ACM Research (ACMR, Financial) is under the radar now, but that will not be the case for much longer. The company is still growing like wildfire, taking advantage of the semiconductor boom driven by AI, while growing its share in the market. Its latest quarterly results were stellar, and despite ongoing cost pressures, it still executes well as it raised its full-year revenue guidance and projected even stronger growth in 2025.

However, the stock is far undervalued compared to its historical valuations and peers. ACM Research has a forward P/E ratio modest enough to suggest upside potential. If the company continues to sell strong earnings and expand in key markets such as China and the U.S., a re-rating looks inevitable.

Company overview: A rising force in semiconductor equipment

ACM Research is building a semiconductor equipment powerhouse in quiet. The company is based in Fremont, California, and specializes in producing cutting edge wafer-cleaning technology, an often overlooked and crucial component of manufacturing chips. ACMR helps chipmakers improve efficiency and boost yields by designing and producing single-wafer wet cleaning equipment.What’s interesting is that while it is an American company, it does a lot of its business through its subsidiary in Shanghai and has a very strong presence in the Chinese market. That has both pros and cons. However, ACM research is not standing still and is making moves to diversify. It has won orders for four wafer-level packaging tools, two from a U.S. client and two from a growing research and development center in the U.S. ACM is gradually expanding beyond China, and these tools are set to be delivered in the first half of 2025.

ACM Research surges with strong quarterly results

ACM Research had a stellar third quarter, with revenue hitting a record $204 million, up 21% year-over-year (YOY). The company is clearly taking advantage of the semiconductor AI boom by making it a major player in wafer processing. In addition, gross margins fell slightly to 51.4 percent from 52.5 percent, which is still a good number given the sustained pressure on costs in an industry. Further, the ability of the operating income to remain robust and grow by 33% despite all these challenges shows that ACM has performed well. We also shouldn’t forget about non-GAAP net income of $42.4 million, which shows that ACM is driving profitability even as it scales.A major highlight is the Ultra C Tahoe cleaning tool, which is now being produced at multiple logic and memory fabs. As a win for both efficiency and sustainability, it can slash sulfuric acid use by 75% without sacrificing performance. ACM’s growth in China is a growth driver, but ACM is also strategically moving on the U.S. front by acquiring a facility in Oregon and getting new orders from American customers.

ACM Research Raises Guidance with Strong Growth Outlook

Looking ahead, ACM now sees raising its full-year 2024 revenue to $755-$770 million, and for 2025, it is much more bullish, expecting $850-$950 million. This optimism is not unfounded as it’s based on trade policy, customer spending trends, supply chain impacts, and first-tool acceptances.The real issue is whether or not ACM can continue to move like this. In a macro uncertainty environment, the company is in a sound place with strong execution, expanding product line, and rising market share. If semiconductor demand continues, and in particular is strong for AI-driven applications like last year, ACM could well be facing another year of breakout growth.

ACM Research’s Promising Revenue and EPS Trends

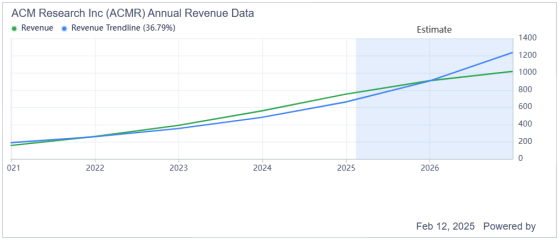

It is evident that ACM Research is embarking on a solid growth path, strongly supported by its consistent revenue trendline that climbs upwards at a 36.79% annual rate. This trend has closely tracked the company’s actual revenue (green line), and importantly, estimates indicate its revenue could exceed $1 billion in 2025 and beyond, validating management’s bullish view. Once again this aligns with ACM Research’s most recent guidance of expecting $850-$950 million in 2025 revenue.The story for EPS growth is similar, growing at 35.56% annually. ACM’s revenue is steadily growing, but earnings per share are less consistent, especially in the period between 2023 and 2024, where earnings per share jumped significantly before stabilizing. While the estimates show EPS will hit $2 by 2026, it implies margin expansion would be slowing down. However, if ACM can maintain profitability gains, and its cost-cutting Ultra C Tahoe programs help, then these forecasts may be beaten. Investors will want to keep their eyes on operating margins and any changes in the competitive landscape to gauge long-term sustainability.

ACM Research Maintains a Strong Liquidity Position

ACM’s cash reserves are far above its debt, with a good cash-to-debt ratio of 2.12. Although cash levels declined from their peak in 2021, they still exceed debt and give an indication of a healthy financial position. The company has kept its leverage under control and has maintained enough liquidity to drive growth. However, debt is creeping up, which is something to watch as ACM grows.ACM Research Could Be a Hidden Gem Ready to Shine

Source: Author generated based on historical data

ACM is a bargain when compared to its sector and to its own historical valuations. The company’s P/E ratios are notably lower than the sector median and its forward P/E is as low as 10.99 times, which is 57% lower than the sector average of 25.37. ACM’s current value is even more striking as it is trading at historically cheap levels, which is around 70% below the stock’s own five-year average. There are enterprise value (EV) metrics in addition to just earnings multiples, which also reinforce ACM’s attractive valuation. EV-to-Sales (FWD) is at 1.87 times, below the sector median of 3.41, indicating investors are paying significantly less for each dollar of sales compared to industry peers.

Similar to this, its forward EV-to-EBITDA is at a discount of 47% to the sector median of 16.09 times. Finally, ACM’s price-to-sales (P/S) ratio also amounts to an attractive entry point. With a 1.90 forward P/S, which is 42% below the sector median of 3.30, the market may be undervaluing ACM’s assets. If ACM continues to execute well, this discount won’t last long. The stock is set to re-rate with strong growth, expanding market share, and solid profitability. The investors might catch a bargain before the market catches up.

Comparison to peers

ACM Research is a compelling value play compared to peers Veeco Instruments (NASDAQ:VECO, Financial) and Ultra Clean Holdings (UCTT, Financial). VECO’s forward P/E of 19.98 times is far above ACM Research’s, and UCTT’s 127.18 times is clearly the most expensive on this basis. On the other hand, ACM’s forward EV-to-EBITDA of 8.50 times is below VECO’s 10.76 times and UCTT at 11.20 times respectively, indicating that ACM trades on a cheaper valuation compared to profitability. Although ACM’s Price-to-Sales at 1.95 times is slightly greater than VECO’s 1.88 times, it is far above UCTT’s 0.85 times, suggesting that investors are placing a premium on its revenue potential. These metrics put ACMR in a good spot to see a potential re-rating as earnings and market share increase.Source: Authour generated based on historical data

ACM Research’s upside potential looks strong

The long-term resilience of ACM Research has been very impressive. It has gained 25.4% over the past year and produced a fantastic 78.7% return over the past five years. According to analysts, the stock’s current price target is $28, which means it could potentially increase by 21.48%, but GF Value model suggests an even higher fair value of $32.50.The company is rapidly growing as its revenue and EPS trend up. Also, ACM trades at a steep discount to both its sector and historical averages.

All of these factors make ACM’s upside look compelling. I would come in with a realistic 12-month price target of $30. Even a modest re-rating to 15 times forward earnings multiple, still cheap relative to peers, would bring the stock to $30. The GF Value model further supports the case for a rebound. As the company has solid earnings growth, is undervalued, and has strong momentum, a $30 feels like a realistic, yet conservative 12-month target.

Risks

ACM Research appears to be a strong investment, but there are two big risks.First, geopolitical and regulatory reasons could be huge headwinds. ACM is exposed to trade tensions and the shifting regulations that come with them because it has a big presence in China. The U.S. has been increasing its use of export controls on semiconductor technology, and ACM was put on the U.S. Department of Commerce’s Entity List in December 2024. This might constrain its capacity to get to fundamental parts, control admittance to particular markets, and hold back on distribution plans. While the company is diversifying, it won’t go smoothly navigating these restrictions.

The second issue is cash flow pressure. Despite nearly doubling revenue and strong profit growth, ACM’s cash flow is not keeping up. Operating cash flow nearly crumbled 80% quarter-over-quarter in Q3 2024, and free cash flow went negative. This likely indicates that the company may find it difficult to fund operations and growth without taking on additional debt.

These risks don’t nullify ACM’s upside, but they should be watched closely by investors to ensure the ongoing financial and regulatory health of the company.

Your takeaway

ACM Research is in a great position as it is generating great revenue growth, increasing its market share, and benefiting from the AI-driven semiconductor boom. Its Ultra C Tahoe tool, increased presence in the U.S., and solid balance sheet all support the company’s rise. However, with these strengths, the stock still looks undervalued, making it a great opportunity for investors who understand the long-term potential of the stock.Risks should not be ignored, but overall, ACM is a high potential undervalued growth story in the semiconductor space. A realistic 12-month price target of $30 gives investors the opportunity to ride out short-term risks in order to realize a significant upside as the market figures out ACM’s true value.

This content was originally published on Gurufocus.com