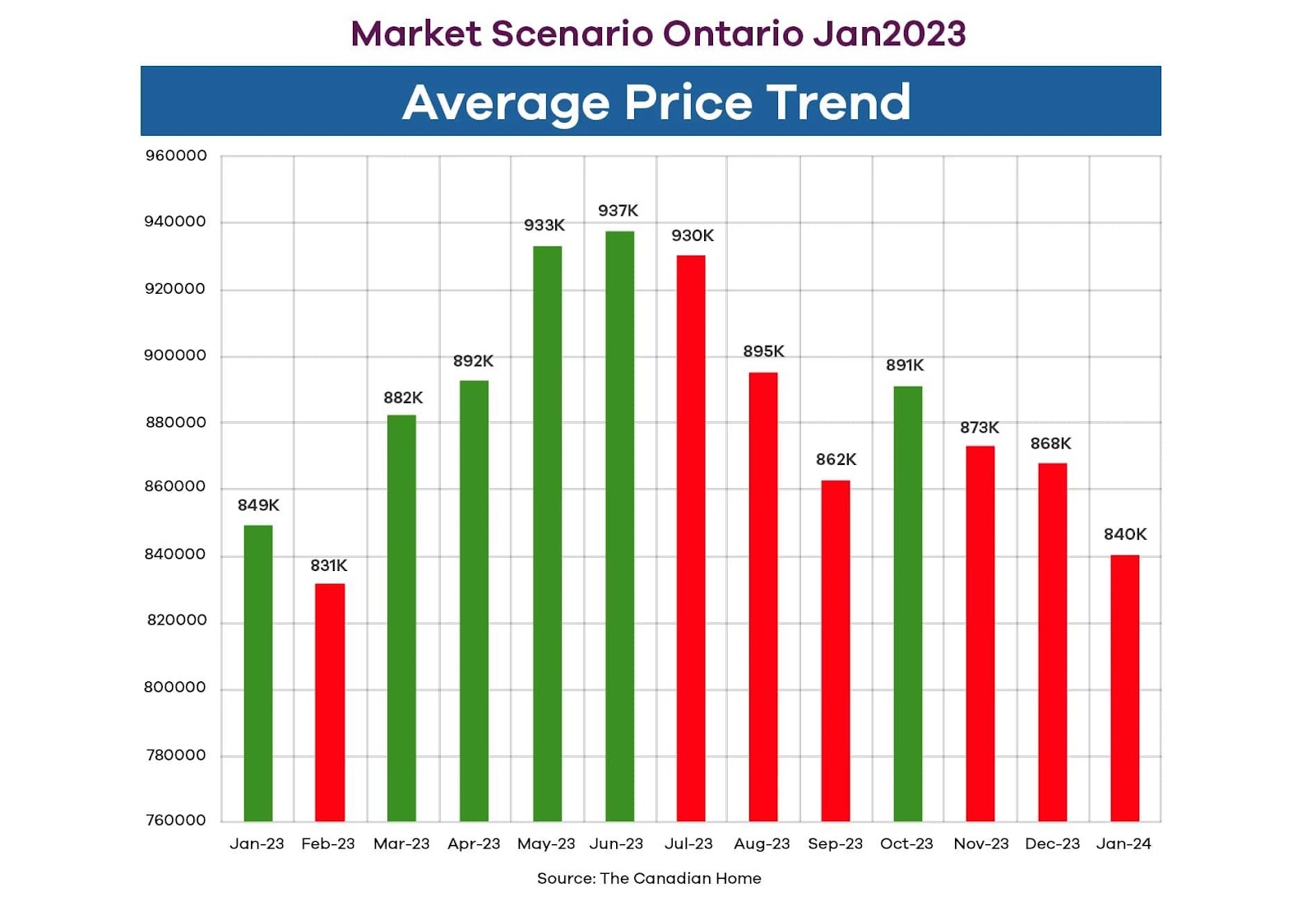

The housing market saw a notable upswing in January 2024 after a sluggish December. The current real estate landscape is showing signs of renewed activity as both the number of transactions and new listings are on the rise. Unlike December’s stagnant activity, January breathes new life into the market as demand and supply surge forward. New listings in January 2024 have already exceeded those from the same time in 2023, with unit sales following the same trend. However, even with the increase in activity, the average selling price has dropped to its lowest level since June 2023, almost matching the prices seen in January 2023.

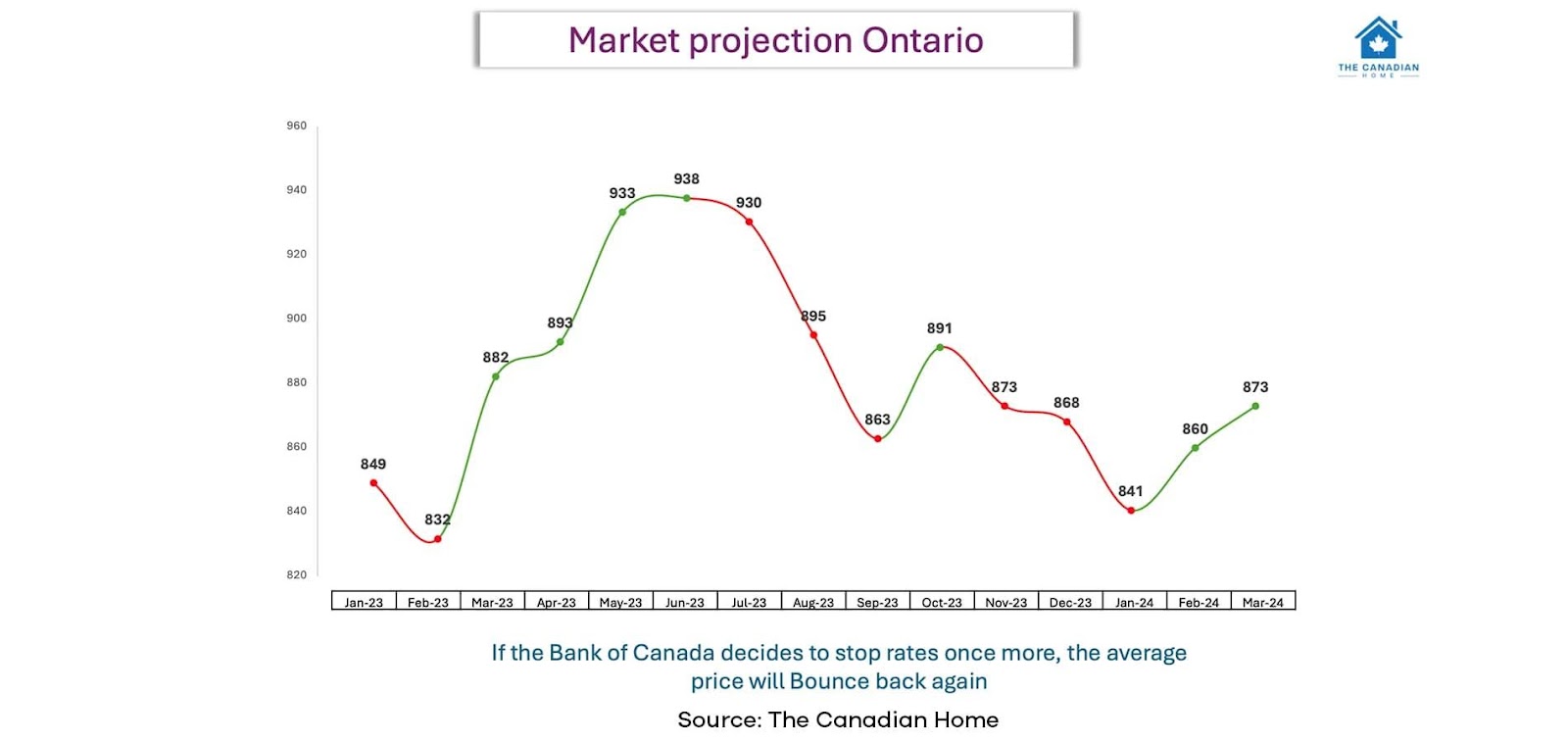

What we are seeing now is an interesting mix of factors that could be sparking buyer interest in the market. With a relatively low average selling price and abundant supply, the stage is set for homebuyers to take advantage of favourable conditions. In addition, the Bank of Canada’s decision to keep interest rates steady over several months further increases the appeal of diving into the real estate market. It is likely that these factors are driving buyers to engage in transactions and capitalize on the current market dynamics.

Key Highlights of the Current Housing Market

Surge in sales: The Ontario housing market heated up in January showing a 26.79% jump in total units sold as compared to December. This increase indicates a bustling market and hints at potential growth in the coming months.

Listings shot up: There was a whopping 168.82% increase in number of properties available for sale, jumping from 9,000 in December to an impressive 25,000 in January. This shows a notable increase in seller participation, giving potential homebuyers more choices.

Consistent demand: Despite the surge in listings, buyer demand remained high. In the closing week of January, 1,240 properties were sold at an average price of $863,000, showing sustained market activity.

Looking at these trends, we can confidently say that the current Ontario housing market is vibrant and bustling, where sellers and buyers are actively involved. We believe this will likely rise in the coming months.

The Canadian Home Outlook for the Housing Market

In the last 10 weeks, there has been a notable revival in the Ontario housing market, with sales activity significantly increasing. In January 2024, an impressive milestone was reached as sales surpassed 9,000 units, showing a remarkable 27.29% increase from previous periods.

Manoj Karatha, the Broker of Record of The Canadian Home highlights the increasing momentum in the market, especially with the shift from winter to spring nearing. He says, “It is clear that housing activity is on the rise again - the data leaves no room for doubt. With March just around the corner, I strongly advise potential homebuyers to act now. As the market heats up, home prices will only go higher, increasing competition for desirable properties. I recommend financially ready buyers to take quick action to avoid pricing themselves out in the market.”

Prepare Yourselves, Ontario Homebuyers!

There is an uptick in the Ontario housing market, with both sales and listings going up. The shifting market offers promising chances for both home buyers and sellers but also calls for careful consideration.

According to Robin Cherian, CEO of The Canadian Home, “The Ontario housing market is seeing an upward trend, where opportunities exist for both buyers and sellers. With a growing number of listings, buyers have a chance to snag better deals, while sellers can benefit from the increasing buyer demand. Swift action is key as prices are set to go up, especially with spring fast approaching which is traditionally the busiest time of year.”

Whether you are thinking of buying or selling a property, staying updated on changing market trends is vital. Partner up with a real estate expert such as those at The Canadian Home who can offer you valuable insights and guide you through the future market.